Copper is an industrial metal whose Latin name is cuprum originating from a country in southern Europe, Cyprus, where it was mined in antiquity. This metal is a good conductor of heat and electricity and is widely used mainly in the industry.

Copper is an industrial metal whose Latin name is cuprum originating from a country in southern Europe, Cyprus, where it was mined in antiquity. This metal is a good conductor of heat and electricity and is widely used mainly in the industry.

The price of copper for a gram – quotes, copper price

Copper, like many other commodities, is currently listed on many futures exchanges. Major exchanges are located in London and New York. Metal is also listed in Hong Kong, Moscow and many others.

The London Metal Exchange (LME) is a futures exchange with the world’s largest market for options and futures for various metals, including copper. Copper is quoted on LME in US dollars and the price is quoted as one ton.

The Commodity Exchange (COMEX) is a division of the New York Mercantile Exchange (NYMEX) and specializes in trading metals futures. Copper on COMEX is quoted in US dollars and the price is given as one pound, a commonly used unit of mass in the US. In kilograms, 1 pound is about 0.45 kg.

Copper extraction

Copper is the main metal used in industry and one of the most important raw materials used by man. Copper ore deposits are located all over the world. It is also the oldest known metal known to man, which was discovered 10,000 years ago.

Copper is in the earth’s crust in the form of ore or in pure form in various minerals. Copper in minerals is rarely found, most often it is extracted in ore.

Copper ore is extracted using two basic methods of extraction: an open-cast method in which all the work takes place on the surface, and the extraction takes place by exploring further layers of earth or by a deep method, where copper is mined through the exploitation of the earth. Mines are used to extract raw materials.

World copper production amounted to around 18 million tonnes a year in 2016. Chile is the leader in copper mining in the world. The mines located in this country occupy sixth out of ten of the largest open-pit mines in the world. In addition to Chile, the largest amount is extracted in China, Peru, USA, Australia.

Also copper is mined in Poland. Copper ore mining in Poland is concentrated in three deep mines, Lubin, Rudna and Polkowice-Sieroszowice. The mines are managed by KGHM Polska Miedź, which is listed on the Warsaw Stock Exchange. The company’s main shareholder is the State Treasury with over 30% ownership.

Biggest mines in the world

Escondida in Chile is currently the largest mine in the world. It is located in the Atacama Desert in northern Chile. The mine has been in operation since 1990 and is currently one of the 10 deepest open-pit mines in the world. Escondida life expectancy is estimated at 54 years.

By the end of 2012, the mine had over 32 million tons of recovered copper resources. Production in the financial year ending in June 2013 was 1.1 million tonnes, which accounted for around 5% of world copper production.

BHP-Billiton, the largest shareholder of the mine, holds a 57.5% stake. Other partners include Rio Tinto (30%), Japanese consortium led by Mitsubishi (10%) and International Finance Corporation (2.5%).

Cananea, also known as Buenavista Copper Mine, located in Sonora, Mexico, is the second largest copper mine in the world. Estimated in December 2012, the mine had 26.8 million tons of copper reserves. In 2012, 200,000 tonnes of copper was recovered.

Cananea was opened in 1899 and is one of the oldest open-pit mines in North America. The current owner is Southern Copper Corporation, a subsidiary of Grupo Mexico.

Toquepala is located 870 km south of the capital of Peru Limy, it is the fifth largest copper mine in the world. Copper reserves in December 2012 amounted to 17.65 million tonnes. Toquepala produced around 152,000 tonnes of copper in 2012. Southern Copper Corporation owns and operates the mine.

Grasberg in Papua, Indonesia occupies the tenth place in the world in terms of copper reserves. The mine has reserves as of December 2012 of approximately 10.5 million tonnes. In 2012, the mine generated 315 thousand tonnes of copper. The mine is also in possession of the largest gold reserves. The mine has been in operation since 1990. PT Freeport Indonesia, which is affiliated with the American Freeport-McMoRan Company, holds a 90.64% stake. The remaining 9.36% is in the hands of the Indonesian government.

