The End of the Day setup overview is a daily set of analyses of investment opportunities based on the EoD strategy, if you want to find more details, check this link. The series will last exactly two weeks. After this period, on Saturday, September 23rd, I will publish a report summarizing the statistics of this strategy and will show whether or not during this two weeks strategy was profitable.

The End of the Day setup overview is a daily set of analyses of investment opportunities based on the EoD strategy, if you want to find more details, check this link. The series will last exactly two weeks. After this period, on Saturday, September 23rd, I will publish a report summarizing the statistics of this strategy and will show whether or not during this two weeks strategy was profitable.

As announced earlier, on the same day, I will also present another strategy that I will test for another two weeks. This way I will try to test as many investment strategies as possible for binary options in order to find the best and most effective one.

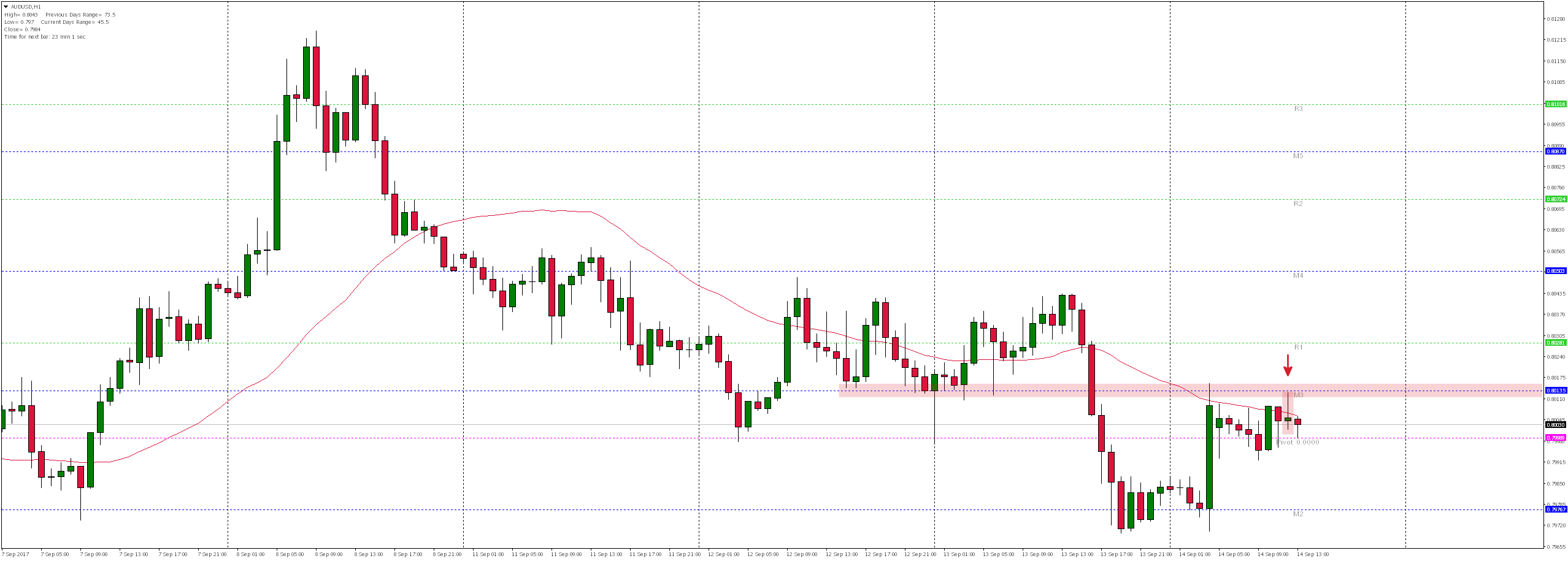

AUDUSD started the Thursday session below the PP level (pink dotted line called Pivot), which means that the only scenario we are interested in is bearish one. As a result of later gains, the price reached the level of M3 and the moving average SMA33, where the first bearish reaction occurred. Rejection of this zone could be a signal for declines. In short term, therefore, it is worth considering PUT option on this instrument.

