Wide View Strategy (WiViSt) is a typical trend following strategy. Purpose of this strategy is enter in transaction at the end of correction which is identified in strong trend (uptrend or downtrend). There are two intervals used in this strategy: m30 and m15.

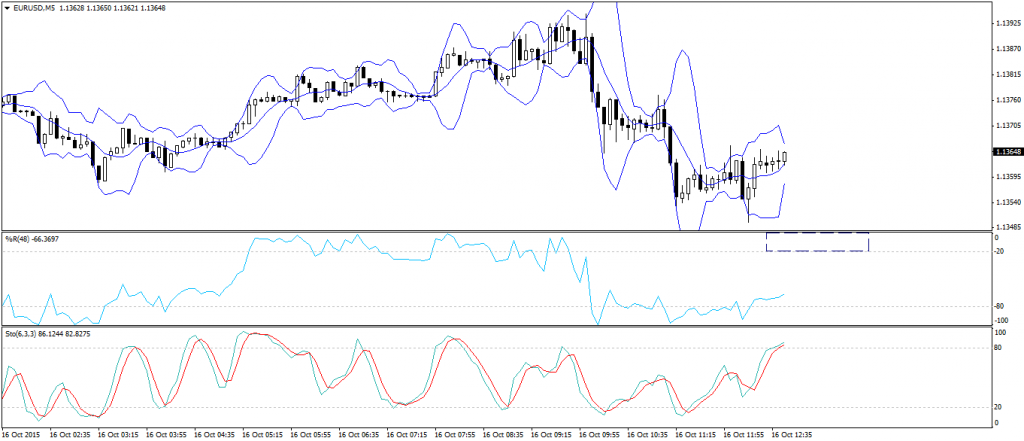

EURUSD

Yesterday’s US CPI data strengthened the US dollar. To full optimism, we need a positive data of industrial production. The publication of these data will occur today at 15:15 CET. On M30 chart averages begun accelerate.

Buy opportunity will occur, when %R come above -20. Nevertheless, we have to remember about todays data .

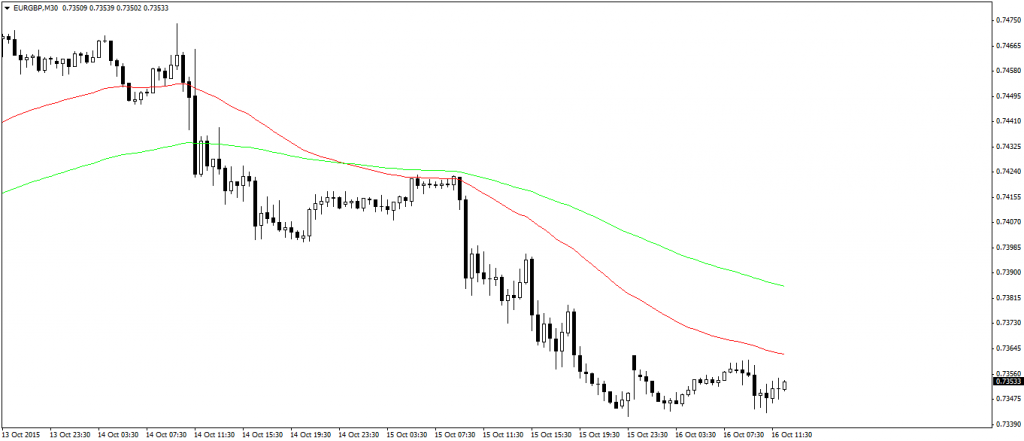

EURGBP

Euro began to depreciate what we can observe on M30 chart on EURGBP.

Now we wait for %R to come in to the overvalued area on M5 chart.

Alcoa

The biggest aluminum producer falls as we can see on M30 chart. It looks like sell potential.

When US market will be open, we can look for sell opportunities. But first, %R has to come above -20.