“Search, Analyse, Trade” is a series of Price Action and Elliott Waves analyses. Its detailed step-by-step description can be found over here. I invite you to today’s review of selected currency pairs and potential trading opportunities. The analyses are based on the Dukascopy sentiment that you can get here.

“Search, Analyse, Trade” is a series of Price Action and Elliott Waves analyses. Its detailed step-by-step description can be found over here. I invite you to today’s review of selected currency pairs and potential trading opportunities. The analyses are based on the Dukascopy sentiment that you can get here.

EUR/USD has chosen scenario with irregular adjustment. Yesterday’s strong decline led to the neck line test of hypothetical Head & Shoulders formation. The pair reached support zone and breached it.

Permanent defeat of the zone should lead to confirmation of the H&S and consequently to a deeper decline to the level of 1.1450. It should be noted, however, that the first downward wave that emerged from the high is five, and now it has three intermediate waves. It is quite possible that two more such waves will emerge and the entire system will be completed. Two scenarios are possible. In the first we will have a completed straight correction and this may set a false breakout of the neck line. This should lead to an end of the correction and we will see a return to growth. In the second option, the formation of the 1212, which will lead to a change of trend and strong decline.

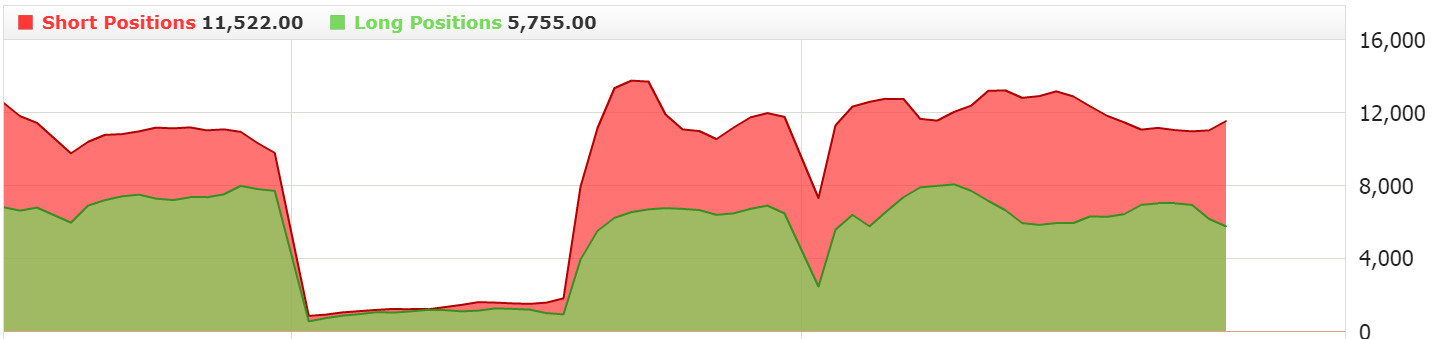

Sentiment shows bullish attitude of players who probably count on defending the support zone. But I’m waiting for breaking the mentioned zone and its re-test, or complete a straight correction and a strong upward movement.

Sentiment shows bullish attitude of players who probably count on defending the support zone. But I’m waiting for breaking the mentioned zone and its re-test, or complete a straight correction and a strong upward movement.

The GBP/USD remains in consolidation, which is more and more reminding a triangle. If we read it properly, then we should see the defence of its lower limit and an upward movement towards the upper limit. Break out of the formation should determine the direction in which the pair will move in the near future.We also need to consider bearish scenario, declines and the trendline test are likely.

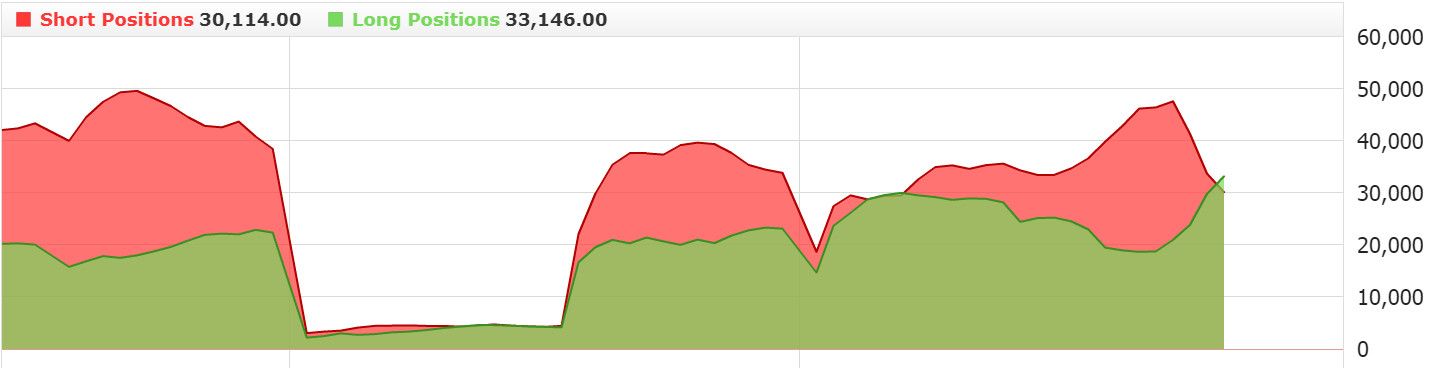

Like on EUR/USD, also here the sentiment supports long attitude. I stay sideways until the breakout from consolidation and confirmation of direction.

USD/JPY ends the pulse wave. Growth has stopped in the supply zone and we should see attempts to reject it. Scenarios outlined in earlier entries continue to be valid. We are dealing with the first growth wave and after it is corrected we will see a movement breaking the currently tested zone, or it is a closing wave which will result in a stronger downward movement. I refrain from opening a position until the resistance zone is breached or a correction will occur and test the support zone in the vicinity of the 38.2 wave Fibo correction.