Welcome to the night trip 🙂

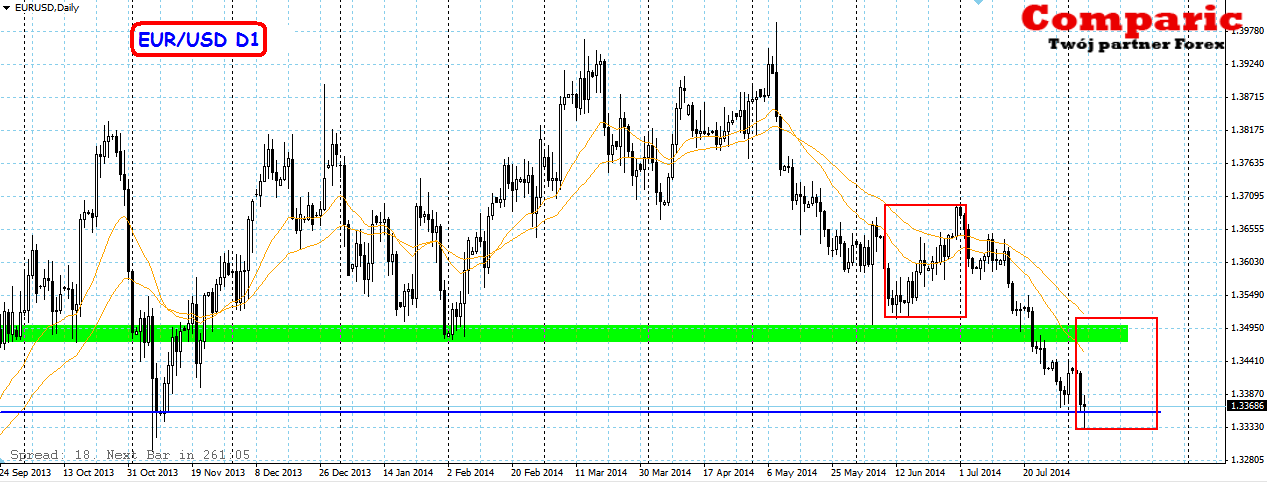

EUR / USD creates a candle with a long lower shadow. The place is almost perfect for a correction, but it decides to tomorrow’s ECB conference after setting interest rates. Feet are likely to remain unchanged, but the conference as usual can bring some surprise. If there would be a correction of growth, the first resistance is checked and coincides with the range of the previous correction.

