Rare earth elements and strategic metals

Rare earth elements and strategic metals belong to a group of minerals for which consumption grows every year.

They are mined in small amounts when compared to industrial metals. It is forecast that between now and 2020 demand will grow by as much as 40%.

Why? These elements and metals are used in modern technologies.

The strategic metals include: lace, germanium, zirconium, molybdenum, indium, gallium, hafnium, bismuth, tantalum, tellurium, cobalt and tungsten.

Rare earth elements include: scandium, yttrium, lanthanum, cerium, neodymium, promethium, samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium or lutetium.

Most people have never heard of them, so why should we pay attention to these groups of metals? Mainly because of their usage in new technologies industry and currently relatively low prices.

Several devices used in energy, electronics, medical, military or automotive industries wouldn’t exist without strategic metals and rare earth elements.

Europium is used in nuclear technology, ytterbium in solar panels, hafnium in computer chipsets, tantalum in smartphones and computers and molybdenum in aerospace industry. Of course, this is just the beginning of long-list. Thus far, as there are no substitutes for them.

Extraction of rare earth elements and strategic metals

Rare earth elements and strategic metals are mined in quite small quantities.

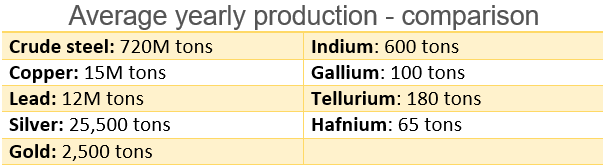

There is a comparison below of annual extraction of few industrial and strategic metals.

As you can see, production of strategic metals and rare earth elements ranges from several dozen to several hundred tons per year. It is a tiny volume compared to other metals.

Supply is limited. This is mainly due to low prices (there was a bear market between 2011-2016) which brought huge problems to the industry. Some of the biggest mines had to suspend mining (USA), others are on the verge of bankruptcy (Australia).

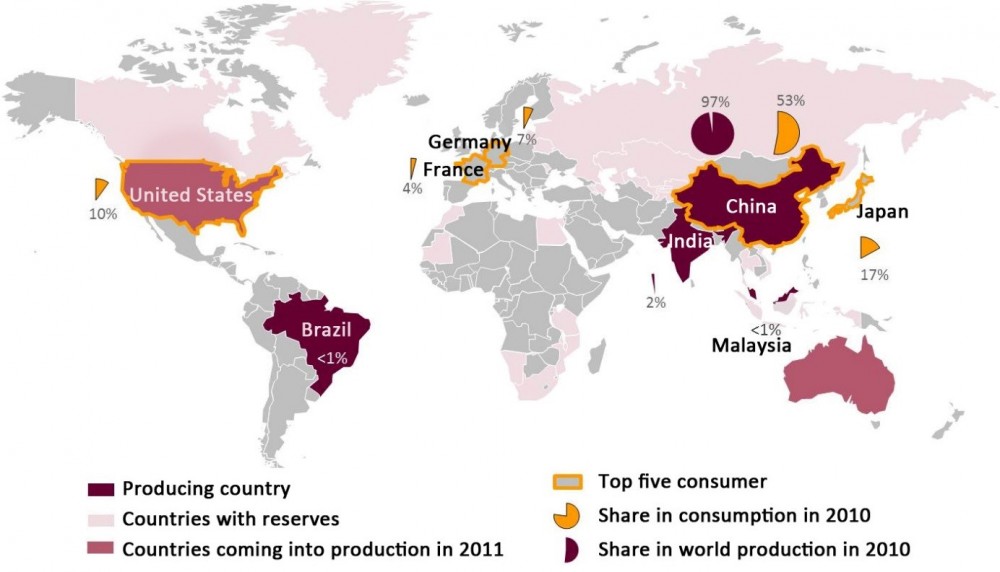

China has benefited from competition issues, the country controls 97% of rare earth elements and 80% of strategic metals. Of course, it is also the biggest consumer of rare earth elements and strategic metals, as you can see on the map below.

The situation looked completely different 20-30 years ago. Then strategic metals were mined not only in China, but also in United States or Australia. China took over the production since it survived bear market due to its low cost of production. They now have a virtual monopoly which is also thanks to mild environmental regulations.

China also mines a lot of strategic metals which are not counted to official production. Due to high pollution, China plans to challenge illegal metal traders and suppliers. That will not only reduce export numbers, but also extraction.

That goes some way to explain weak supply, but what of demand?

In 1990, the global consumption of strategic metals and rare earth elements was 45k tons. Development of new technologies increased demand, in 2013 it was 124k tons, in 2016, 155k tons. There are forecasts of 40% demand rise in years 2017-2020.

To sum up, strategic metals and rare earth elements are mined in relatively small quantities, while demand is steadily increasing. This is not the only factor in a potential surge in prices.

Geopolitical situation

Chinese dominance has led to a situation where the prices of strategic metals and rare earth elements are strongly dependent on Chinese government politics and geopolitical situation.

