This week’s macro events which would be worth mentioning were: OPEC meeting in Vienna, Payrolls (USA and Canada) and BoC’s decision to leave the % rates in Canada unchanged. Why have I just mentioned these? Because it was these events that had the greatest impact on my analysis. The Canadian dollar turned out to be particularly susceptible, where mood changes and exchange rate jumps looked like a rollercoaster…

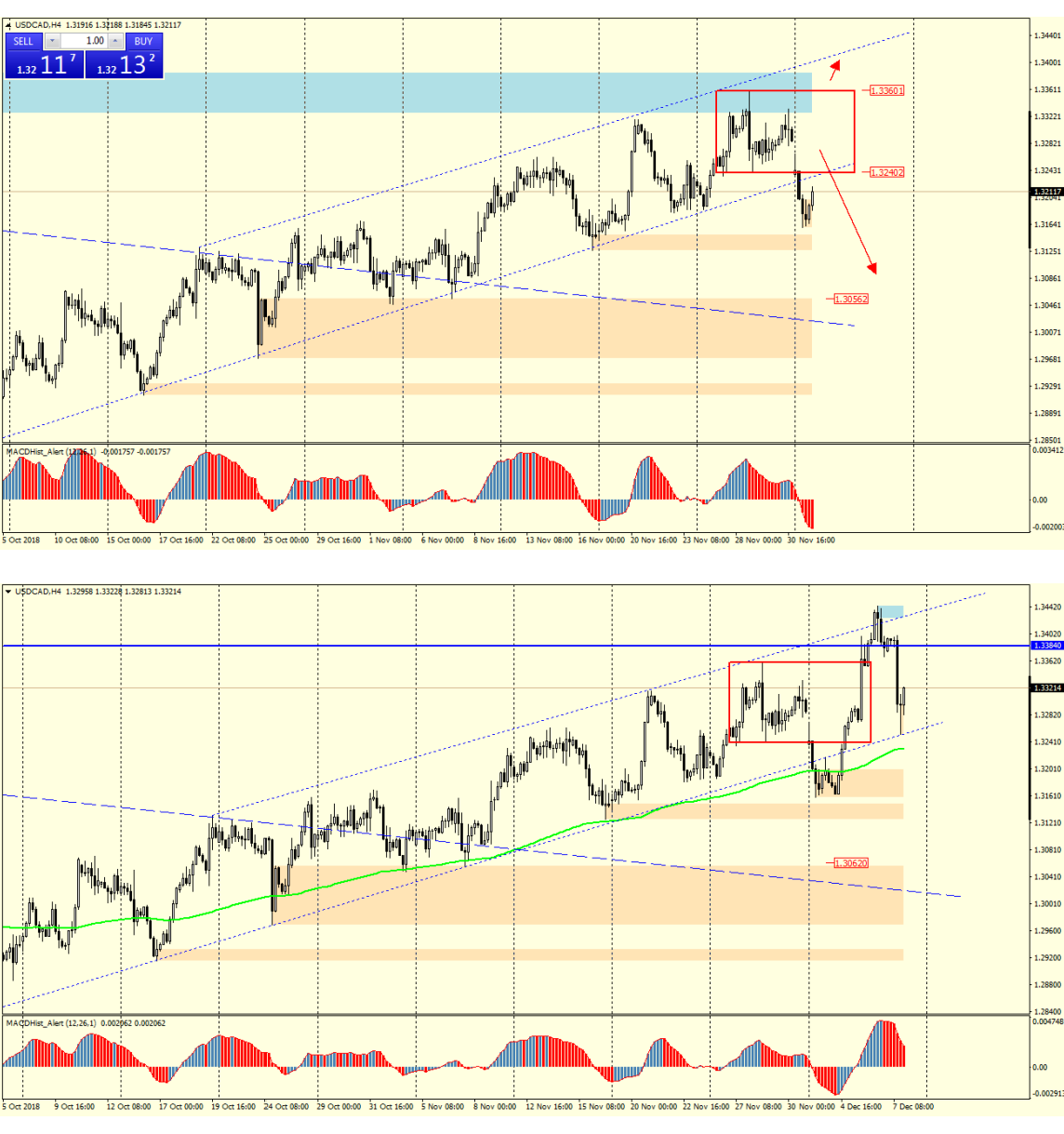

USDCAD 03-08.12

USDCAD – another Inside Bar on the Top….. Ach…. This was the third approach to this “commodity” pair in the last 2 weeks and once again missed. The technical approach to CAD was a mistake – more important were the fundamentals, i.e. the Bank of Canada’s message about leaving the rates unchanged and cheap oil. The analysis was based on the Inside Bar formations and breakout…. but the reality was different, the price went north and at an accelerated rate of 170p after the BoC announcement. The result was that I lost 190p and 7% of my account 🙁

NZDJPY 05-08.12

In the analysis of this pair – NZDJPY – bearish divergence on Daily chart – 05/12/18 I wrote so: “On chart H4 the price is in the middle of the growth channel in which it has been moving since November 1. Due to divergences on D1 and decreasing MACD on H4, we can expect further decreases towards the support of this channel.” A glance at the charts above and you can see that everything was fulfilled. Good analysis, sufficient realization – collected only 27p.

