The British pound rate against the US dollar in the last days has recovered nearly 230 pips, which means that the GBP/USD pair is approaching the upper limits of the correction range again. Does this mean that the pair has very limited possibilities for further growth?

Strong declines on the pound sterling are nothing new – the situation of uncertainty about further negotiations on the Brexit and Theresa May’s cabinet agreement was in doubt for a moment. Then also the volatility exceeded all expectations – knocking out all the support as if it was not there at all. And nothing strange when the country during the most important debates about the economic future is under the sign of the possibility of losing the prime minister. However, in recent days the situation seems to have been somewhat alleviated and the commentators are already familiar with the vision of not quite a favourable contract for the United Kingdom itself. That is why the pound moves have some time to recoup at least some of the losses from the last critical period.

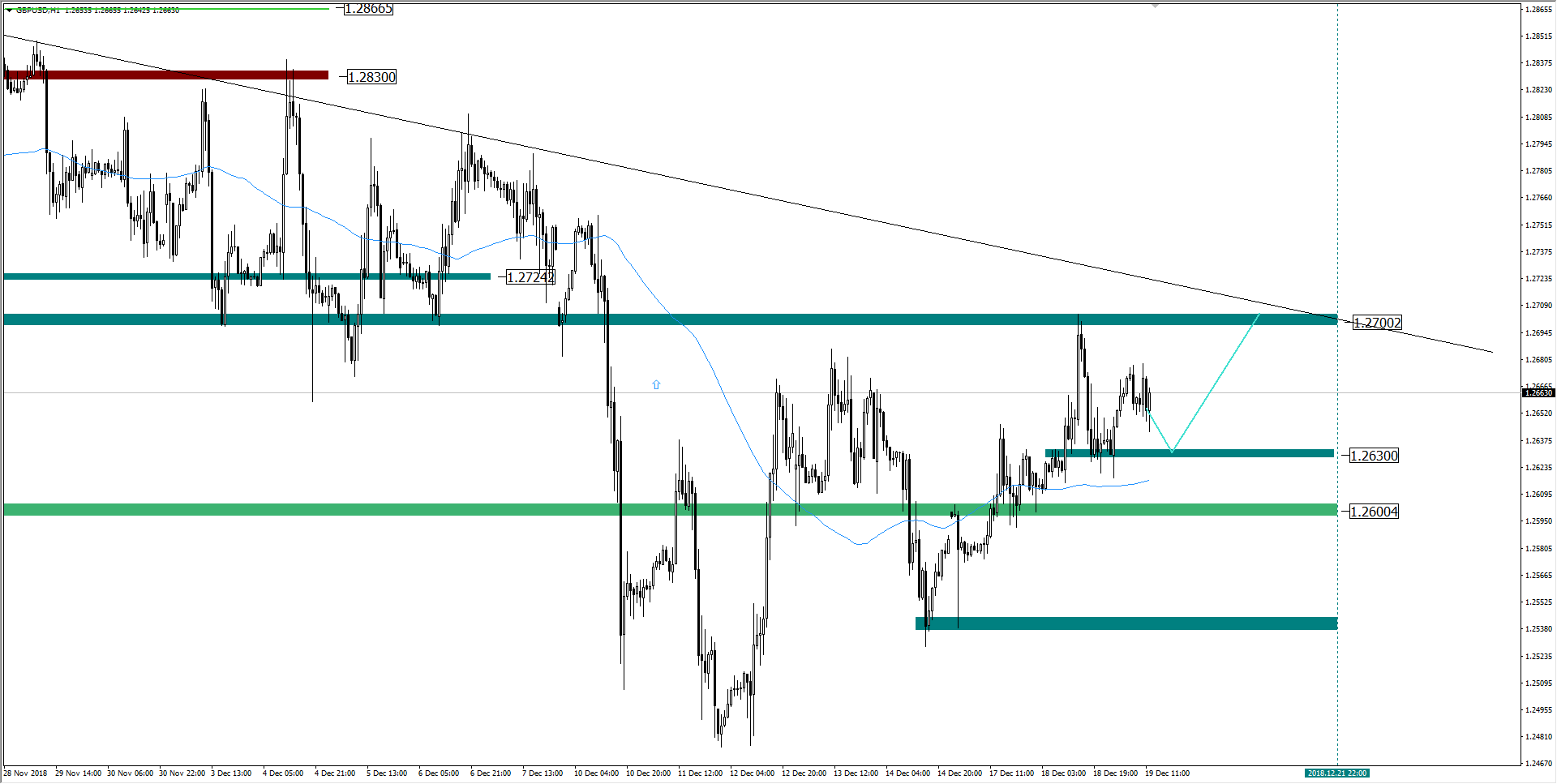

GBP/USD – a possible scenario

In the present situation on charts on the GBPUSD from the perspective of the H1 interval – it seems that the most reasonable scheme to play the possibility of further climbing the pair would be waiting for a correction, which should reach the level marked on the graph below – zone 1.26300. Next, further increases can be expected with the target level of 1.27000 – 1.27100, where the pair should then make a correction.

However, if the level described as current price support is broken, then further increases may be temporarily negated – until this level is broken again. The upper limit goal (1.27000 – 1.27100) should be completed in the next two trading sessions, ie before the Christmas break starts in the markets.