U.S. West Texas Intermediate and international-benchmark brent crude oil slightly retreated some ground after yesterday’s mixed session. Traders reacted to the forecasts of high U.S. production and exports offset concerns that fighting between Iraqi and Kurdish forces could threaten the country’s crude supply abilities.

U.S. West Texas Intermediate and international-benchmark brent crude oil slightly retreated some ground after yesterday’s mixed session. Traders reacted to the forecasts of high U.S. production and exports offset concerns that fighting between Iraqi and Kurdish forces could threaten the country’s crude supply abilities.

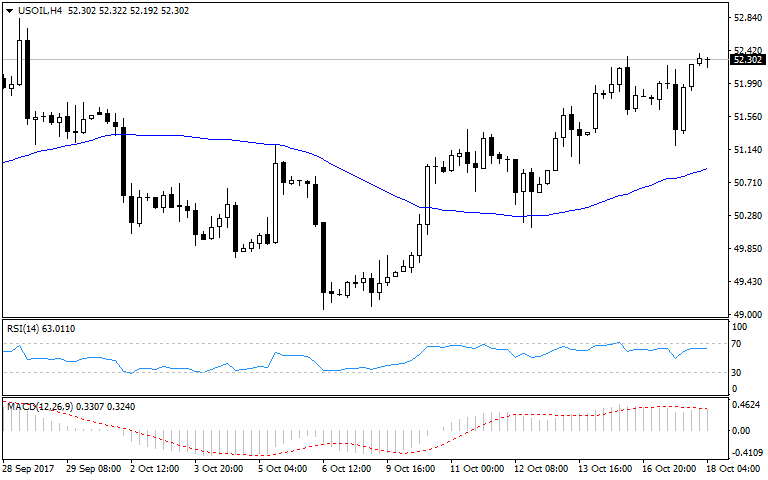

December West Texas Intermediate crude oil settled at $52.11, which is a decline of $0.03 or 0.06% and January Brent crude oil finished the session at $57.54, a loss of $0.02 or 0.03%. Traders are concentrated on the rising U.S oil production and persistently high exports tied to the widening spread between Brent and WTI crude oil.

Trade oil WTI CFDs with 24option.com>>>

On the alternative side, prices are being bolstered by the situation in Iraq and the tension between the United States and Iran. The American Petroleum Institute (API), announced that U.S. crude inventories slipped by 7.1 million barrels in the week to October 13 to 461.4 million barrels. Moreover, gasoline inventories, according to the API, saw a surprise build of 1.941 million barrels for the week-ending October 13. Wednesday’s U.S. Energy Information Administration inventories report is expected to show a draw of 4.7 million barrels.