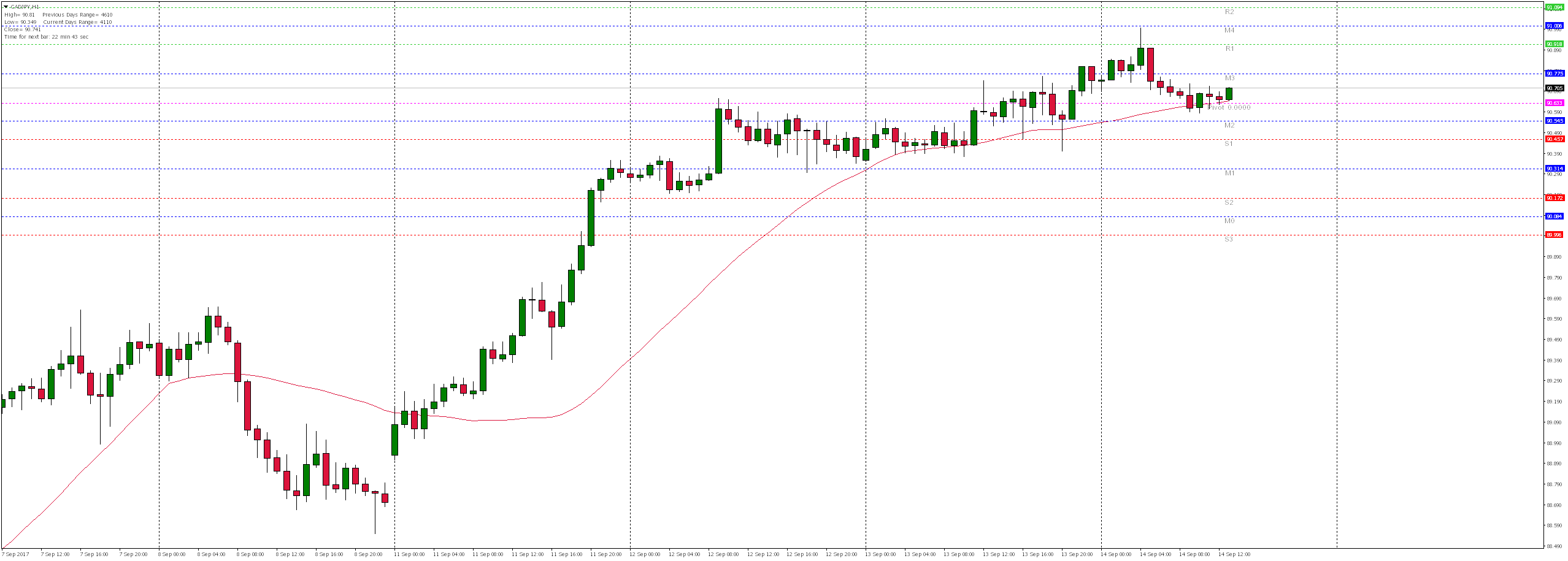

CADJPY started Thursday’s session above PP, which means that the only scenario we are interested in is the bullish one. As a consequence of subsequent falls, the rate reached the level of PP converging with the moving average SMA33, where the first demand response has already occurred. Rejection of this zone could be a signal to continue growth. In the short term, therefore, it is worth considering CALL option on this instrument.

EURCAD started the Thursday session below PP, which means that the only scenario we are interested in is the bearish one. As a result of later gains, the price reached the 38.2% of Fibonacci correction where the first supply reaction occurred. Deepening these gains to the moving SMA33 and PP levels, where a supply reaction would appear, could be an interesting signal to continue the declines.

