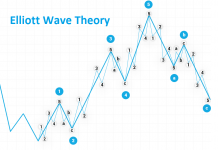

„Searching, Analysing, Trading” is a series of analyses designed for an investment strategy based on Price Action and Elliott Waves. Its step-by-step description can be found in this link. We kindly invite you to follow our today’s review of selected currency pairs and potential opportunities for transactions.

„Searching, Analysing, Trading” is a series of analyses designed for an investment strategy based on Price Action and Elliott Waves. Its step-by-step description can be found in this link. We kindly invite you to follow our today’s review of selected currency pairs and potential opportunities for transactions.

Our analyses are prepared based on Ducascopy’s SWFX Sentiment Index, available here.

EUR/USD

The pair is still hovering within the support area. So far, it has been defended, yet no major willingness can be seen to react more sharply, e.g. from the inner line. I am considering two scenarios. The first assumes that the impulse down is completed via broken wave 5 – however, so far it doesn’t seem viable. Based on the second scenario, the last impulse down gets completed, corrected and then further declines follow. Therefore, we are waiting for a stronger move in a specific direction.

No major changes can be observed on the Ichimoku chart, either. The pair is sitting under the green line – Senkou Span A M1. There are still around 150 pips of free space left to the next support level, where the Kijun M1 line is located. That’s why I am watching out for shorts, bearing in mind that sentiment has been neutral for a long time. However, in order to enter a position, we need a clear signal – and that’s a rather remote perspective. I am waiting for a correction towards the Kijun / Tenkan D1 lines.

GBP/USD

The pair failed to defend the support zone yesterday and headed south, reaching a consecutive demand zone. I personally expected that wave 1 would be corrected, yet that did not happen, and the impulse continued. The pair also landed underneath the inner line, which acted as strong support/resistance. If the pair decides to defend its current level, I am expecting that there will be a retest of the line mentioned above. From the wave perspective, it is quite probable that a scenario with an extended wave 5 is playing out, which means that we may be in wave 3 of 5.

On the Ichimoku chart, we can see that the pair breached the Senkou Span A W1 line yesterday, marked as a dotted line. It turned into support, which we may use to trade continuation of declines as part of wave 5. The prerequisite for that is a correction and a retest of that level. All we can do now is wait.

The partner of “Search, Analyse, Trade” series is a Dukascopy Europe broker who gives its customers access to ECN accounts in different currencies.

Trade on Forex, indices and commodities thanks to Swiss FX & CFD Marketplace. Open free trading account right now.

USD/JPY

The pair defended its key support level yesterday – crucial for the scenario involving 1212 sequence. If this level is upheld, we may envisage continuation of the moves up. A surge up will confirm that scenario. However, if that level is upheld and the price merely edges up, I will be inclined to bet on a scenario in which an impulse up starting from the bottom is not completed and its wave 5 has been effectively wave b in an irregular correction. In such a case, the current move is its wave 5.

On the Ichimoku chart, we can see that the pair reached the Kijun D1 line – that line and Tenkan M1 converge, which gives a clear boost to the rejected level. At present the pair is sitting near the Kijun H4 line and is close to breaking out of the cloud. It such a rebound takes place, it will generate a buy signal and we will be able to trade continuation of the moves up.

Translation: Mirosław Wilk