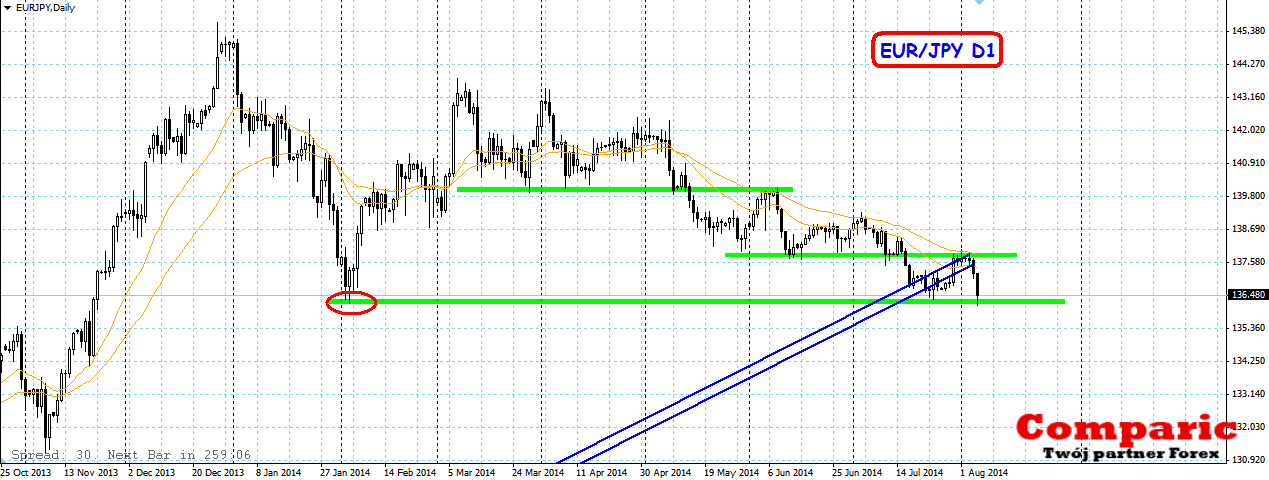

EUR / JPY – as predicted declines acted today. Price came to support that sets the previous one, and the last hole is still prevailing in the wide interval uptrend. If tomorrow’s data triggered a plunge in the Euro and support collapses, it will mean the end of a long-term trend in the pair. This would be the first pair of the yen, which this happened.

USD / CAD – course stops at 100% coverage so far the biggest wave of growth, including a few months move downward. Right there goes the resistance determined based on the last summit of this downward trend. We have two shadows candles protruding above the zone of resistance, and today’s downward candle creates a kind of so-called. formation curtains dark clouds, this is the announcement of inheritance, although it is not as strong as the formation of taking a bear market, but according to the principle of combining candles when we combine the last 2 we have a sizeable pin bar. It seems that, indeed, after such a large series of growth time at least for the correction.

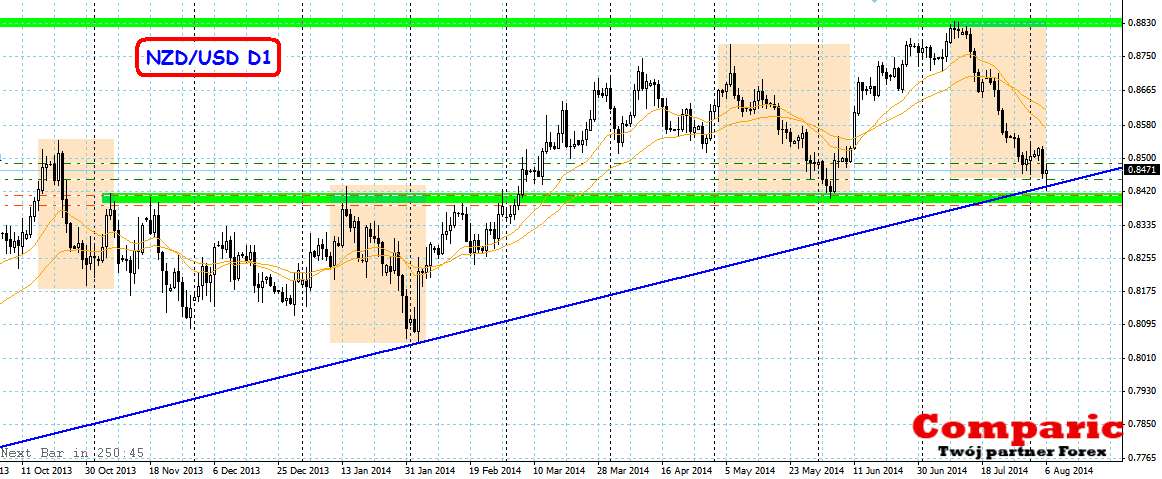

NZD / USD – here we have 100% coverage adjustments occurring frequently, like every previous time, the correction is (was?) Very violent. More important, however, is that the price reached today more or less to the support area surrounding the 0.84 and there is a candle with a long shadow on the bottom. Furthermore, in this place runs, not shown in its entirety on the chart trend line, which includes almost a year of trading. On the other hand, the collapse of support can significantly undermine the upward trend.

EUR / NZD – course inside the previous pin bar today, but it is a candle, which also leave behind a long upper shadow. We have a downward trend, candlestick signal, readable resistance trend line and a full range of frequently encountered adjustments. It seems that the time to drop, I already made my choice playing on the strengthening of the NZD against USD and EUR precisely. I have already mentioned about tomorrow’s data for the Euro, which can spoil everything, or drive the downward movement. See how it goes, all positions shown are of course protected and opened in accordance with the principles of capital management, or risk a little to win a lot more, what I wish you and me.