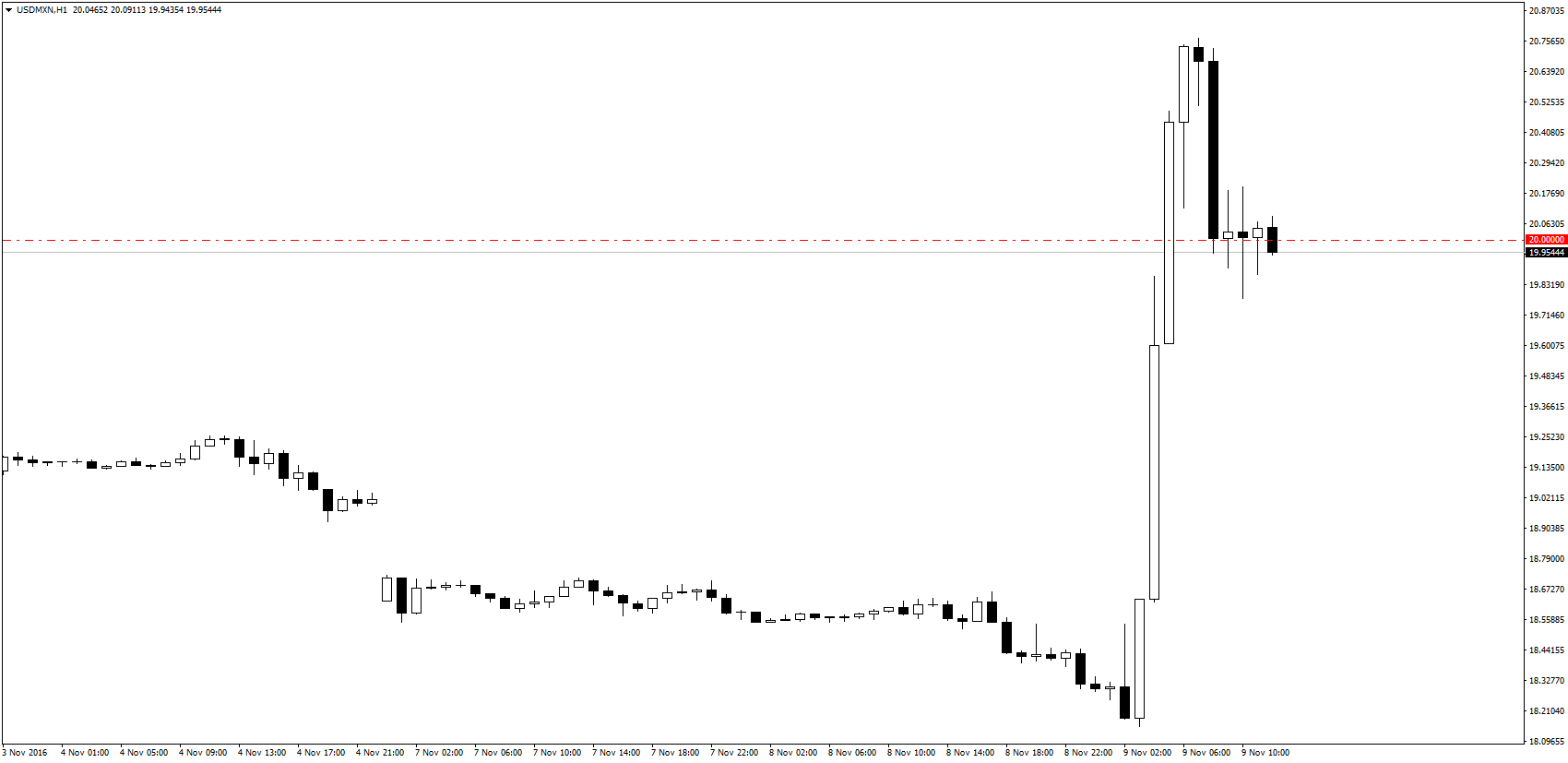

Financial markets have reacted sharply to Republican candidate Trump winning America’s election. S&P futures were limit down 5% in Asia, EURUSD has tested 1.13, USDJPY broke 102 and USDMXN made record highs above 20.70.

Falling stocks have cut the prospects of a December Fed rate hike but EURUSD will struggle to break out of its two year 1.05-1.15 range. As Chart 1 shows, the European Central Bank’s quantitative easing continues to anchor the exchange rate. With the ECB in December set to extend its €80bn a month bond purchases throughout 2017, EURUSD is unlikely to sustain any upside breaks of its two year range. Similarly, GBPUSD has been supported by diminished Fed expectations. We continue to see sterling trading up to 1.30 in Q4’16 as the risk of a ‘Hard Brexit’ gets priced out.

We also think any further near term USDJPY losses will be limited by the rising risk of FX intervention. Vice Finance Minister Asakawa says he is watching FX markets, and as Chart 2 shows the authorities have intervened before at current levels in USDJPY. More medium term, the prospects of substantial US tax cuts and infrastructure spending – with the Republicans controlling the White House, the Senate and the House of Representatives in 2017 – should start to support risk sentiment. We continue to like USDINR, TRYZAR and PLNHUF all lower and see the RUB benefiting if US-Russia relations warm.

In contrast, the NZD is still at risk from the RBNZ cutting 25bps on Thursday and forecasting further easing in 2017. Further, the MXN, CAD and KRW also are likely to stay heavy on concerns over future trade agreements and geopolitical risks. But otherwise reflation trades should recover on the prospects of looser US fiscal policy and still very loose G4 monetary policy.