Wide View Strategy (WiViSt) is a typical trend following strategy. Purpose of this strategy is enter in transaction at the end of correction which is identified in strong trend (uptrend or downtrend). There are two intervals used in this strategy: m30 and m15.

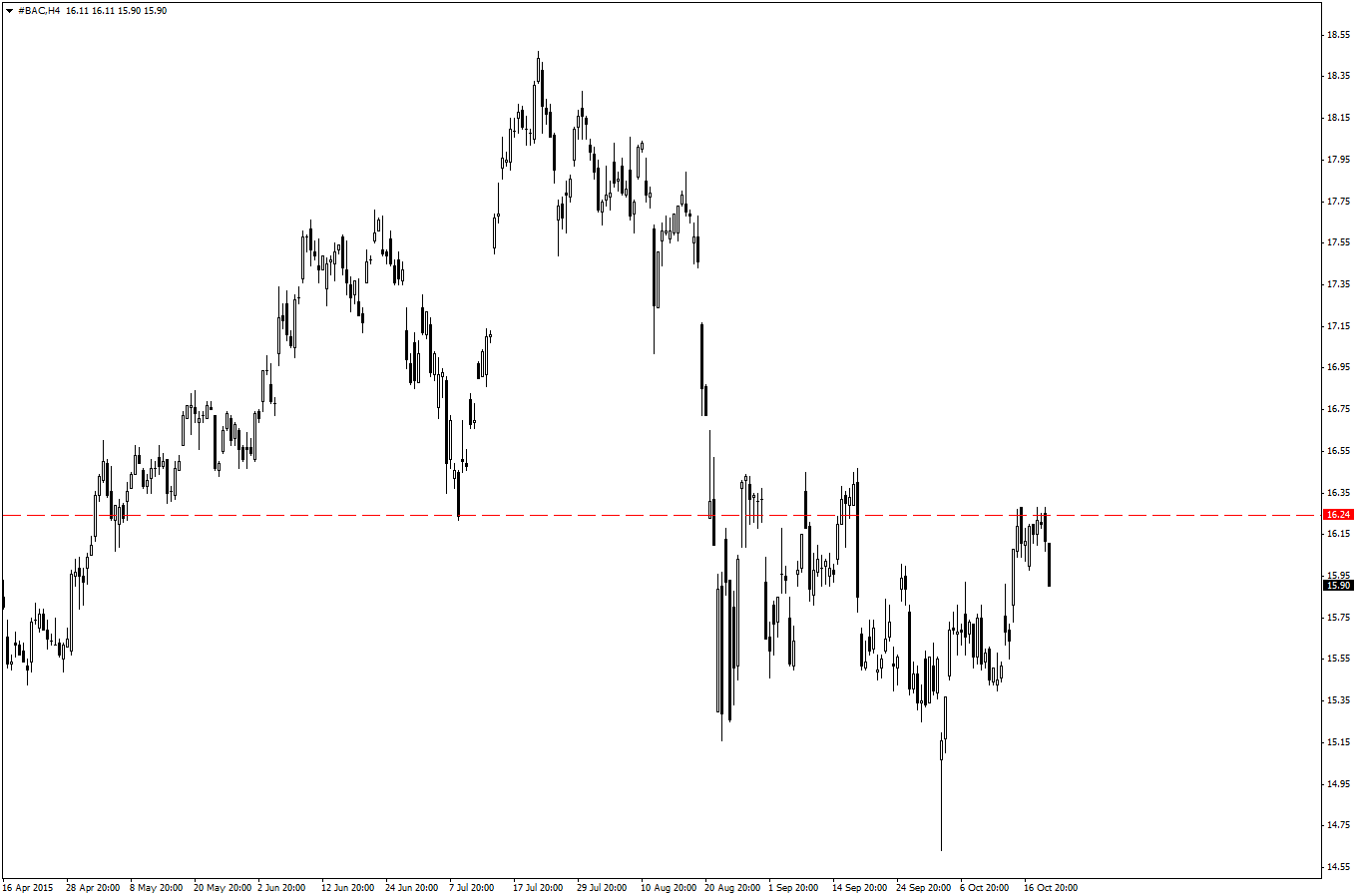