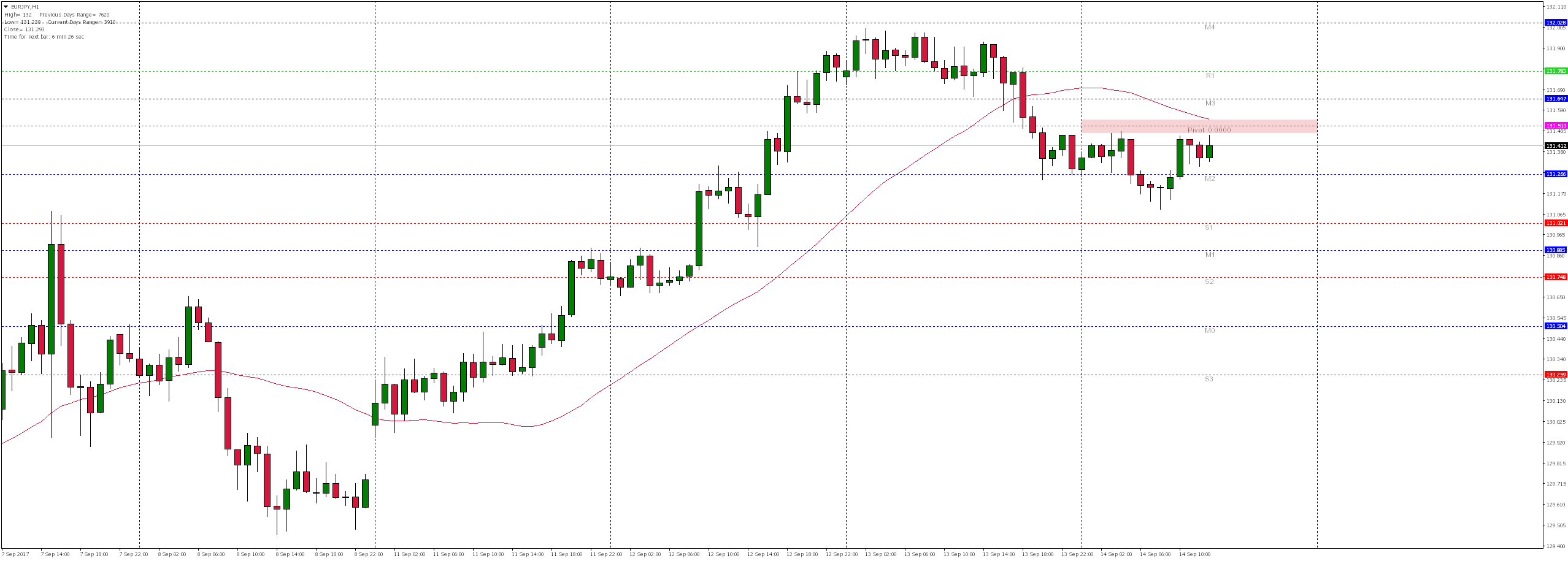

EURJPY started Thursday’s session below PP, which means that the only scenario we are interested in is the downside one. As a result of later gains, the rate reached the PP level and the moving average SMA33. Rejection of this zone could be a signal for recurrence. In the short term, therefore, it is worth considering a PUT option on this instrument.

Try trading on binary options on currencies, indices, commodities and shares of popular companies. Create a real account and earn 50 to 150% Welcome Bonus.

Try trading on binary options on currencies, indices, commodities and shares of popular companies. Create a real account and earn 50 to 150% Welcome Bonus.

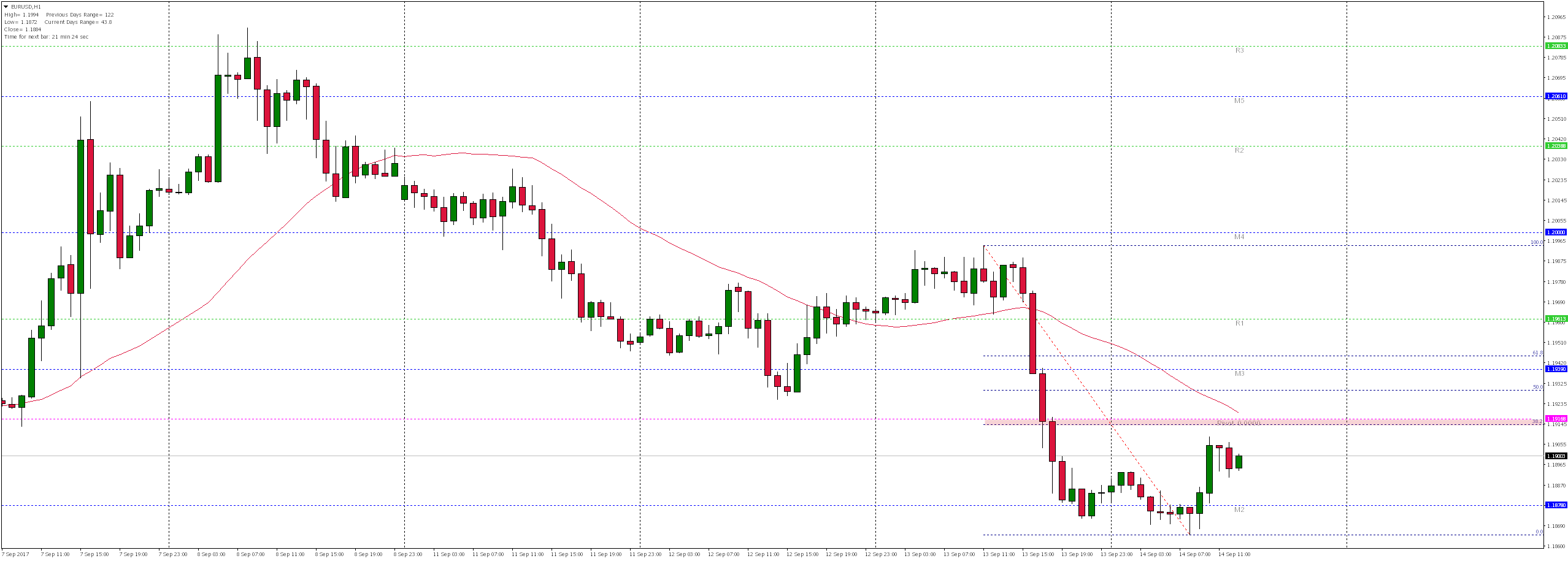

EURUSD started the Thursday session below PP, which means that the only scenario we are interested in is the bearish one. For several hours, however, we have seen increases and if the market reaches vicinity of PP level converging with the 38.2% Fibonacci correction and the SMA33 average, and there would be a supply reaction, we could expect continuation of declines.

