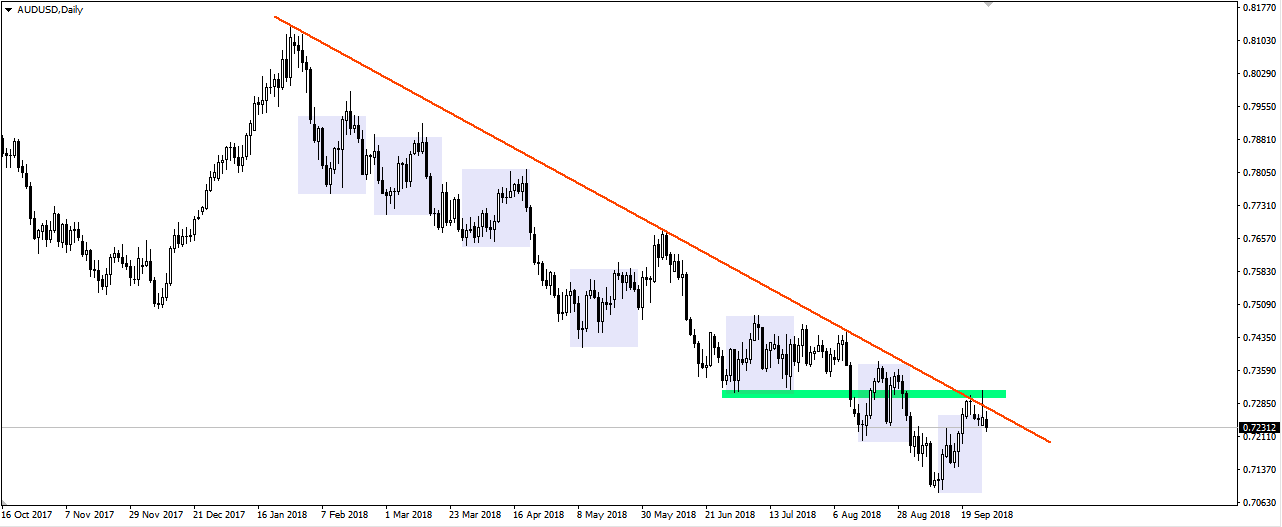

The most important event of yesterday’s session, and maybe even the whole week was the meeting of the American Federal Reserve. As expected, the main interest rate was increased from 2 to 2.25%. The forecast of 4 interest rate hikes in the whole 2018 and another 3 in 2019 was also maintained. It seems that such a resolution should gently support the dollar, at least to some currencies. Interestingly looks situation on the graph, for example, AUD/USD. The last few candles show a slide, and yesterday we have a pin bar with a long, top shadow. Even information about good budget performance in Australia and improvement of the rating for this country did not help. The technique clearly indicates a downward trend, the correction has done more than the standard range, the price tests the trend line and it seems that another downward rebound may occur.

The Comparic.com is created out of our passion for financial markets and online trading. We do it every day and we are the best in it. Our goal is simple - to provide the most proven tools that you will use in your trading. We hope to inspire you, unleash your potential and contribute to your success in investing in financial markets. We believe that thanks to online trading you will be able to realize your dreams and goals.

All content posted on the website comparic.com and its subpages is for information purposes only and presents the authors' own opinions. These contents have been prepared diligently, with due diligence and do not constitute the basis for making investment decisions, investment advice or recommendations within the meaning of the Regulation of the Minister of Finance of 19 October 2005 on information constituting recommendations regarding financial instruments, their issuers or exhibitors (Dz. Of Laws of 2005, No. 206, item 1715). The comparic.com portal is not responsible for all transactions, damages, expenses incurred and lost profits arising in connection with investment decisions made on the basis of the content available on the website comparic.com.

The comparic.com portal informs that investing in financial markets may be associated with a significant level of risk and significant losses of invested funds. Particular consideration should be given to financial instruments based on margin trading, in particular, Forex currency exchange instruments (FOReign EXchange), futures and CFDs (Contract for Difference). For these instruments, leverage may result in losses exceeding the investor's initial deposit.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 74% to 89% of retail investor accounts have money losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

The administrator of the website comparic.com is Finvest Group based in Warsaw at Bieniewicka 26, 01-632 Warsaw, Poland.

All content posted on the website comparic.com and its subpages is for information purposes only and presents the authors' own opinions. These contents have been prepared diligently, with due diligence and do not constitute the basis for making investment decisions, investment advice or recommendations within the meaning of the Regulation of the Minister of Finance of 19 October 2005 on information constituting recommendations regarding financial instruments, their issuers or exhibitors (Dz. Of Laws of 2005, No. 206, item 1715). The comparic.com portal is not responsible for all transactions, damages, expenses incurred and lost profits arising in connection with investment decisions made on the basis of the content available on the website comparic.com.

The comparic.com portal informs that investing in financial markets may be associated with a significant level of risk and significant losses of invested funds. Particular consideration should be given to financial instruments based on margin trading, in particular, Forex currency exchange instruments (FOReign EXchange), futures and CFDs (Contract for Difference). For these instruments, leverage may result in losses exceeding the investor's initial deposit.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 74% to 89% of retail investor accounts have money losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

The administrator of the website comparic.com is Finvest Group based in Warsaw at Bieniewicka 26, 01-632 Warsaw, Poland.

© comparic.com