“Search, Analyse, Trade” is a series of Price Action and Elliott Waves analyses. Its detailed step-by-step description can be found over here. I invite you to today’s review of selected currency pairs and potential trading opportunities. The analyses are based on the Dukascopy sentiment that you can get here.

EUR/USD pair did not manage to maintain support. It seems that the movement that took place from the last low was the ending wave. If it was a wave ending the third wave, then after the correction we should see the continuation of rise in the wave five. Movement towards the level of support that has been defeated is quite possible and should take place within wave 2B. It is also possible to consolidate and prolong the lateral movement.

On the Ichimoku chart, the pair defeated the support of the Kijun line. At the moment, both Kijun and Tenkan lines are arranged horizontally, which may mean consolidation. The Chikou line has a price line from which it can reflect.

On the Ichimoku chart, the pair defeated the support of the Kijun line. At the moment, both Kijun and Tenkan lines are arranged horizontally, which may mean consolidation. The Chikou line has a price line from which it can reflect.

The sentiment remains unchanged. We have a balance in the number of long and short positions. You can open positions in any direction. If the pair tests the Kijun line on the daily chart and rejects it, you can think about a short towards Senkou Span A line.

The sentiment remains unchanged. We have a balance in the number of long and short positions. You can open positions in any direction. If the pair tests the Kijun line on the daily chart and rejects it, you can think about a short towards Senkou Span A line.

The partner of “Search, Analyse, Trade” series is a Dukascopy Europe broker who gives its customers access to ECN accounts in different currencies.

Trade on Forex, indices and commodities thanks to Swiss FX & CFD Marketplace. Open free trading account right now.

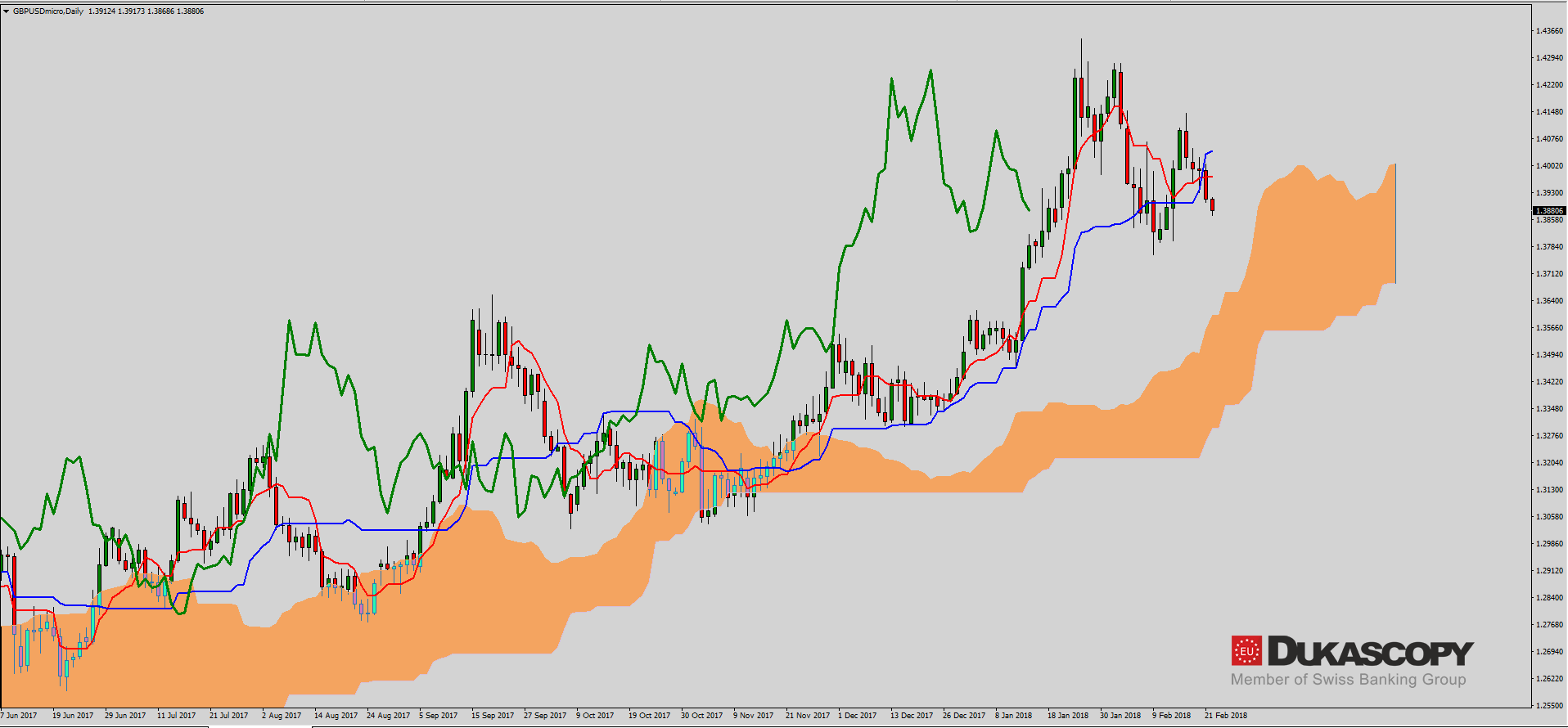

Also the GBP/USD did not maintain support and it is clearly visible that the upward movement was the C wave of the irregular correction and not the first wave . If we assume such an assumption, in the near future we should see at least an accelerated trend line test. If the line is defeated, the move towards key support will be very likely. The downward scenario may still be negated, but the pair should not be able to overcome the currently tested support.

On the Ichimoku chart, the situation is very similar to that on the EUR / USD. The pair crossed Kijun and Tenkan lines. A cross emerges above the growth cloud, which is not a signal when lines are growing. In combination with the Chikou line, the whole looks typical at this moment for lateral movement.

Also, the sentiment has not changed for several days. It remains to wait for some bigger move.

The USD/JPY yesterday reached the resistance zone and there was a reaction of supply. It is an important zone and its defeating would allow for a bigger upward movement. On the other hand, rejection of the level should result in either prolongation of sideways move or a decrease towards the last low in the wave of the fifth wave of 3C.

On the Ichimoku chart, the pair crossed the Tenkan line and perhaps will approach the distant Kijnun line. On the H4 chart, the pair reached the downward cloud. Its rejection may be the beginning of a continuation of declines, or also a movement within the B wave of correction towards the Kijun flat line.

On the Ichimoku chart, the pair crossed the Tenkan line and perhaps will approach the distant Kijnun line. On the H4 chart, the pair reached the downward cloud. Its rejection may be the beginning of a continuation of declines, or also a movement within the B wave of correction towards the Kijun flat line.