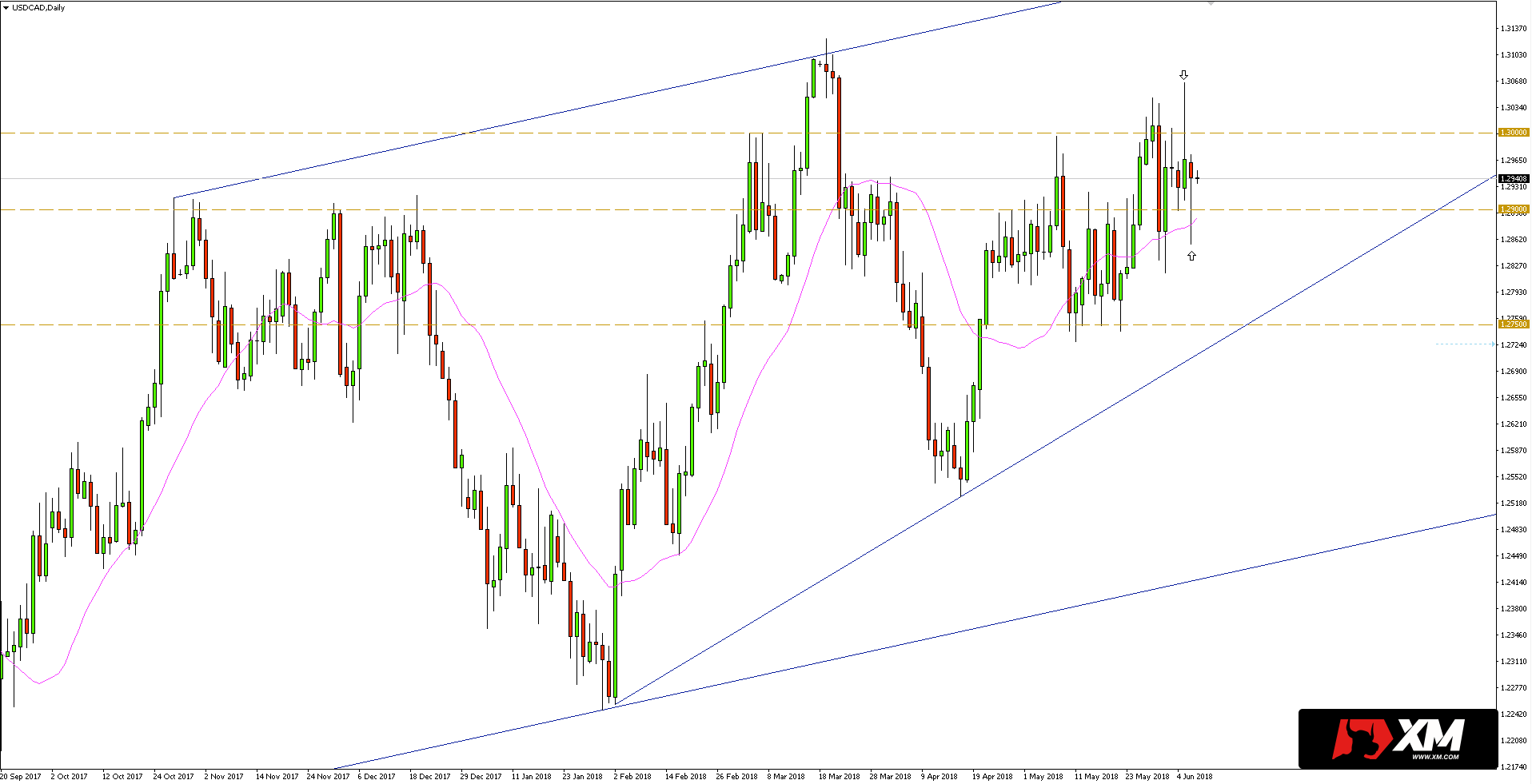

USDCAD is recently found in an interesting position. Before the decision of the Bank of Canada on monetary policy, the course tested the level of 1.3000. Already after the decision, the Canadian dollar strengthened, which resulted in a slump on the closing of the session to support at 1.2900.

However, the next day, the pair returned to the range between 1.3000 – 1.2900, where it stays to this day. During the Tuesday session, the key resistance at 1.3000 was again tested and then a candle with a long upper wick was formed, indicating that this level was respected.

In turn, yesterday we were witnessing a reverse situation, where there was a support test at 1.2900, and on the daily chart appeared a candle with a long shadow at the bottom showing advantage of the demand side. So we have two opposing signals formed in a 100-pips range.

In favour of yesterday’s bullish formation, speaks the prevailing north direction and that the price is over 20-day SMA. However, the key seems to be the negation of the high from Tuesday or the lows of Wednesday’s session.

I trade on this instrument at broker XM, which has in its offer more than 300 other assets >>

In the first case, the pair may go further up to this year’s high at 1.3124, and then to the upper limit of the growth channel. Alternatively, breaking the minima of yesterday’s session would open the way to confluence of

supports where the trend line from February this year meets with the horizontal area at 1.2750.