The largest companies involved in the extraction and production of copper

Codelco ranks first in the world in terms of copper production volume with production of approximately 1.8 million tons in 2016. It is a state-owned enterprise founded in 1955. Headquartered in Santiago, Chile.

Freeport-McMoRan Copper & Gold Inc. ranks second in global competition in copper mining. In 2016, about 1.7 million tonnes of copper were produced, about 12% more than in 2015 (1.5 million tonnes). The company has its headquarters in Phoenix, Arizona in the United States. It is listed on the New York Stock Exchange (NYSE). It is part of the S&P 500 index.

Glencore International Plc with copper production of approximately 1.29 million tonnes in 2016 occupies the third place in the world. Headquartered in Switzerland and listed on the London, Hong Kong and Johannesburg Stock Exchanges.

BHP Billiton reduced its copper production by 6%, from about 1.18 million tonnes in 2015 to about 1.11 million tonnes in 2016. It currently ranks fourth in the world rankings. The company’s name and structure is the result of a merger of the Australian company Broken Hill Proprietary Company with British Billiton. The company is headquartered in Melbourne, Australia. The company is listed on the stock exchanges in Australia, New York and London.

Southern Copper Corporation, a subsidiary of Grupo México, increased its copper production by 21% from 743,000. Tons in 2015 to a record level of 900 thousand tonnes in 2016. It is listed on the NYSE and in Peru on the Lima Stock Exchange.

KGHM Polska Miedź produced in 2016 677 thousand copper, 6% less than in 2015 (718 thousand tons). Still, it is the sixth largest company in the world to produce this metal.

Rio Tinto, a British-Australian company, is in seventh place. The company increased copper production by 4%, from 504,000. Tons in 2015 to 523 thousand. Tonnes in 2016. The company is headquartered in London and Melbourne, Australia. It is listed on the Australian, New York, and London Stock Exchanges.

Demand for copper

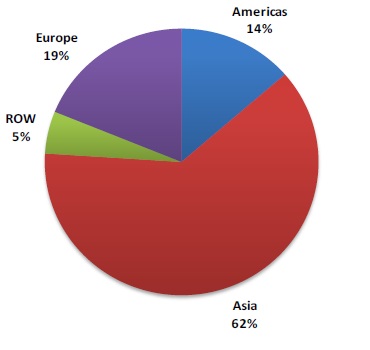

Main demand for copper is reported by China, which report as many as 50% of the world’s demand for this raw material. Next places are respectively Western Europe, North America, Japan, India, South Korea.

Asia is about 60% of the world’s demand for copper, of which around 50% is China itself. Western Europe is also an important sales area for this industrial metal with a demand of around 20%. Third place occupies America with 15% of the demand. t immediately follows that the price of copper is most affected by the situation in China. Good Chinese data will support rising commodity prices. Especially GDP readings, industrial output, infrastructure investment indicators, or PMI indices for industry.

Investing in the commo dity market, including copper, is most beneficial in the fourth phase of the business cycle, during economic expansion. In this period there is an increase in lending, more and more companies are willing to invest, unemployment is falling, consumption is rising, etc. This is the best period for raw materials as stocks and bonds are already overvalued and good sentiment makes capital move to the commodity market, strongly dependent on the economic.

dity market, including copper, is most beneficial in the fourth phase of the business cycle, during economic expansion. In this period there is an increase in lending, more and more companies are willing to invest, unemployment is falling, consumption is rising, etc. This is the best period for raw materials as stocks and bonds are already overvalued and good sentiment makes capital move to the commodity market, strongly dependent on the economic.

Copper in the years 2014-2016 has recorded one of the worst results among raw materials. The sudden price increase came in late 2016 after Donald Trump’s victory and his pledges on infrastructure plans for $ 500 billion and thus the impact on metal demand. One of the world’s major banks predicts that copper prices will rise to as much as $ 8,000 per tonne by 2020. The main reason for rising prices is the growing demand for this raw material from China. Copper is currently very much used in the production of electric cables (60%), roofing and plumbing (20%) and industrial machinery (15%). The main industries where the copper is consumed are construction, infrastructure and machine construction.