Daily Forex Market Preview, 16/08/2017

The monthly retail sales data released yesterday showed a better than expected headline print which helped to support the US dollar’s recovery. Data from the US commerce department showed that retail sales rose 0.6% on the month in July. This was higher than the estimates of a 0.4% increase and marked the biggest monthly gain since December. Excluding autos, retail sales rose 0.5%, more than the estimates of 0.4% increase.

In the UK, consumer prices remained steady, rising 2.6% on the month. This was slightly lower than the estimates of a 2.7% increase, and inflation rose at the same pace as the previous month in July. The British pound weakened, as a result, led by a stronger US dollar.

Looking ahead, the economic calendar is busy today. The Italian preliminary GDP figures are expected to show a 0.4% quarterly growth. In the UK, the monthly wage data suggests that average earnings increased 1.8%, rising at the same pace as the month before, while the unemployment rate is expected to remain steady at 4.5%.

Flash GDP estimate from the Eurozone is also due today and is expected to show a 0.6% GDP growth in the second quarter. Later in the day, the US building permits and housing data is due followed by the FOMC meeting minutes.

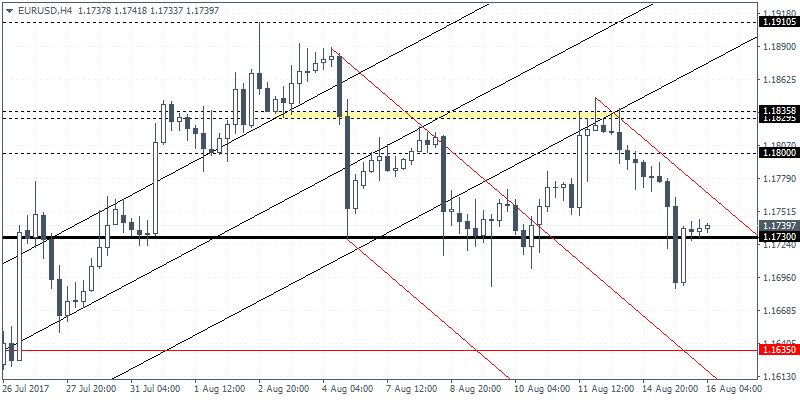

EURUSD intraday analysis

EURUSD (1.1739): The EURUSD posted declines for a second day. Price action broke to the downside from the inside bar that was formed on Monday. This potentially suggests some downside in prices. However, on the 4-hour chart, after a brief break down below the main support at 1.1730, EURUSD managed to recover back above this level. We could expect to see some consolidation taking place in the near term with the potential for the currency pair to rebound back to 1.1800. Only a confirmed close below 1.1730 will signal further declines towards 1.1635.

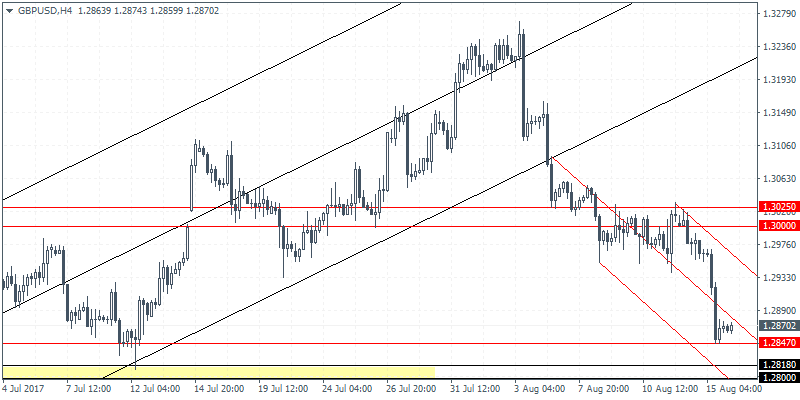

GBPUSD intraday analysis

GBPUSD (1.2870): The British pound extended declines to 1.2847 yesterday. This marks a support level that was previously tested around early July. A rebound off this level could suggest a near-term retracement, potential back towards 1.3025. This would mark the formation of the short-term head and shoulders pattern. A reversal off 1.3025 could suggest further declines down to 1.2626, which marks the measured move as well as coinciding with the former support.

Above article was provided by Orbex – Serving Traders Responsibly. Check the trading conditions and open your own account.

The Latest News covering forex, commodities, and indices in addition to exclusive CFD and forex trading opportunities identified by the Orbex research team

USDJPY intraday analysis

USDJPY (110.22): The USDJPY managed to post strong gains for a second consecutive day. Price action briefly rallied to a 6-day high at 110.85 yesterday before slightly easing back below the resistance level of 110.80. On the 4-hour chart, the trend line break has signaled a strong move to the upside. However, lack of a retest of the breakout levels suggests some downside risk. A retest to 110.17 is, therefore, quite likely. However, if we get to see a reversal here, USDJPY could be seen pushing higher.