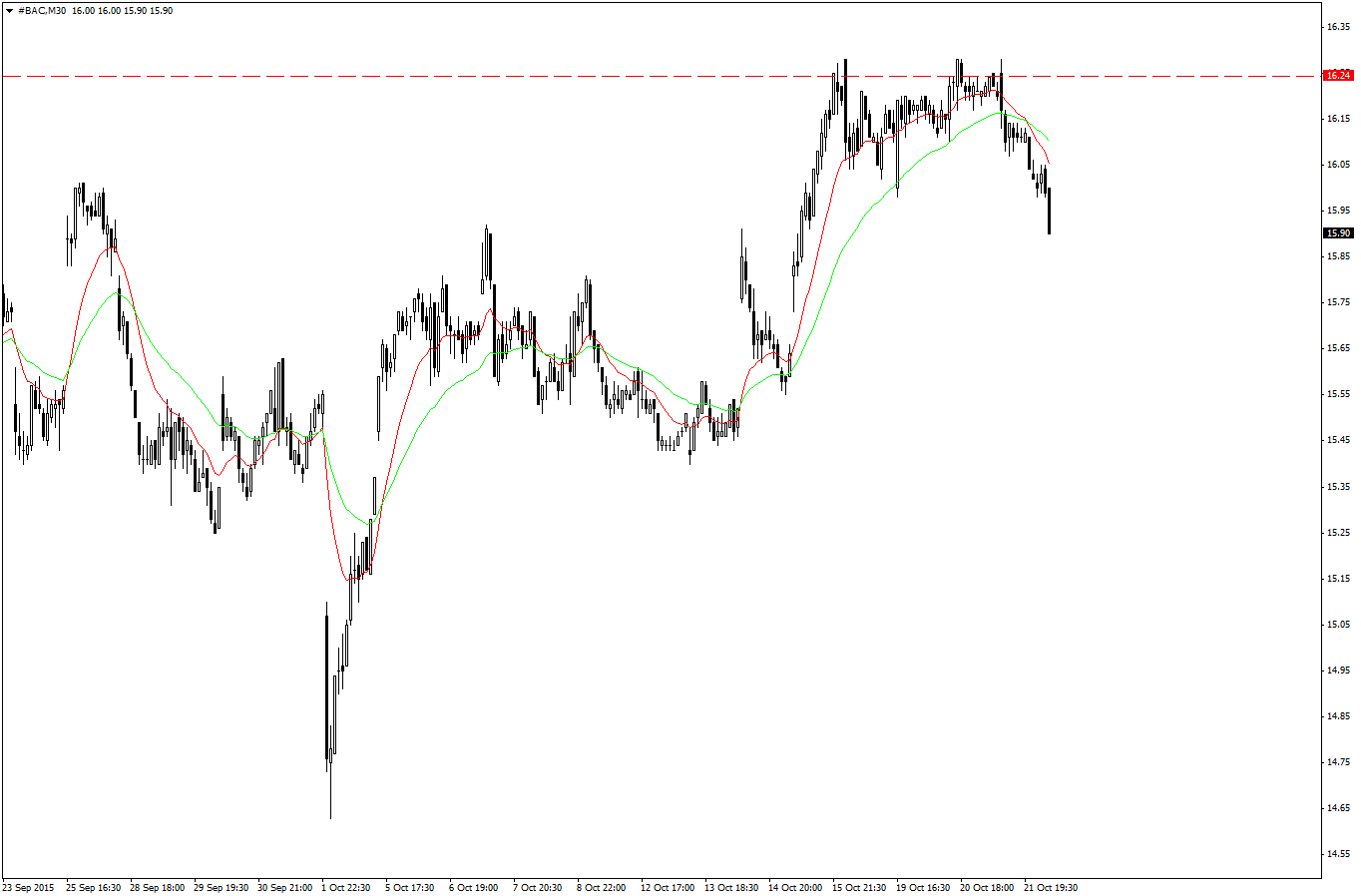

Bank Of America:

Looks like BofA starts to depreciate. After publication of earnings data resistance on $16.24 is still strong. On H4 and M30 chart marubozu black candle has occur. Averages on M30 chart confirmed downtrend. On M5 chart, sell opportunity will occur when %R come to undervalue area.

