As I wrote last week, one of the most important events of the passing week was Sunday’s constitutional referendum in Italy, in which 59% of voters opted for “no.” Italian Prime Minister Matteo Renzi, whose government lost constitutional referendum on Sunday, announced that he will resign.

As writes “The Economist” ” Italy has for long been the biggest threat to the survival of the common European currency and the European Union itself. The Financial Times quotes the president of Deutsche Bank, John Cryan who warned employees of his company, that result of the referendum in Italy “is a harbinger of new turbulence which can spread from the political scene to the economy, particularly threatening United Europe.”

Let’s get to the charts …

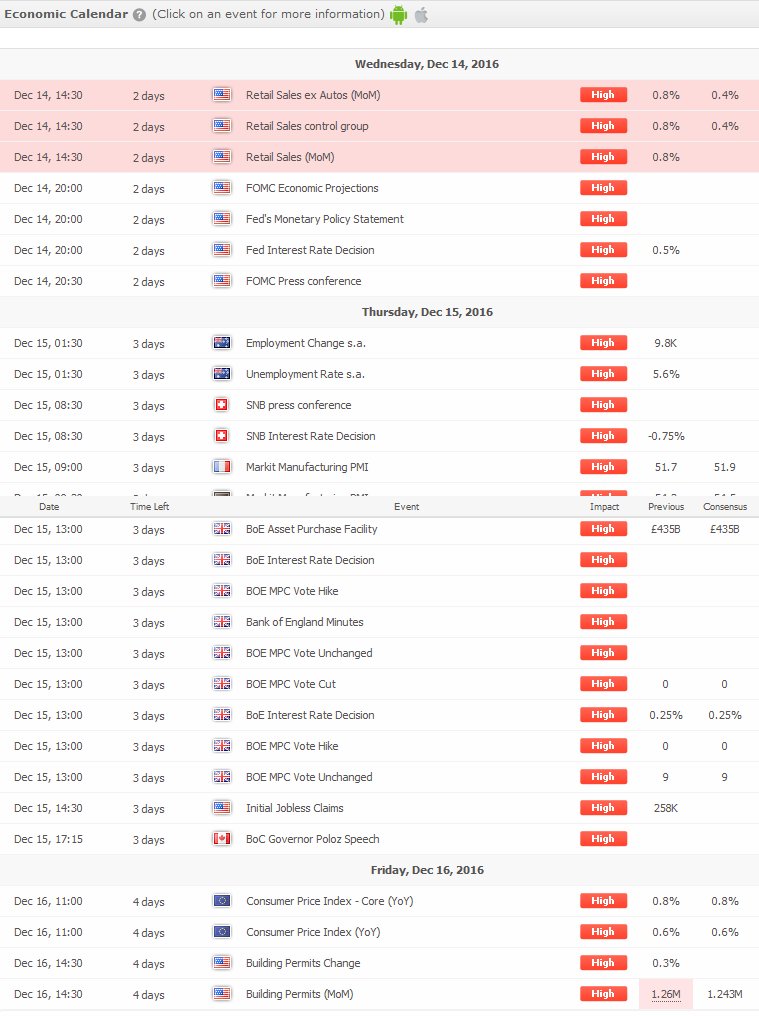

AUDUSD

Through last week the market was moving in quite big consolidation and for three weeks we observe it forming a triangle formation, which from technical point of view seems more probable to be broken down and we expet continuation of declines.

Bearish scenario is also supported by present situation on the daily chart, where market in November 11th defeated the upward trend line thereby changing the attitude of the market to more bearish.

What last week affected the market is primarily Tuesday’s decision of Reserve Bank of Australia (RBA) to leave interest rates unchanged at 1.50%. Since leaving status quo was expected, more important was the tone of the message, in which the RBA stressed that the strengthening of the AUD could complicate economic transformation and adjustment of the economy to the new conditions. The statement also noted that the current policy promotes the growth of GDP and inflation and increases in commodity prices supported growth in trade.

Although the message published on Wednesday, the results of the GDP turned out to be much worse and quarterly amounted to -0.5% compared to forecasts of 0.3% and the previous reading of 0.6% and annual terms, only 1.8% of the forecast at 2.5% which was already lower than the previous reading of 3.3%.

