“Search, Analyse, Trade” is a series of Price Action and Elliott Waves analyses. Its detailed step-by-step description can be found over here. I invite you to today’s review of selected currency pairs and potential trading opportunities. The analyses are based on the Dukascopy sentiment that you can get here.

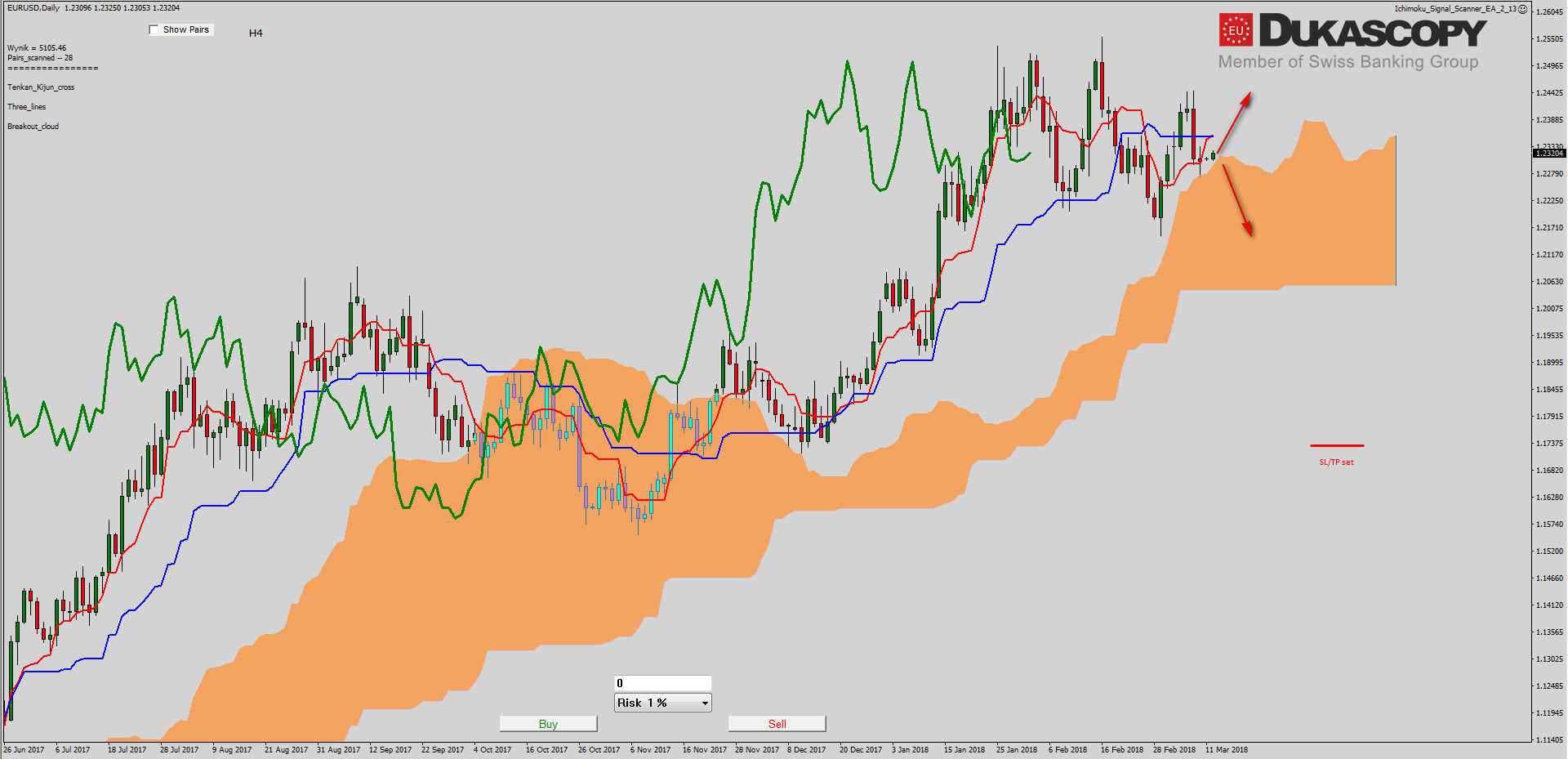

EUR/USD pair remains in consolidation. It looks like a lateral movement stretched in time, which may be the fourth wave of recent increases. The current pair balances between the internal support/resistance line and remains trapped between the two levels. It remains to wait to beat one of them which should result in determining the direction in which the pair will move in the near future.

EUR/USD pair remains in consolidation. It looks like a lateral movement stretched in time, which may be the fourth wave of recent increases. The current pair balances between the internal support/resistance line and remains trapped between the two levels. It remains to wait to beat one of them which should result in determining the direction in which the pair will move in the near future.

On the Ichimoku chart the pair has reached the cloud and if the lateral movement extends over time, the pair will soon break the line of Senkou Span A. Layout of other lines is typical for correction. The Chikou line has come in price and will probably be balancing for a while between her. The Kijun and Tenkan lines are close to the intersection and create a cross above the cloud, which may be a buy signal if the price is above them.

