Light Monday macroeconomic calendar did not surprise us with anything special in the afternoon. Only at 15:00 we heard E.Rosengren from the FOMC, which promises regular increases of federal funds rate in the near future. At 18h45 (GMT+1) spoke also another member of the Commission, Lockhart.

Light Monday macroeconomic calendar did not surprise us with anything special in the afternoon. Only at 15:00 we heard E.Rosengren from the FOMC, which promises regular increases of federal funds rate in the near future. At 18h45 (GMT+1) spoke also another member of the Commission, Lockhart.

In the industry happened a lot – below highlights of today

January 9 has been dominated by weakening of the US dollar – for some pairs extremely visible – and a lot of business-relevant information for the sector FX/CFD. More highlights:

- Admiral Markets change the trading hours for the DAX and FTSE100

- The morning market overview – Japan celebrates, the yuan strongly loses

- French AMF blocks marketing of FX and binary options

- Favorable data from Switzerland and the UK

- MPC (Monetary Policy Commission) will face higher inflation in Poland

- $ 5.5 million prize for US whistleblower

- SGX reports market statistics for December 2016

- The European unemployment rate unchanged. Eurodollar at the new minimums

- Credit Suisse: EUR/GBP best idea for 2017 year

- Plus500 will be sponsor of Atletico Madrid in the 2017/18 season

- Worth $ 5 million binary options icon Banc de Binary will disappear from the market?

The gradual and regular increases in interest rates granted by Fed

As stated at the beginning, Eric Rosengren of the FOMC had his speech at 15:00 (GMT+1). Although this year he has no right to vote in the Commission – and does not have directly influence on the monetary policy of the US – this is another official who confirmed that the US was in a state of full employment:

- The Fed intends to continue its policy of gradual interest rate hikes – the process will be much more regular

- 3 increases in 2017 seem to be reasonable, unless the economic outlook will remain at the same levels

- If the Federal Reserve does not perform the following movements on the rates may have a problem with excessive inflation

- The unemployment rate at a very good level in the long term

- The inflation target of 2% will be reached by the end of 2017

Fed’s Lockhart was on the same position while his speech at 18:45. He forecasts two hikes in 2017,maybe we could see three.

During Monday’s session, USD/JPY was losing up to 140 pips – at this moment at level of daily Pivot and 38.2% abolition of declines from last week are drawn two pin bars, which may suggest a try to rebound in favor of the USD:

During the question and answer session Rosengren said that despite the positive attitude to increase, it is still too early to talk about specific dates for the current year. The exact schedule will depend on macroeconomic data and fiscal state of the economy

On Monday, AUD/USD is gaining and after ending Friday’s correction, returns to appreciation started on the beginning of the year. For bullish movement could be continued, it will be necessary that daily closing is above 0.73500 and intraday highs from 5-6 January:

Tuesday’s calendar rather empty

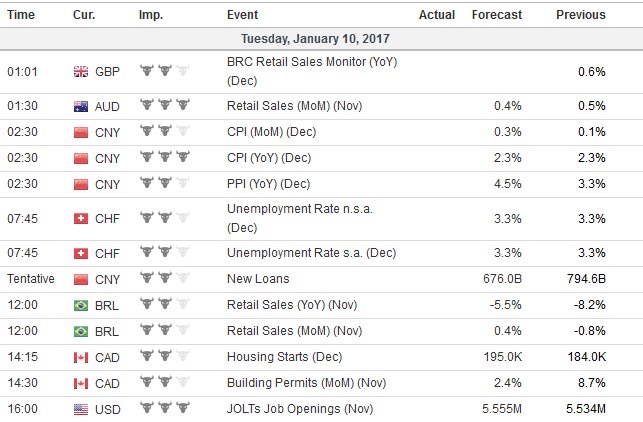

During the session on Tuesday, January 10, most of the relevant macro data will appear in the night – this refers to the CPI and PPI readings for December in China. At the start of the European morning, we will further know value of unemployment in Switzerland, further data at 14:15 – housing starts and building permits in Canada: