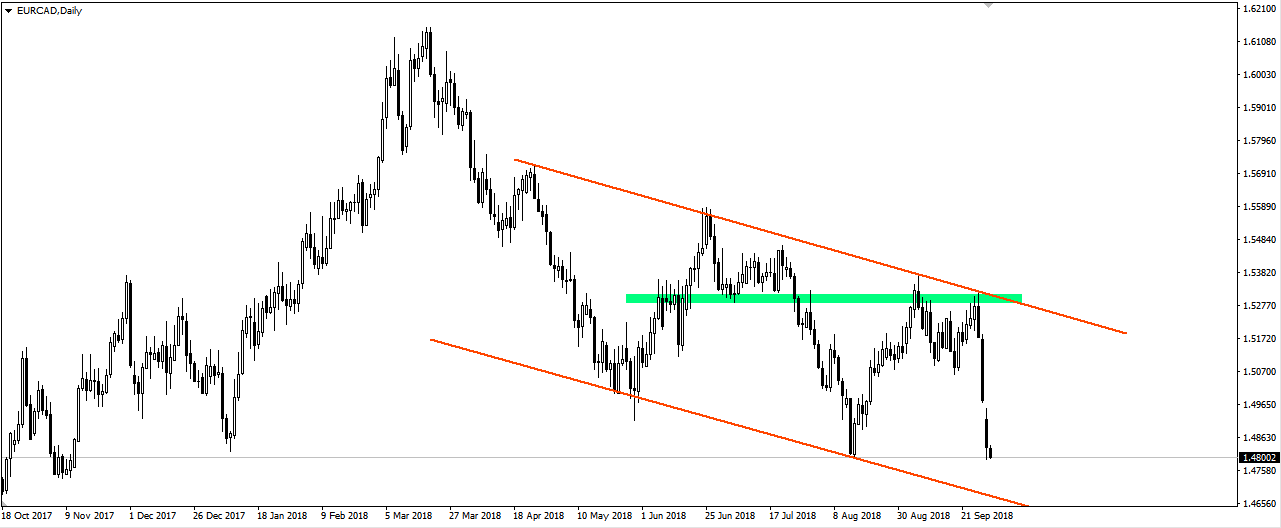

The number one theme on Monday, maybe after more speculations and gossip around brexit, was to reach agreement between the countries of North America: Mexico, Canada and the United States. Previously, there was speculation about problems in negotiations, the more the market’s reaction was determined to hear about the conclusion of an agreement. Old NAFTA, as it was called the previous agreement, will be replaced by the USMCA. Looking at quotations, Canada’s currency is the main winner of this agreement. Not only the agreement consolidates it, it is worth remembering about good economic readings from this country and about growing price of oil. In this context, it can be seen that the earlier lack of agreement or uncertainty about its shape was the reason why the Canadian currency was slowly growing stronger. Now the problem is gone, but it is on the other hand in the Euro zone. Again, Italy appeared on the highlights, which wants to increase the deficit in its budget. This caused a weakening of the European currency. Looking at the graph, you can see the local downward channel. It seems that the target of supply is its bottom edge, all growth movements can be treated as a correction.

I trade on this instrument at broker XM, which has in its offer more than 300 other assets >>