EURUSD

It is a currency pair, which was undoubtedly in the past week in focus of many investors and analysts. As a result of Italian referendum market began the week with nearly 74 pips bearish gap , which in the first hour deepened. As a consequence of emergence of a strong reaction of demand around the November lows we observed through next part of Monday’s session dynamic growth, which even positive readings of ISM index for services in the US at 57.2 on the forecasts 55.4 have not been able to stop. As a result of such a dynamic growth Euro strengthened against the US dollar by 0.85%, which was the biggest daily increase of this instrument since 16 August.

On what all investors eagerly awaited and what undoubtedly had largest share in shaping the EURUSD last week was published in Thursday afternoon the ECB’s decision to leave interest rates unchanged at 0.0% and the deposit rate at 0.40%.

The first market reaction to this information was the strengthening of European currency as a result of which EURUSD reached vicinity of an important resistance 1.0850. The increases did not last too long … because just 1 minute. Moments later, we witnessed dynamic fall, which was also supported by Mario Draghi during a press conference, which took place 45 minutes after the publication of the official decision of the ECB’s monetary policy. The most important information was the announcement that the ECB QE is extended to April 2017 at level of buying 80 billion per month, and then to December 2017 at a level of buying 60 billion per month. A detailed summary of the conference and Q & A session read here.

As a result of Monday’s dynamic growth and than equally intensive declines in the second half of the week on the weekly chart was created a powerful bearish pin-bar, which undoubtedly may indicate declines in near future. Overcoming the level of 1.0490 not only would bring us to the lowest level since January 2003. This could also open way for further declines.