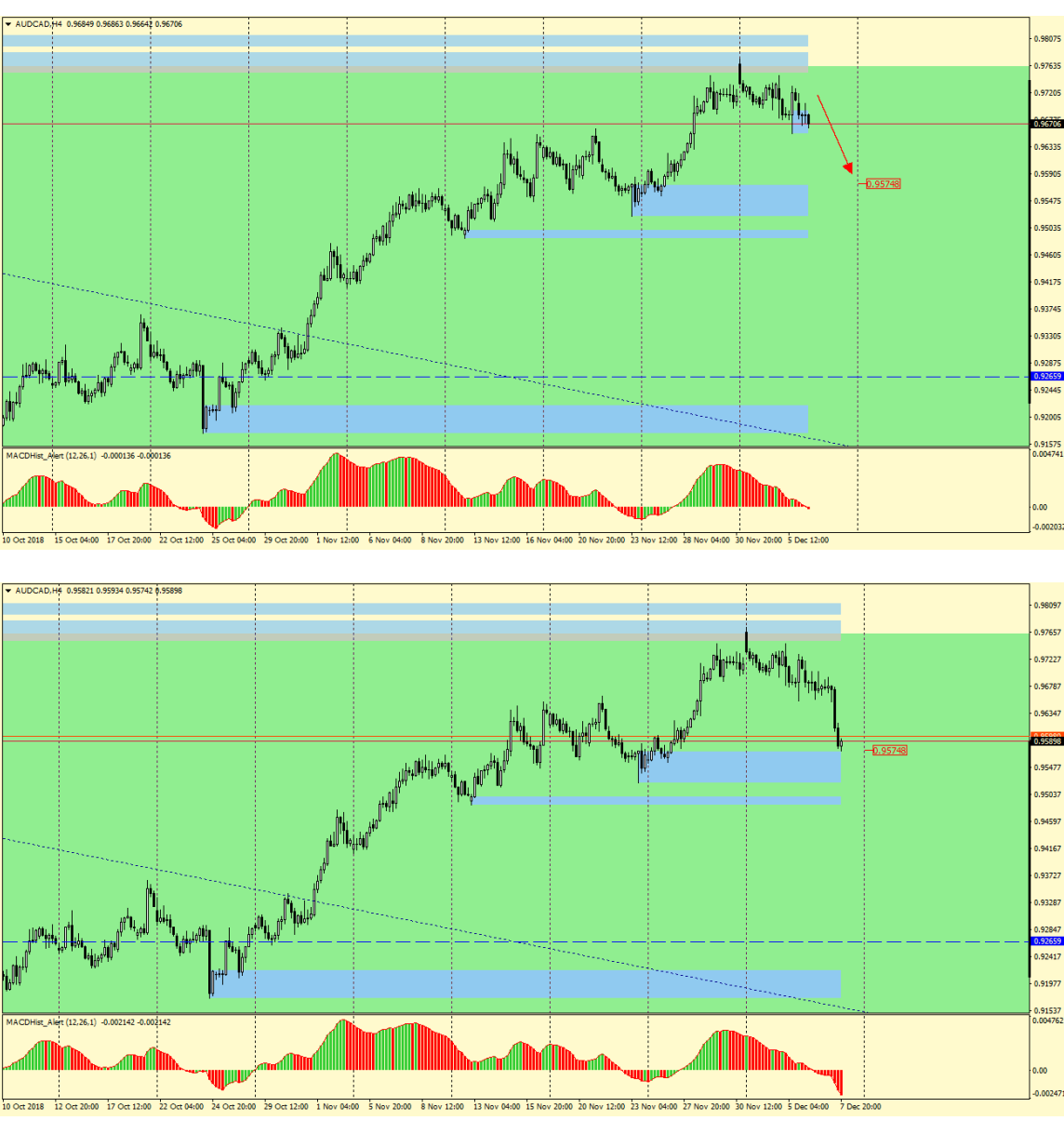

AUDCAD 06-08.12

Analysis from Thursday – “AUDCAD – Over Balance and divergence – 06/12/18” similarly as the one on NZDJPY was 100% fulfilled. I wrote there: “Going to chart H4, considering the downward scenario, we can determine the closest supply target, which is 0.9575 distant by about 100p at the moment”. The charts above nicely confirm the development of events.

It happened faster than I expected, Friday’s weak Payrolls in the USA and good data from the labour market in Canada helped, caused a rapid return on CAD and the scenario from the analysis was realized within one day. To sum up: analysis was good, but I didn’t take advantage of this 100p movement, this time leverage 30:1 was not enough…. the funds in the account were entangled in orders on other pairs and there wasn’t enough balance for this one more.

To sum up the week: in the analyses the result 2:1 for me, despite the fact that I lost on the loonie, in %, the account grew a bit.