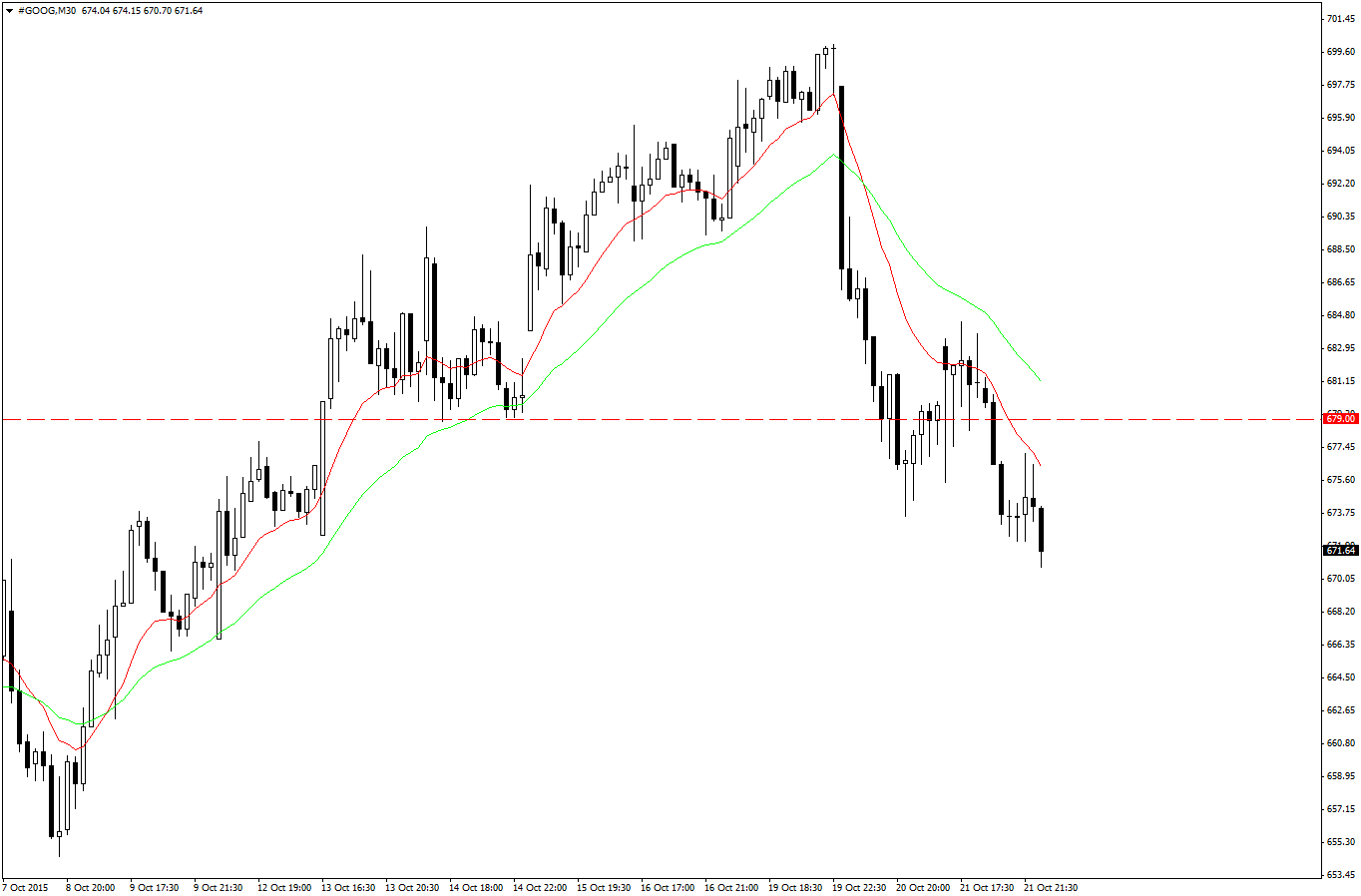

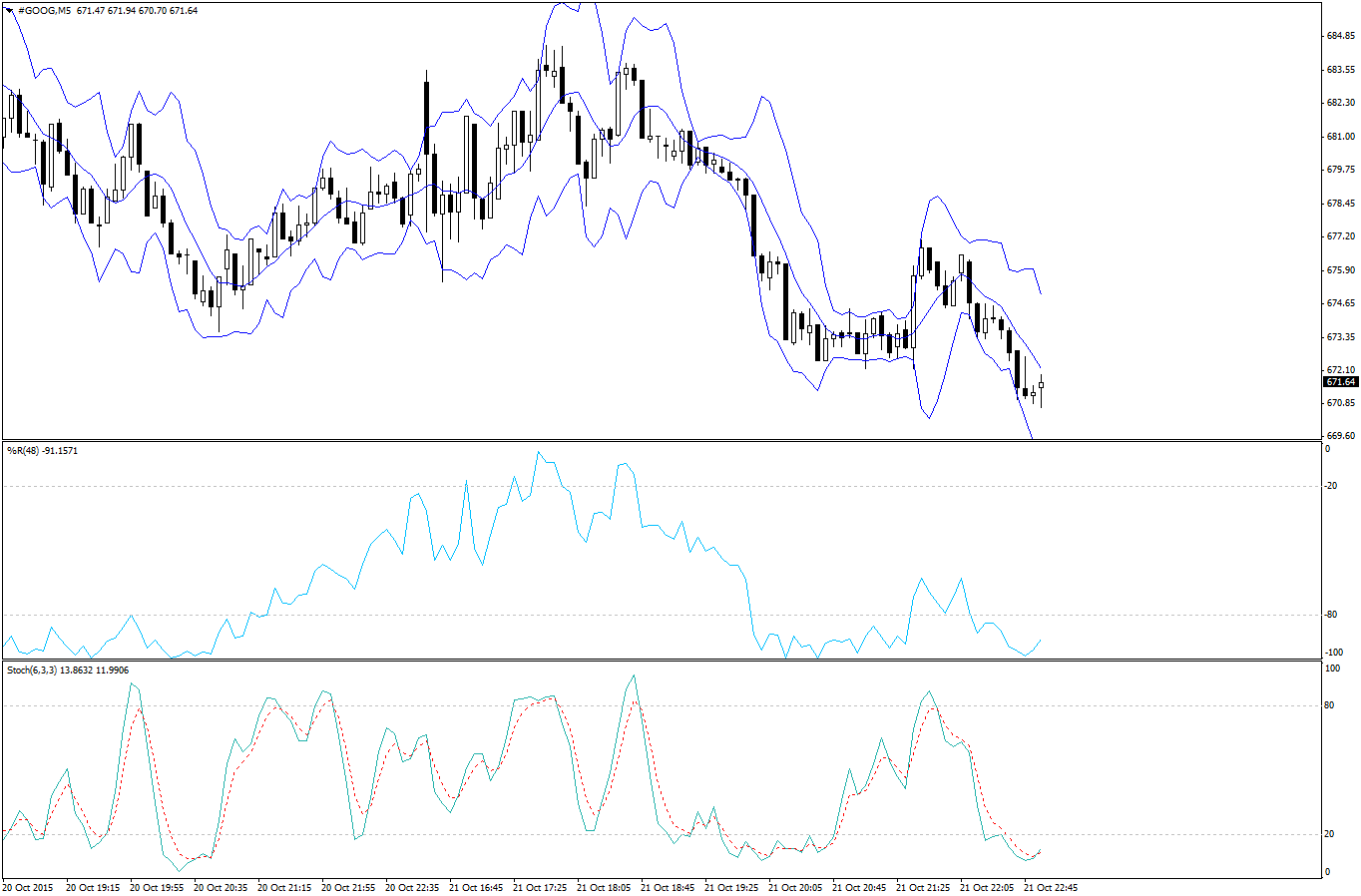

GOOGLE:

EPS on Friday has been very surprising for Google shareholders. That’s why it’s very odd that this stock has deppreciate lately. We can observe downtrend on M30 chart. On M5 chart, sell opportunity will occur when %R come to undervalue area.