AUDUSD

For nearly a whole week the market was moving north. It is worth noting that as a result of significantly weakening dynamics of growth and weakening demand, has formed a triangle formation. Given the number of re-tests of resistance which is the upper limit of formation, which always ended with rejection, we can expect in the near future it is more likely to overcome the growthtrend line and declines in the vicinity of 0.7661, 0.7649 or even further to around 0.7612.

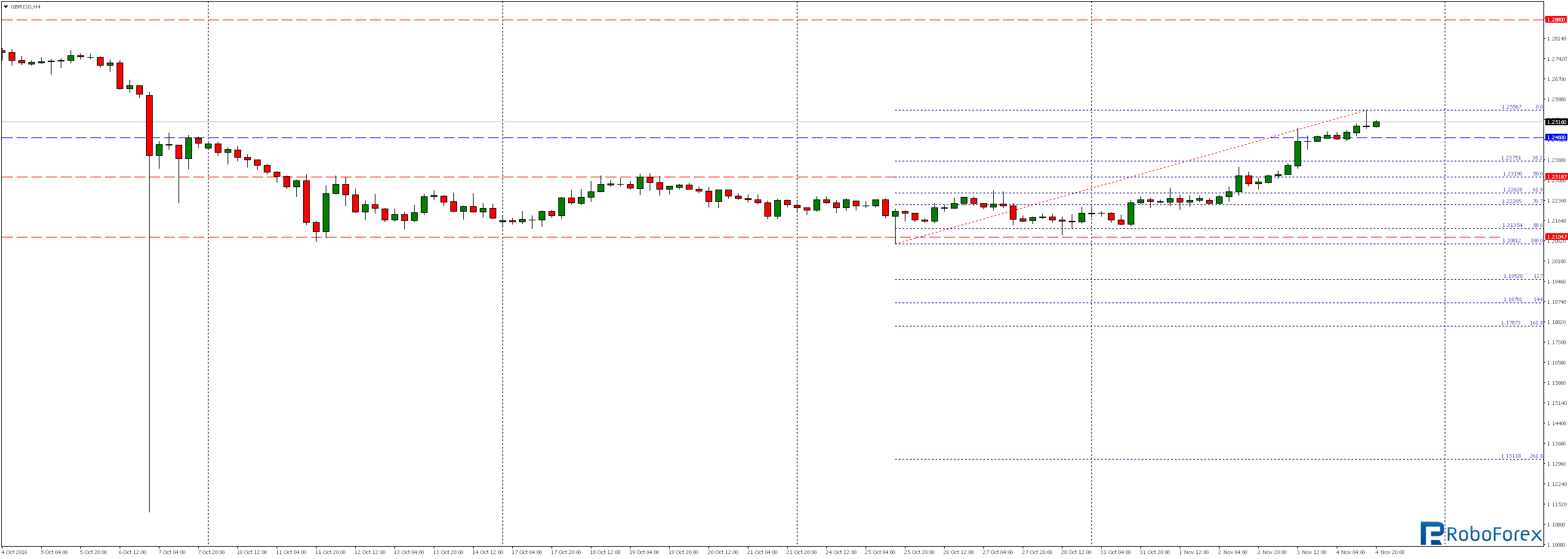

GBPUSD

Throughout the week we saw increases, resulting that the market overcame both local resistance 1.2319 as well as 1.2460 thus opening the way for further growth even in the vicinity of the extremely important from the point of view on daily chart 1.2880 level. In the near future we can expect a downward correction and re-test of the aforementioned level 1.2319 coinciding with the momentum of 50% Fibonacci correction of recent increases.

NZDUSD

It is a currency pair, which rarely appeared in “market reviews” but I hope that now it will change and will be a regular here. Since last Friday, we saw a strong depreciation of the US dollar to New Zealand dollar. From Thursday, however, we see a slowdown, which may herald impending downward correction with the potential range to 0.7279 support or further support zone around 0.7245.