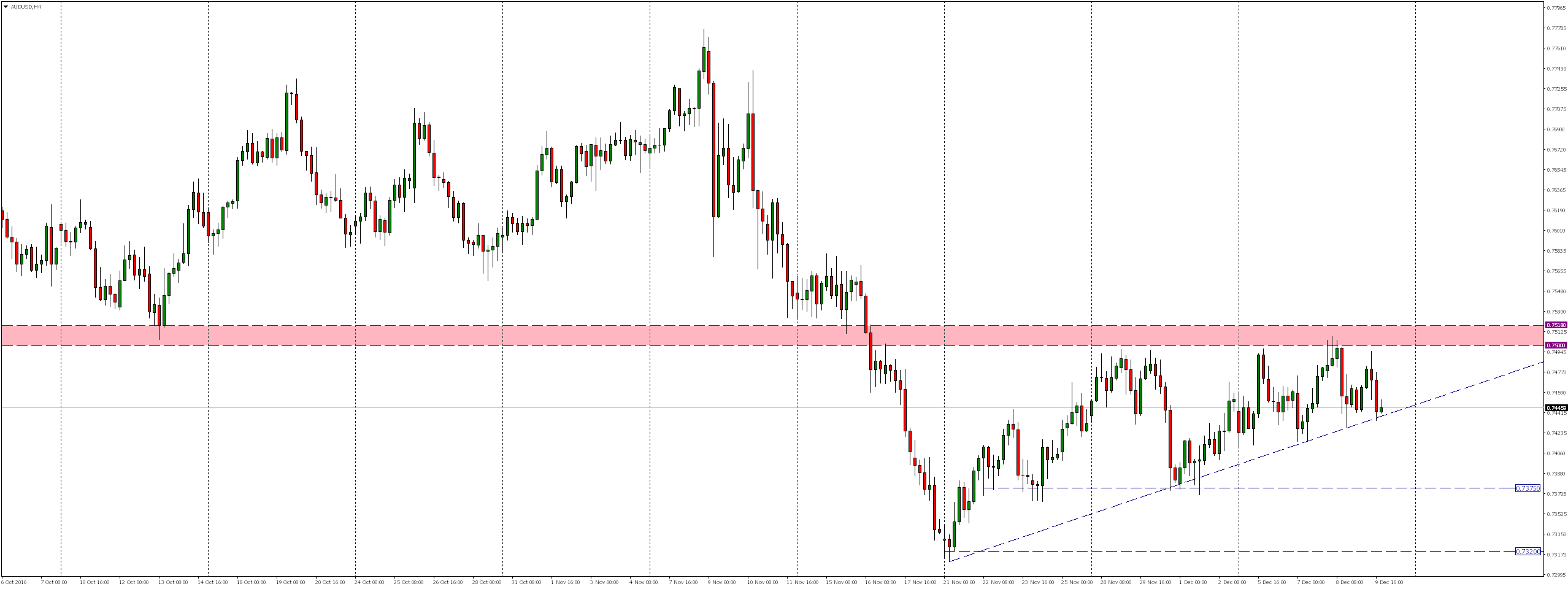

GBPUSD

Despite the growth on the beginning of the week supported by, among others by positive reading of the PMI for services in the UK, which in spite of worse forecasts at 54.0 from the previous reading of 54.5 in November was 55.2, for the vast majority of the week we saw declines.

The weakening of the Pound Sterling against the euro was influenced among others by mentioned earlier positive readings of ISM for services in the US and Wednesday’s extremely pessimistic data on industrial production in the UK. From technical point of view, in the near future we expect to test support area around 1.2525 level. Rejection of this level could initiate growth even in the vicinity of level 1.2870 mentioned last week here .

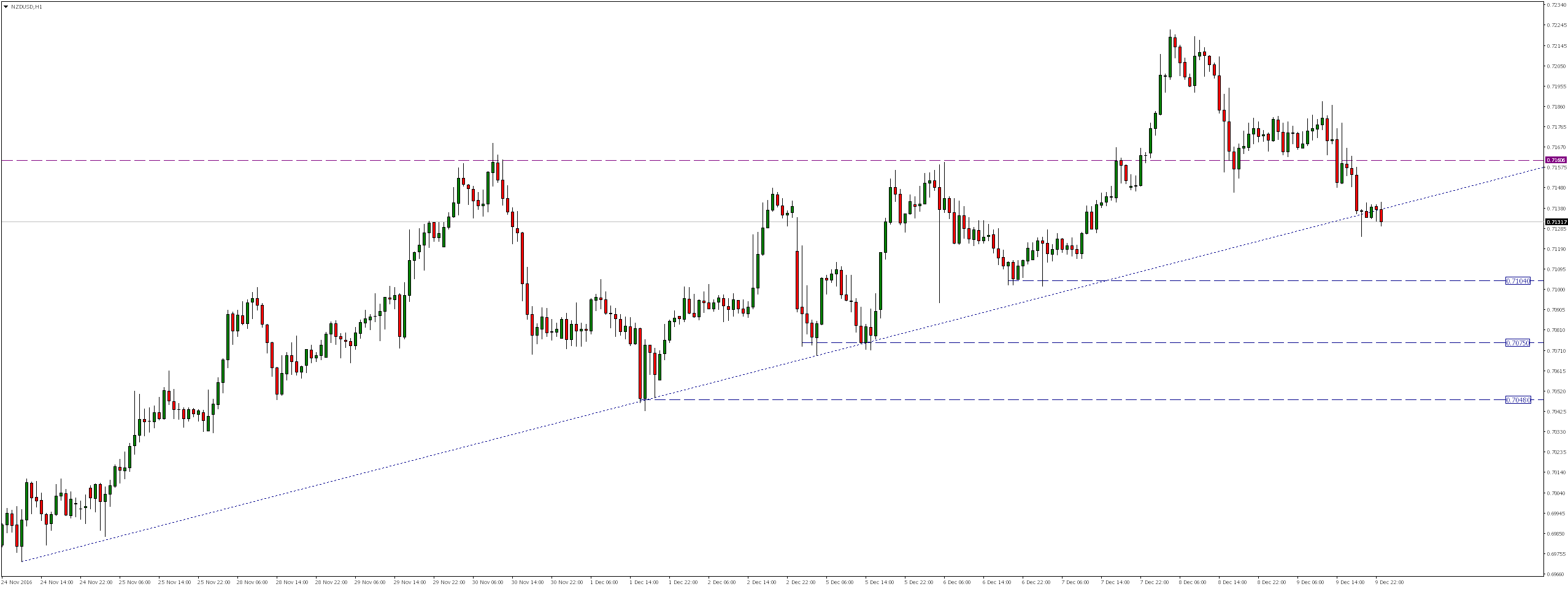

NZDUSD

Since beginning of the week we saw increases, due to which in the night from Wednesday to Thursday market overcame the resistance level around 0.7160. Although in the past week, there have been no significant macroeconomic data, which could cause so dynamic weakening of New Zealand dollar ,on Friday, the market was not only back below this level 0.7160 but also defeated the growth trend line. If in the near future demand does not negate the breakout, declines could even reach the levels around 0.7104, 0.7075 or 0.7048 further.

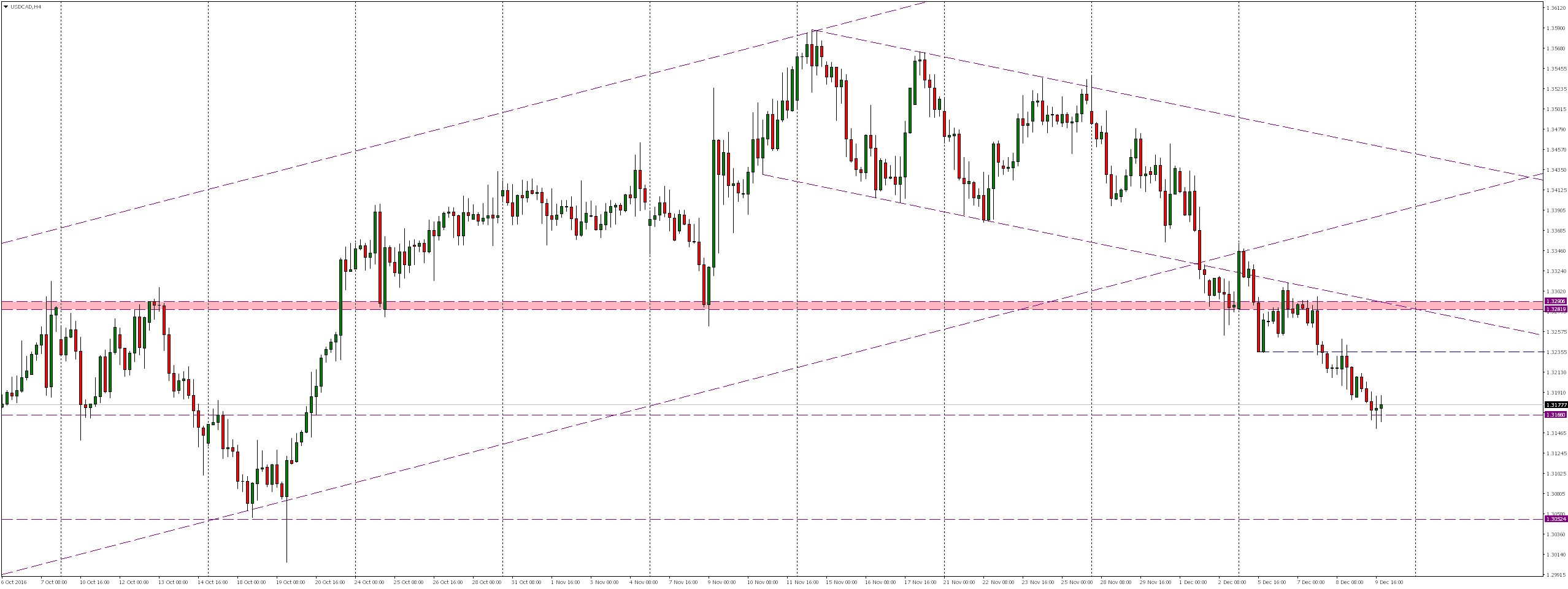

USDCAD

According to my last week’s projection, despite initial gains market this week defeated the crucial support zone around 1.3290 level. Since we are now in the area of local support 1.3166, in the near future we expect a correction of growth around level 1.3235 coinciding with the momentum of 50% Fibonacci correction of the last bearish impulse.

What had decisive influence on the exchange rate of the Canadian dollar were undoubtedly published on Tuesday negative readings Ivey PMI, which, contrary to slightly better forecasts of 59.9 from the previous reading of 59.7 in November were only 56.8.

The most important publications on USDCAD, however, were published on Wednesday, stocks of crude oil, which according to the latest report shrunk by as much as 1,389 million barrels and the decision of the Bank of Canada (BoC) to leave interest rates unchanged at the current level of 0.50%.

