Wide View Strategy (WiViSt) is a typical trend following strategy. Purpose of this strategy is enter in transaction at the end of correction which is identified in strong trend (uptrend or downtrend). There are two intervals used in this strategy: m30 and m15.

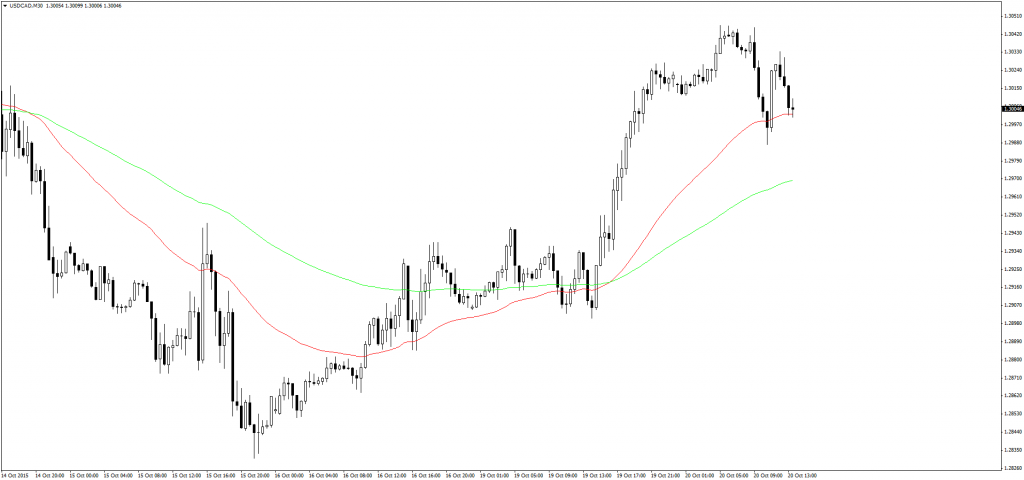

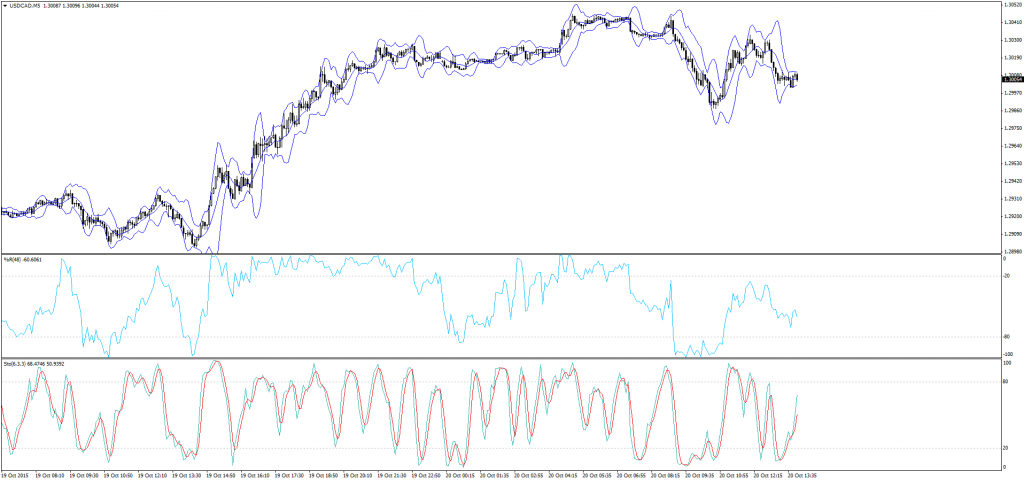

USDCAD:

Lately US dollar is depreciating. Still we don’t know if FED will raise interest rate. Today we have US Api Weekly Oil Stock data. Today also Janet Yellen will be speaking. USDCAD is worth to observe, consider the fact that oil is highly correlated to Canadian dollar. On M30 chart we can observe strong uptrend. On M5 chart, buy opportunity will occur when %R come to undervalue area.

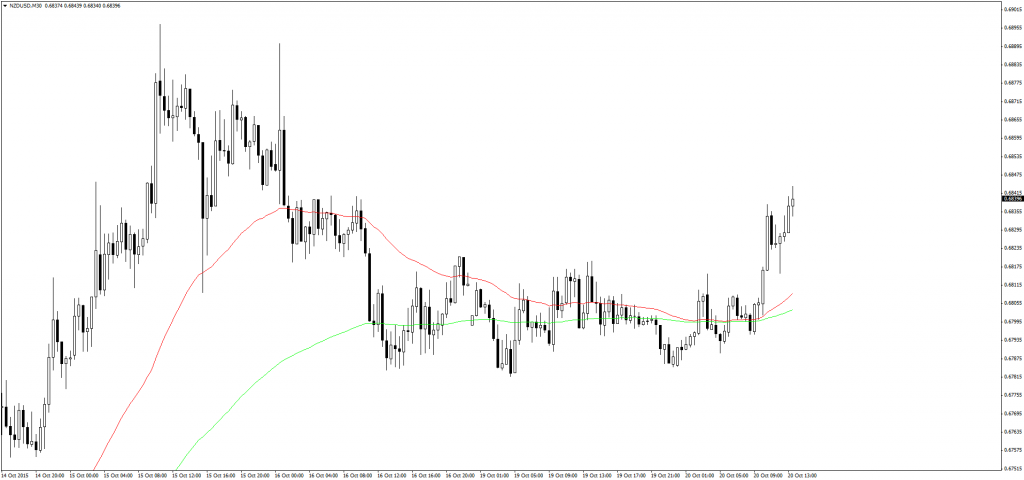

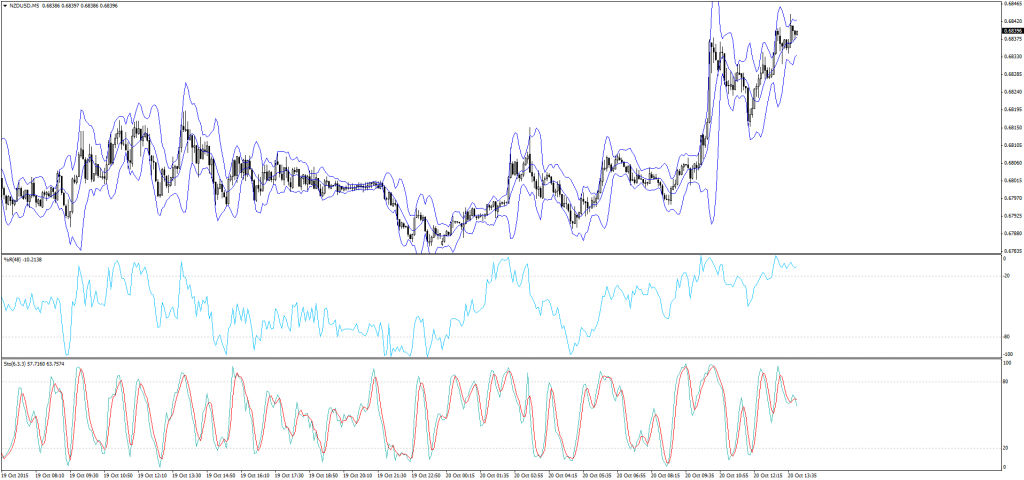

NZDUSD:

Today important data for New Zealand dollar will be GDT Price Index. As we know milk is one of the most important export product. On M30 chart we can observe that averages are accelerating. On M5 chart we wait until %R will come to undervalued area. Then we will look for buy opportunity.