On the Ichimoku chart the pair has reached the cloud and if the lateral movement extends over time, the pair will soon break the line of Senkou Span A. Layout of other lines is typical for correction. The Chikou line has come in price and will probably be balancing for a while between her. The Kijun and Tenkan lines are close to the intersection and create a cross above the cloud, which may be a buy signal if the price is above them.

The sentiment is slightly bullish, which with a possible signal will allow us to open a position.

The partner of “Search, Analyse, Trade” series is a Dukascopy Europe broker who gives its customers access to ECN accounts in different currencies.

Trade on Forex, indices and commodities thanks to Swiss FX & CFD Marketplace. Open free trading account right now.

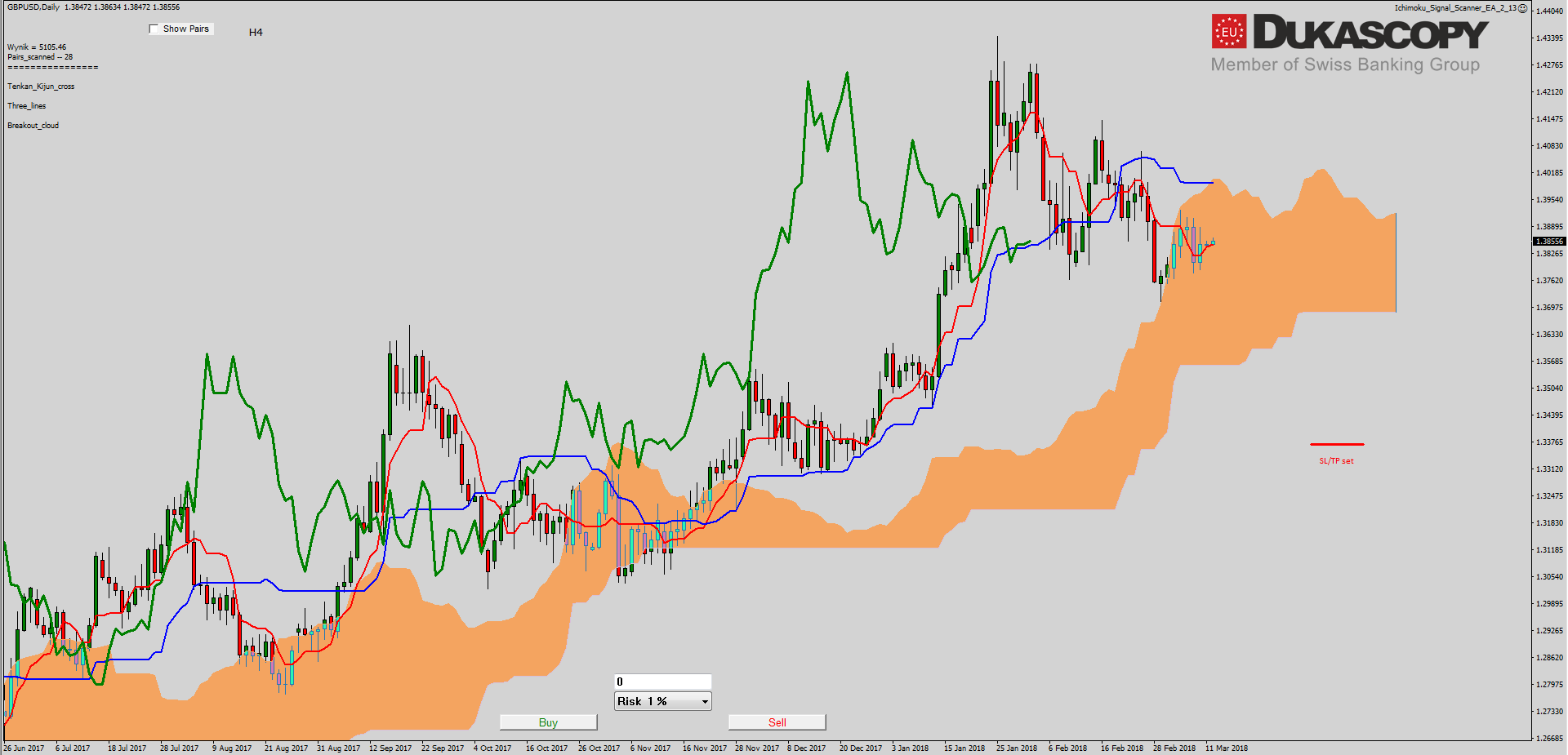

Also the GBP/USD pair is in a consolidation that resembles a triangle. Currently, the pair is still fighting the trend line and can not decide whether to beat it or not. Its overcoming should lead to a decrease towards the last low. It may be a movement within the potential triangle e wave, or as a fifth wave of the C wave in a simple correction.

On the Ichimoku chart, the pair has been in the cloud for some time. Tenkan and Kijun lines recently somehow gave a weak sell signal, crossing over the cloud. Currently, the Kijun line is laid flat, and the price has moved away from it at a considerable distance, which is why it can attract it to itself.

On the Ichimoku chart, the pair has been in the cloud for some time. Tenkan and Kijun lines recently somehow gave a weak sell signal, crossing over the cloud. Currently, the Kijun line is laid flat, and the price has moved away from it at a considerable distance, which is why it can attract it to itself.

