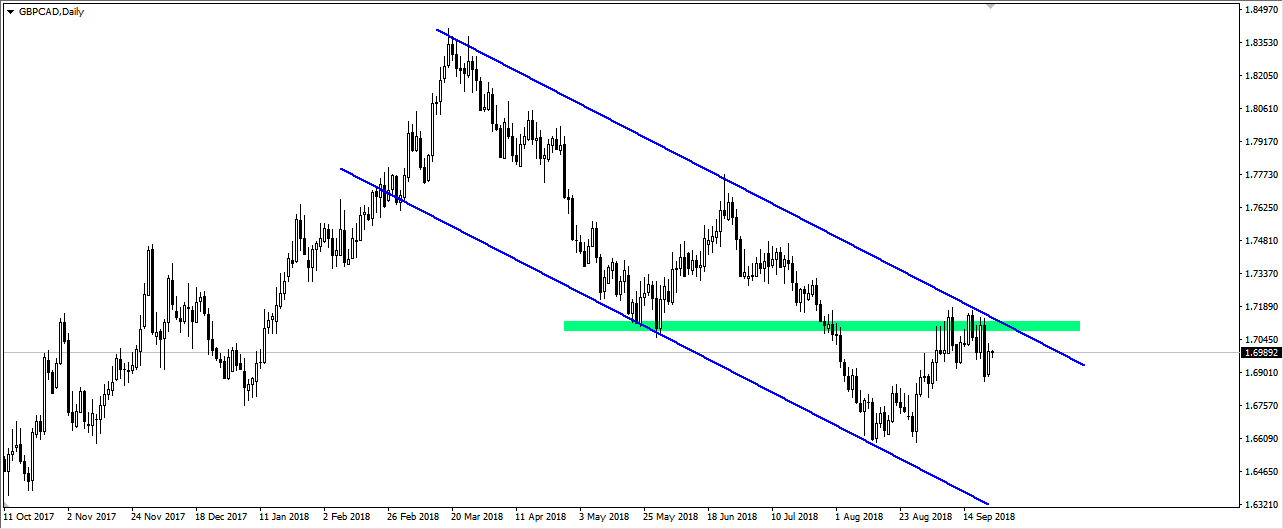

An interesting technical situation has place on the daily chart of GBP/CAD pair. From mid-March, the course respects the edge of the bearish channel. Currently, the price is at the upper edge and the resistance zone based on the previous low. Theoretically, the situation should support sellers. Similarly, it seems to be with fundaments. A few days ago, there was information from commodity traders who, in connection with sanctions on Iran, expect oil prices to rise at the end of the year. This may translate into a strengthening of the Canadian dollar. In turn, the pound seems to be under political pressure related to the Brexit negotiations. Recently, British media wrote about the humiliation of Prime Minister May in Brussels. The Prime Minister did not remain indebted and also criticized the attitude of the European Union. Negotiations are stuck, and there are more and more reports that instead of a bad compromise, a better solution may be a lack of agreement. Yesterday, the Minister of Brexit said that the UK is interested in talks but is also prepared for a fiasco of talks. All the time there are also rumours about the weakness of Prime Minister May’s political position or even about the Brexit referendum being repeated. It seems that uncertainty should weigh on the Pound, leading to its weakening, although the state of uncertainty and numerous reports also make it harder to predict Pound’s quotes. However, if the scenario assumes an increase in oil prices and the strengthening of the Canadian currency as well as maintaining the supply pressure on the Sterling, a fall in GBP/CAD could occur.

I trade on this instrument at broker XM, which has in its offer more than 300 other assets >>