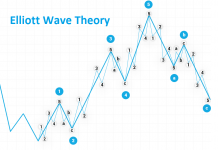

„Searching, Analysing, Trading” is a series of analyses designed for an investment strategy based on Price Action and Elliott Waves. Its step-by-step description can be found in this link. We kindly invite you to follow our today’s review of selected currency pairs and potential opportunities for transactions.

„Searching, Analysing, Trading” is a series of analyses designed for an investment strategy based on Price Action and Elliott Waves. Its step-by-step description can be found in this link. We kindly invite you to follow our today’s review of selected currency pairs and potential opportunities for transactions.

Our analyses are prepared based on Ducascopy’s SWFX Sentiment Index, available here.

EUR/USD

We haven’t observed much change on EUR/USD since yesterday. The pair is continuing the moves up triggered off a few days ago by the rejection of the lower limit of the support zone. The pair succeeded in exceeding that zone and then retest if from the top. Until a larger impulse up occurs, this move should be considered as a correction of the last strong wave down. With that assumption, the pair should test the area of 50% retracement, where a local resistance is located. Once rejected, we should see continuation of declines as part of wave three. A strong break above that level will negate this scenario.

On the Ichimoku chart, we can see that the pair is sitting below the Kijun D1 and Tenkan D1 lines, which confirms a downward-moving tendency. The green line is Senkou Span A M1 and it is quite possible that the pair is heading in its direction. It rejection should coincide with the rejection of Tenkan D1 and will create a very good opportunity to trade continuation of declines. If the price goes above SP A M1, this scenario becomes negated.

GBPUSD

The pair is staying contained within the Inside Bar, which developed between two zones. A break-out should outline the direction for the sessions to come. Looking back on the last decline, my bet would be on a break-out from the bottom and continuation of declines as part of an extended wave five. So far, the impulse that follows the break-out has not been completed yet and I am expecting another sub-wave to test the last bottom.

On the Ichimoku chart, we can observe a situation that resembles what is going on with EUR/USD. The pair is sitting below the Tenkan and Kijun D1 lines, which are slowly changing their directions from sideways to descending. The two lines that are visible on the chart are: Senkou Span A W1 dotted line at the bottom and Kijun M1 at the top. Currently the pair bounced off Senkou Span A W1 and should head towards Tenkan D1, where I am going to look for a short position based on a downward scenario.

The partner of “Search, Analyse, Trade” series is a Dukascopy Europe broker who gives its customers access to ECN accounts in different currencies.

Trade on Forex, indices and commodities thanks to Swiss FX & CFD Marketplace. Open free trading account right now.

USD/JPY

It is the USD/JPY pair that has been the most active since yesterday. It has rejected the resistance line that it tested yesterday and collapsed. At present it is testing a support level and its breach will negate all the upward scenarios presented before – perhaps except for 1212 sequence. In this case the pair would have to fall below the bottom of the last wave up. For the time being, the basic scenario for me is the one indicated above, i.e. completion of the simple correction of the last impulse down and continuation of declines as part of wave 3C.

On the Ichimoku chart we can see that the pair has reached a crucial spot. It is testing the Kijun D1 line and Tenkan M1 – marked as a green line. Once they are breached, declines towards the dotted line should follow – where the Tenkan W1 line is sitting. If the pair breaches the lines currently being tested, their retest from the bottom will provide a great opportunity to look for an entry to trade wave 3C.

Translation: Mirosław Wilk