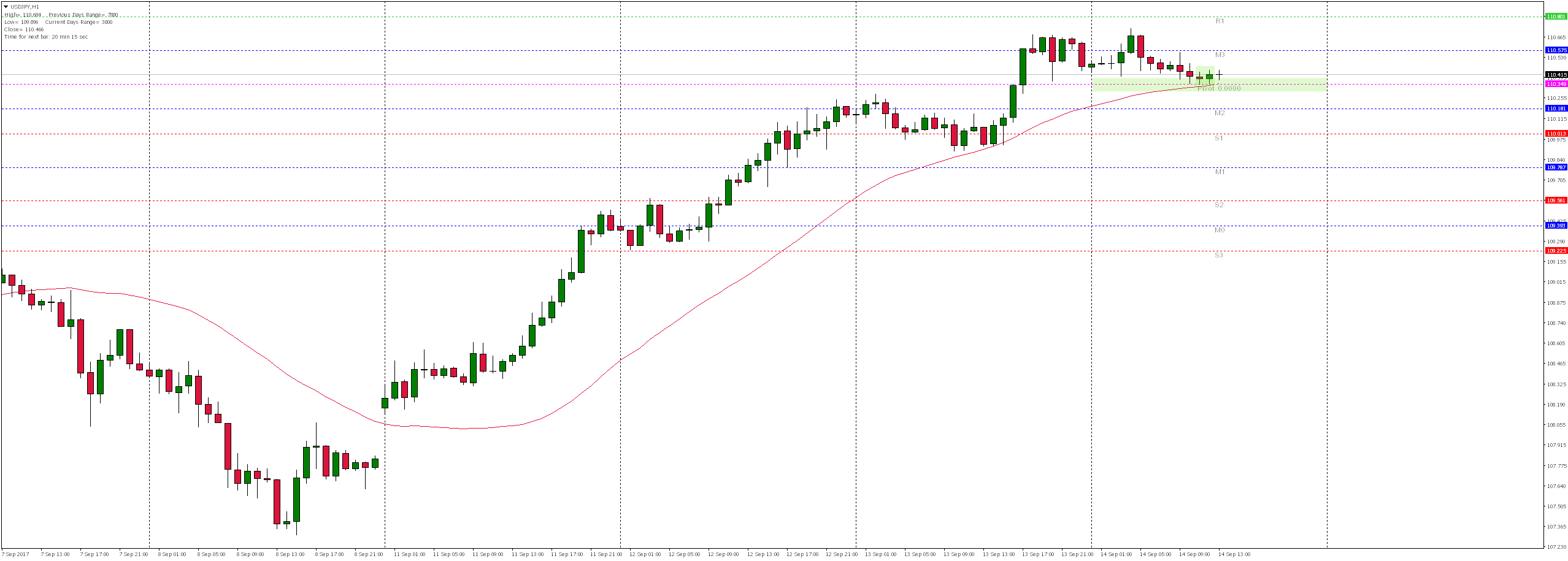

USDJPY started the Thursday session above PP level which means that the only scenario we are interested in is a pro-growth one. As a consequence of subsequent falls, the market reached level of PP, where the first demand response was already occurring. Rejection of this zone could be a signal to continue growth. In the short term, it is therefore worth considering CALL option on this instrument.

USDTRY started Thursday’s session above the PP level which means that the only scenario we are interested in is the pro-growth one. As a result of later falls, the market reached the 38.2% Fibonacci correction and SMA33 average, where the first demand response was already occurring. In the short term, therefore, it is worth considering the CALL option on this instrument.

GOLD started Thursday’s session below PP, which means that the only scenario we are interested in is the bearish one. As a result of later gains, the rate reached PP level and the moving average SMA33. Rejection of this zone could be a signal for declines. In the short term, therefore, it is worth considering PUT option on this instrument.

SILVER started the Thursday session below PP, which means that the only scenario we are interested in is the bearish one. As a result of later gains, the rate reached the PP level and the moving average SMA33. Rejection of this zone could be a signal for declines. In the short term, therefore, it is worth considering PUT option on this instrument.

Binary options broker uTrader offers a 76% return on AUDCHF, EURJPY and GOLD and 74% on NZDUSD options. If you win your account will increase by such percentage of the invested amount. If you lose, regardless of the size of the loss, you never lose more than you bet. You can also choose other expiration hours for options, both shorter and longer. Create a real account and earn 50 to 150% Welcome Bonus.

Binary options broker uTrader offers a 76% return on AUDCHF, EURJPY and GOLD and 74% on NZDUSD options. If you win your account will increase by such percentage of the invested amount. If you lose, regardless of the size of the loss, you never lose more than you bet. You can also choose other expiration hours for options, both shorter and longer. Create a real account and earn 50 to 150% Welcome Bonus.