Welcome in today’s price action setups preview. Comparic team prepared 4 the most interesting currency pairs in the Tuesday morning. Let’s start!

Welcome in today’s price action setups preview. Comparic team prepared 4 the most interesting currency pairs in the Tuesday morning. Let’s start!

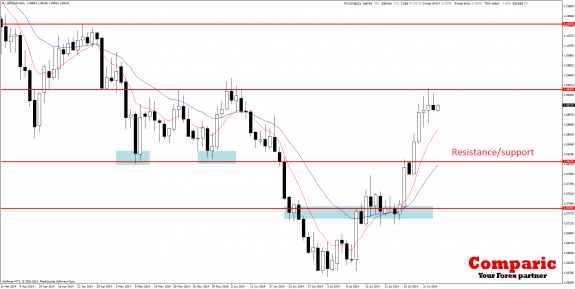

AUD/USD:

After decent Australian macro data, Aussie price broke above the level which may be considered as a resistance (earlier support). It may become a longer retracement to increases – everything will be clear after closing today’s session. In the case of clear pullback, movement will be a re-test and confirmation than the resistance is working. It will give an opportunity to look for short positions. However, trend is still upward – so short positioning has got lower chance of profitability.

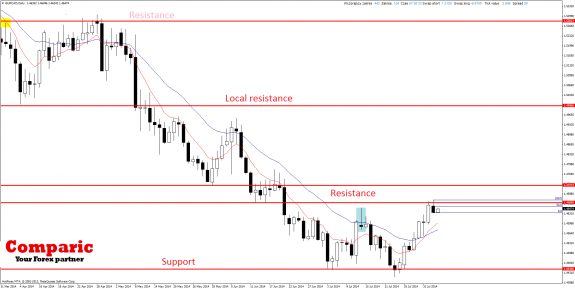

EUR/CAD:

Cross tested resistance yesterday, and rejected it dynamically. Candle, which formed may be considered as a signal one. We can trade it in 3 different ways:

-Selling after breaking below minimum, SL above maximum,

-Selling after breaking below minimum, SL above 50% of candle’s abolition (better risk-reward ratio than in the first case where the probability of loss was greater),

– Sell limit (50% of candle’s abolition), SL above maximum. Better r/r ratio than in the first case and safer SL than in the second one. However there is a risk that correction will not appear and we will be left without any position.

EUR/JPY:

Another cross in our daily preview. Euro vs yen cannot break above the resistance. We can see further daily candles with high long shadows which clearly show that supply is getting more active. It should give a start to decreases continuation.

USD/CAD:

Currency pair reached key resistance and rebounded from it. However the last momentum is upward – American dollar also – so it is better to play against the euro then wait for CAD rallies. Especially, the single currency is much, much weaker than USD.