The sentiment remains neutral, which allows us to open positions in any direction, but the appropriate setup is far away, therefore I stay on the side until the end of consolidation.

The sentiment remains neutral, which allows us to open positions in any direction, but the appropriate setup is far away, therefore I stay on the side until the end of consolidation.

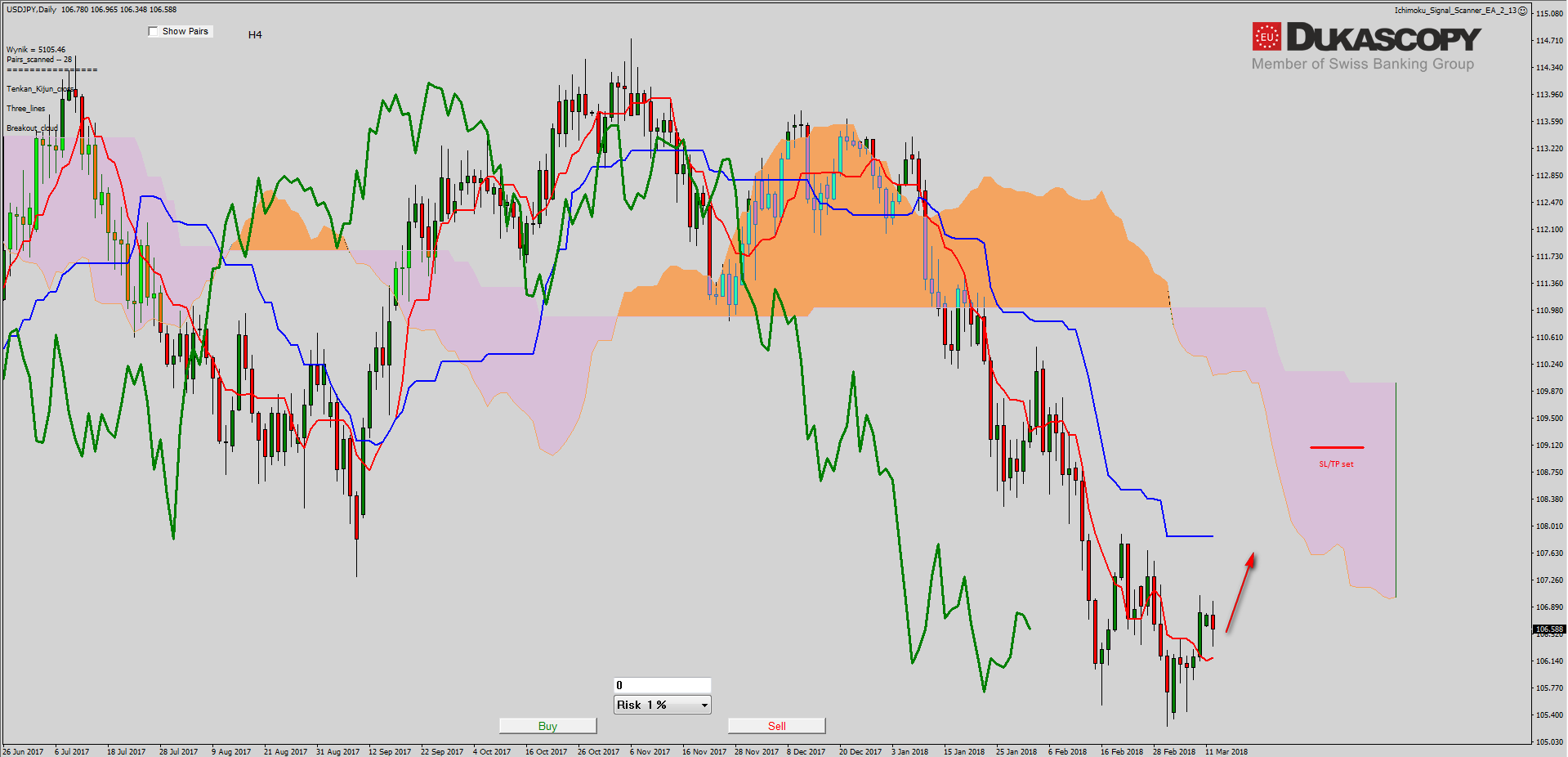

USD/JPY continued last week’s upward move initiated by the defense of an important support zone. Currently, the pair is between important zones and only breaking one of them will show the direction in which the pair should move in the near future.

On the Ichimoku chart we can see that the pair managed to beat the Tenkan line. This line begins to go flat, and even turn back. This may indicate that the correction is imminent, or the move towards the far away from the price -Kijun line. For now, the pair has completed the abc correction and if it is to change into an impulse, then we should see the continuation of the increases from these levels.

On the Ichimoku chart we can see that the pair managed to beat the Tenkan line. This line begins to go flat, and even turn back. This may indicate that the correction is imminent, or the move towards the far away from the price -Kijun line. For now, the pair has completed the abc correction and if it is to change into an impulse, then we should see the continuation of the increases from these levels.