The main rivals are two biggest importers, the USA and Japan. This is one of the main reasons why China wants to reduce export to both of these countries. In addition, China is trying to encourage the largest users to move their production there. This would provide China with access to the latest technology and processes

In the United States, the situation looks totally different.

Six months ago, Donald Trump became President. He announced during elections that he will bring well paid jobs back to the U.S. Furthermore, Trump wants to put high tariffs on imported products from other countries, including China. If his policy will be implemented, it could lead to trade war between two countries.

China could react as it did in 2010 with Japan. Then, China stopped exporting two metals; neodymium and dysprosium. The prices of these two elements increased by 600-800% in ten months as you can see on the chart below.

The conflict was about few rocky islands in the East China Sea, nothing to do with trade.

Chinese dominance in the industry is stronger than it was 7 years ago. A potential trade war between the US and China could lead to the explosion of strategic metals and rare earth elements prices.

If there is no trade war, more gradual price gains are expected, but demand alone dictates that they will rise. China has achieved its goal and dominates production. Now, maintaining low prices is not a priority of the Chinese Government.

A conflict between USA and North Korea would also affect prices. The value of strategic metals and rare earth elements belonging to Pyongyang is $6 trillion. Due to sanctions etc., North Korea is not able to capitalize upon this potential. The removal of Kim Jong Un would allow te United States access to these precious minerals, until then, they will be dependent on Chinese export.

A conflict between North Korea and the U.S. leading to the removal of Kim is a black swan event.

How to gain exposure to strategic metals and rare earth elements

Most of mining takes place in China, but there is no way to get exposure there. The Government controls supply, the mining firms are not quoted on any stock market.

There are two solutions that provide exposure to rare earth elements. The first one is the ETF VanEck Vectors Rare Earth/Strategic Metals with REMX ticker.

The fund’s portfolio includes companies involved in the extraction or processing of strategic metals.

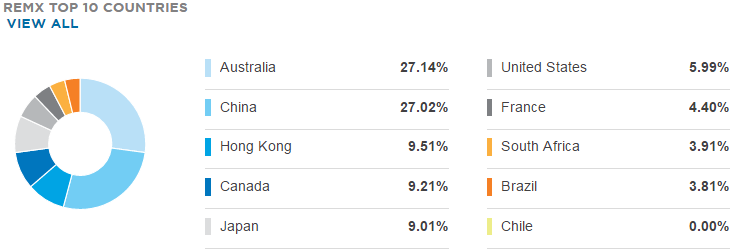

The chart below shows REMX exposure for each country.

Despite most of the metals being mined in China, this ETF has only 27% focus on this country.

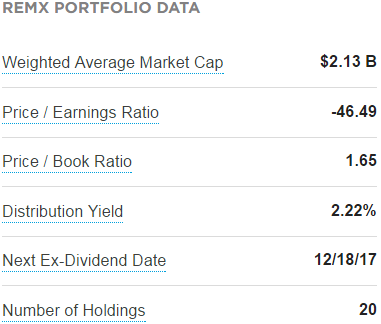

The table below provides data about the capitalization, financial indicators, dividend levels and number of companies in the ETF.

Low metal prices lead to production losses. As a result, financial indicators (as you can see on the example above) are unfavourable. The positive part of this investment is the huge selloff which occurred in 2011-2016.

The current REMX level is 83% lower than in 2011 as you can see on the chart above. Historically these are extremely low levels. Looking at the bottom in 2016, the fund lost 90% of its value. Since then there was slight gain. It doesn’t change the fact that the potential for growth is enormous.

The stocks of companies mining rare earth elements and those elements itself are strongly correlated with commodities prices, which still are undervalued.

The second solution is to buy strategic metals through German company Schweizerische Metallhandels AG (SMH). Their offering is based primarily on four baskets (each one containing several metals). Purchasing selected baskets provides access to metals are stored in a free warehouse in Switzerland.

Metals are grouped by the industries they are used in:

- Solar and energy basket (2 kg of indium, 3 kg of hafnium, 2 kg of gallium).

- Key industrial basket (2 kg of indium, 3 kg of hafnium, 2 kg of gallium, 47.4 kg of bismuth, 8 kg of tantalum, 7 kg of tellurium)

- Machine construction basket (20 kg of molybdenum, 20 kg of tungsten, 20 kg of chromium, 20 kg of cobalt, 4 kg of tantalum, 20 kg of zirconium).

- Modern technology and electronics basket (0.5 kg of rhenium, 2 kg of silver, 2 kg of indium, 5 kg of cobalt, 4 kg of tantalum).

The value of baskets ranges from 6 to 12k euro.

In our opinion because of minimal spread and higher sell-out, the better solution is to invest in REMX ETF.

![How to install MetaTrader 4 / 5 on MacOS Catalina? Simple way. [VIDEO]](https://comparic.com/wp-content/uploads/2020/07/mt4-os-218x150.jpg)