We remain bullish that the USD/JPY will rise to over-115 in the medium term. This week we continue to focus on news indicating the strength of the US economy such as the ISM index, auto sales, the Beige Book, and payroll data. However, it will likely be difficult to identify factors to move the USD/JPY soon and substantially – wrote Deutsche Bank’s analytics in their newest publication.

We remain bullish that the USD/JPY will rise to over-115 in the medium term. This week we continue to focus on news indicating the strength of the US economy such as the ISM index, auto sales, the Beige Book, and payroll data. However, it will likely be difficult to identify factors to move the USD/JPY soon and substantially – wrote Deutsche Bank’s analytics in their newest publication.

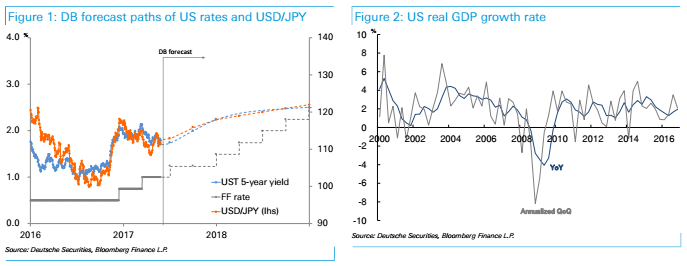

There are still no decisive stories for the USD/JPY. A Fed rate hike in June is largely factored in, but the next hike could now slip from September to December in our forecast. Yields on 10-year and 5-year US Treasuries remain below 2.5% and 2.0%, respectively, expectations for US fiscal stimulus have receded, we think uncertainties (RussiaGate, US isolation at G7) for the Trump administration will likely persist, and the euro’s recent firmness is pressuring the dollar bulls.

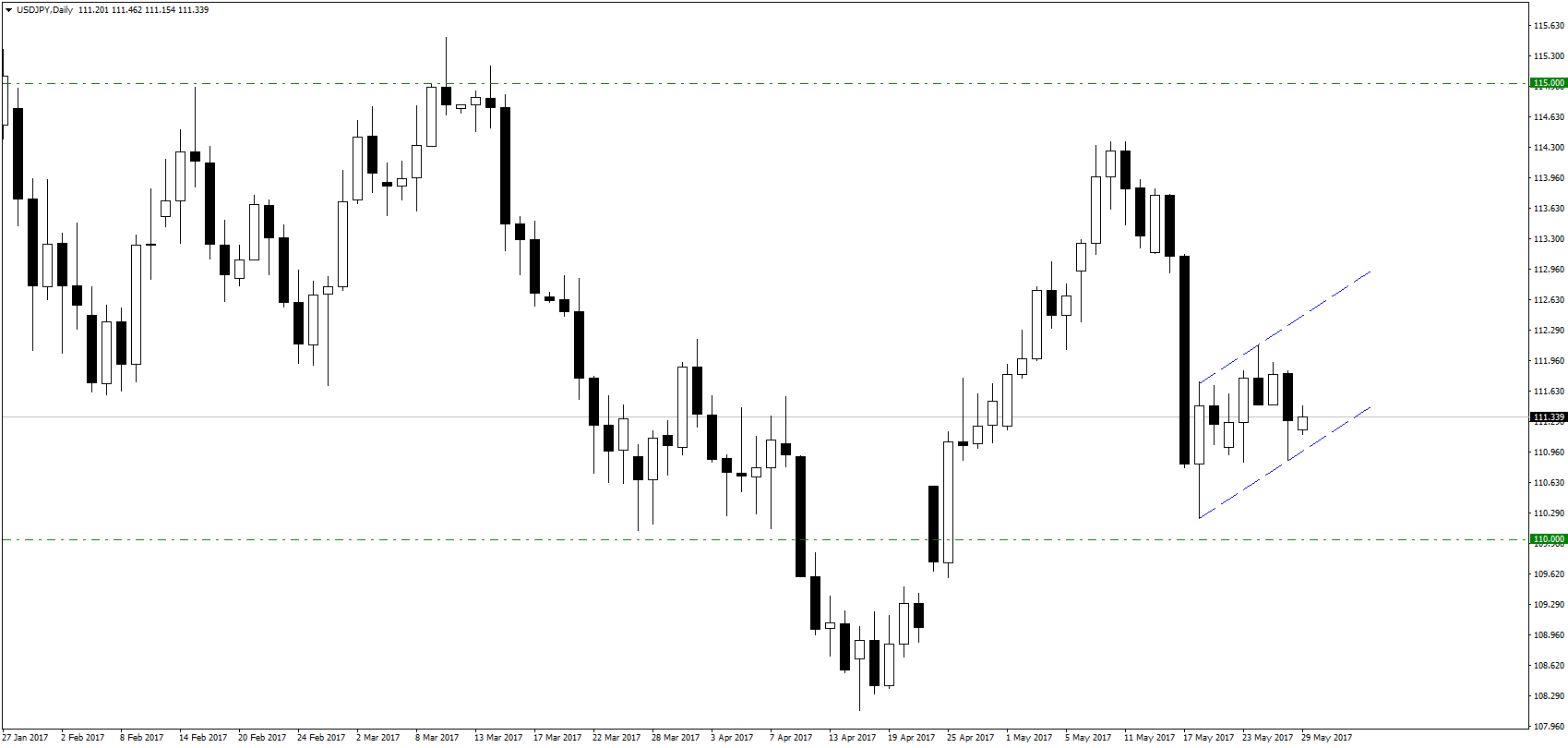

Emerging-market currencies (Brazil, South Africa) are becoming fragile again, and combined with a ratings downgrade for China and the situation regarding North Korea, we see this as a factor for loss of risk-friendliness. DB Japan economist has lowered the 2018 GDP growth forecast from 1.2% to 0.8% as signs of slowing start to emerge. (However, the 2017 growth forecast is up from 1.1% to 1.4%.)

Try out FxWatcher service for free and get similar commentaries on your email>>>

However, we still see support factors for USD/JPY upside: we expect US economic growth to continue in the mid-2% range in the medium term and forecast two further rate hikes this year and 3-4 in 2018. In the near term, we see the USD/JPY tending to trade around the low 110 level. We continue to recommend buying the USD/JPY at around 110 while monitoring foreign securities investment flows at institutional investors such as Japanese life insurers, as well as firmness for key US indicators and the Trump administration’s progress delivering its policies.