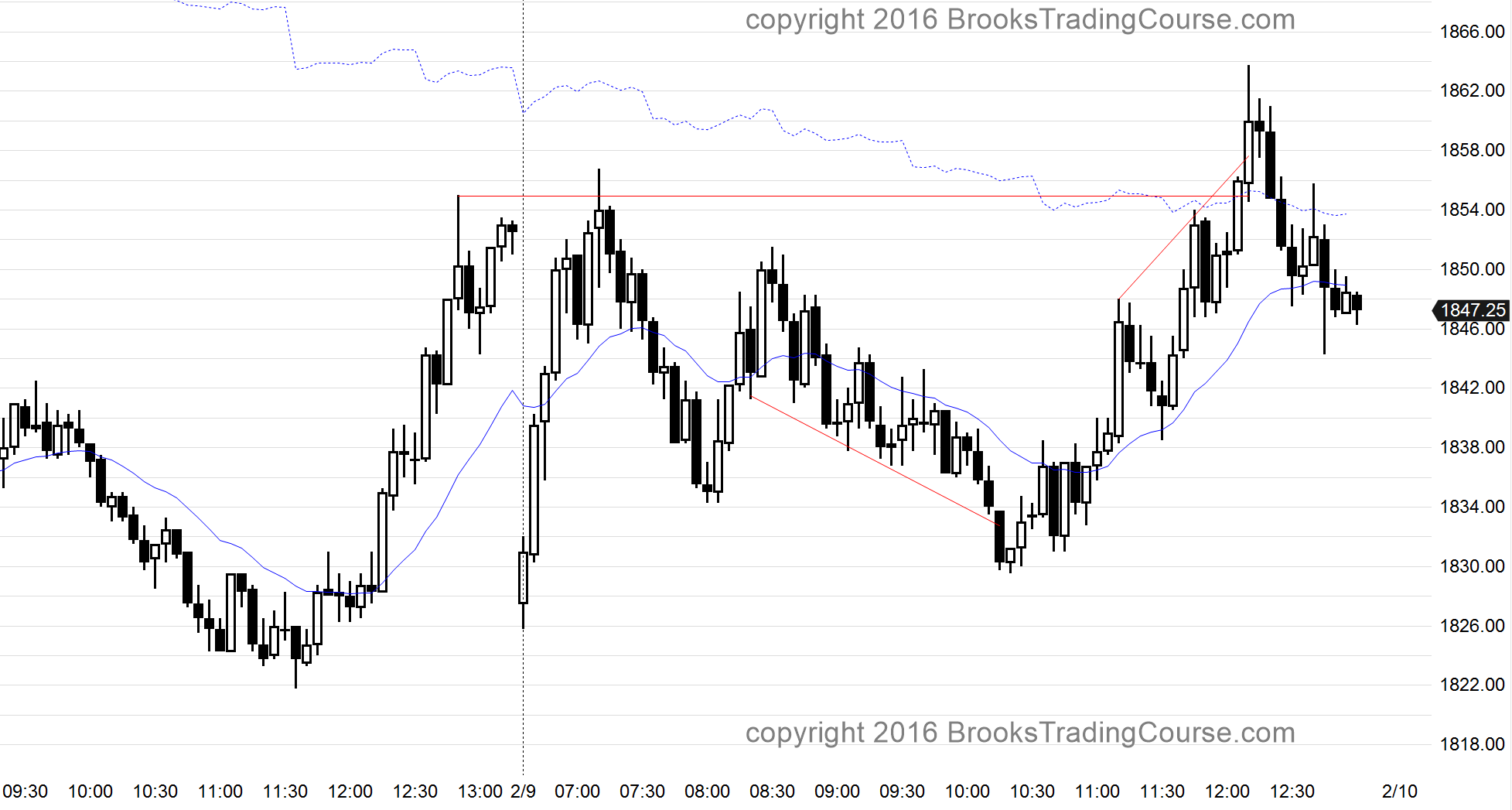

Yesterday was a buy signal bar on the daily chart for a higher low major trend reversal. The buy triggered early today, but the Emini had a deep pullback. It got back above yesterday’s high at the end of the day, but pulled back in the final hour. If tomorrow gaps up, there would be a 2 day island bottom, and the bulls would look for a measured move up to around 1880 – 1900, based on the height of the 2 day trading range.

If instead tomorrow reverses down strongly and it does not close the gap below Friday’s low, the Emini would then try for a break below the January low. As I wrote over the weekend, a test up is more likely, but the odds favor a bear breakout below the January low at some point in the next several weeks.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.