USDJPY

Nearly over a week we see declines, which, if not their dynamics could be called a downward correction. We are seeing the struggle of demand and supply in the area of local support 102.80 coinciding with the momentum of 50% Fibonacci correction of previous increases. The rejection of this level would be a signal for growth even in the resistance area around 107.30. However, if the decline will continue, then we would expect to test this year’s lows around 99.90.

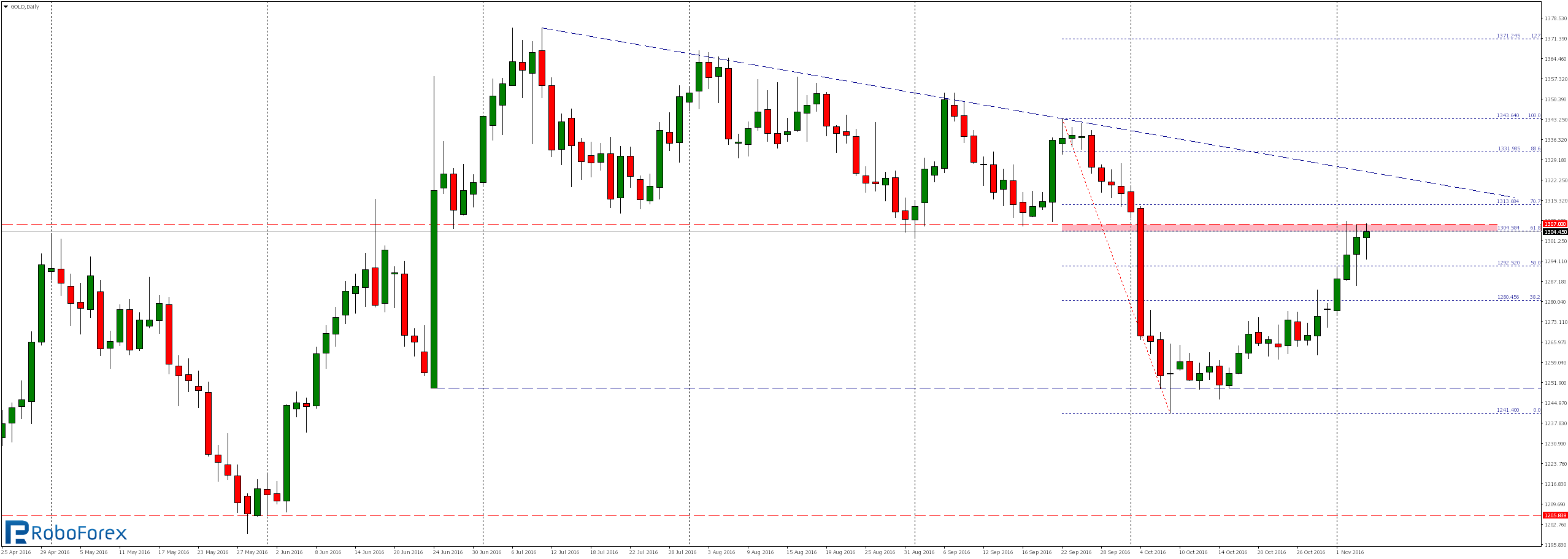

GOLD

The gold market at the beginning of October recorded very dynamic decreases as a result of which was broken very important support 1,307.00. At the end of this bearish movement we arrived at the local level around 1250.11 coinciding with the level of 70.7% Fibonacci correction of the entire previous upward movement.

The second part of October, however, belonged to the demand and despite the initial consolidation and relatively low growth dynamics finally we arrived at the said zone of support (now resistance) re-testing the level of 1,307.00 coinciding with the golden ratio 61.8% Fibonacci correction of the earlier declines from the bottom.

Rejection of the current resistance might be a signal for continuing declines in the area of the October lows or further to a very important support 1,200.30 coinciding with the level of 161.8% Fibonacci extension of the last correction upward.

However, if the growth will continue, then we could expect emergence of a strong supply response in the vicinity of the downtrend line.