Use this analyses and invest at Broker BDSwiss, which offers leverage up to 1:500

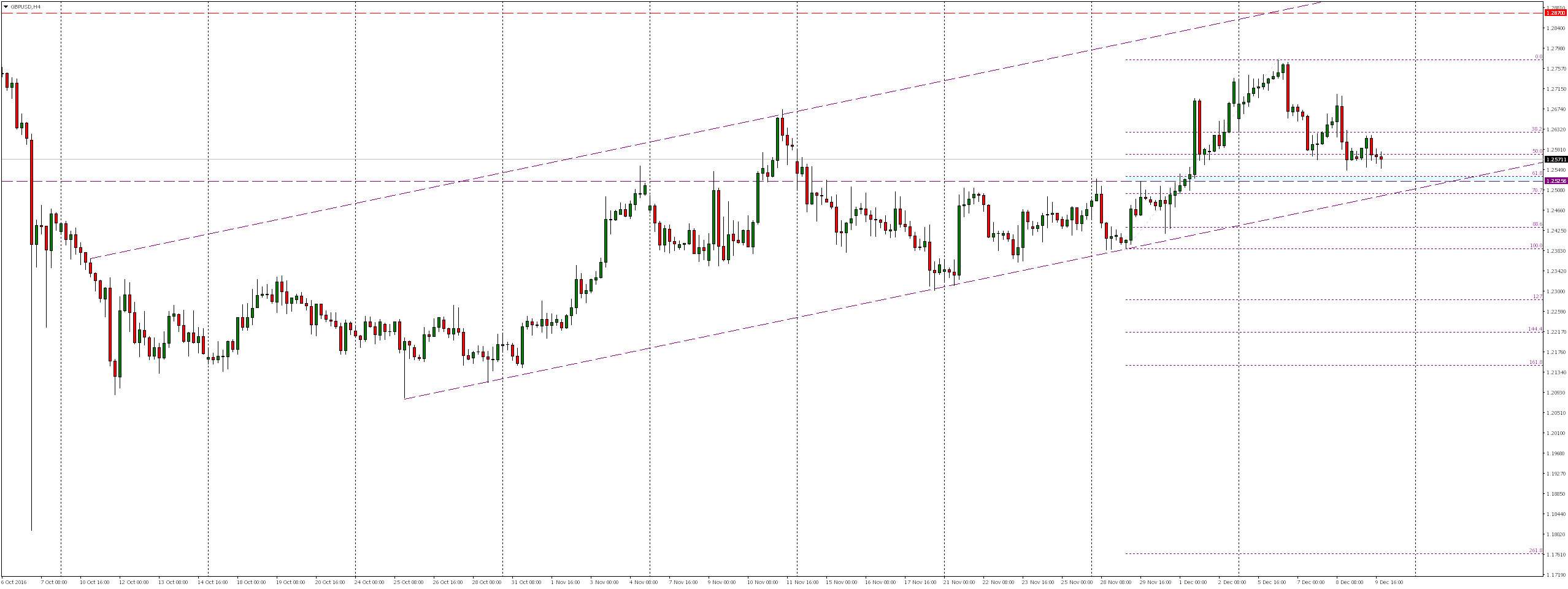

What awaits us in the coming week?

Below we will find the most important macroeconomic publications, which should be paid attention to in the coming week. Undeniably one of the most important events will be the Wednesday meeting of the Federal Reserve, which probably for the first time this year and the second between the last 10 years will raise interest rates.

On Thursday, will be held meeting of the Central Bank of England and at 13:00 will be announced decision on interest rates and publication of the minutes from the meeting.

But we should not forget that on this weekend (December 10-11) will be held meeting of OPEC, during which representatives of the Member States meet the non-aligned in the Organization producers, to discuss additional cuts of oil production in their case.

Weekend review of markets is almost a tradition in portal Comparic.pl and comparic.com but as you probably noticed it is somewhat altered edition with quite extensive summary of the most important macroeconomic events of the past week added. Since this is only second such issue very important to me is your opinion and if you have a moment, please leave your comment below with brief information which form you prefer: purely technical or present, taking into account the most important events and macroeconomic publications.