About 11:30 and 21:00 will be announced two decisions on interest rates. The first will take Polish National Bank (NBP) while the second Reserve Bank of New Zealand (RBNZ). Analysts agree that in both cases we will not see any change in monetary policy.

Night data failed in Japan

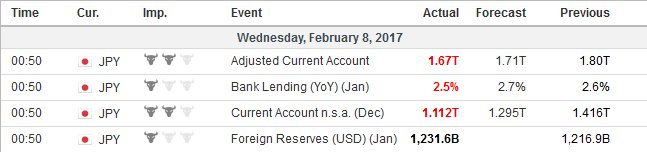

Before we get to discuss Polish and New Zealand polmon, let’s focus on the data that at 0:50 our time published Japan. Current Account Seasonally adjusted fared below expectations, as well as the dynamics of bank loans and the total value of the current account balance. All data collected on the screenshot below:

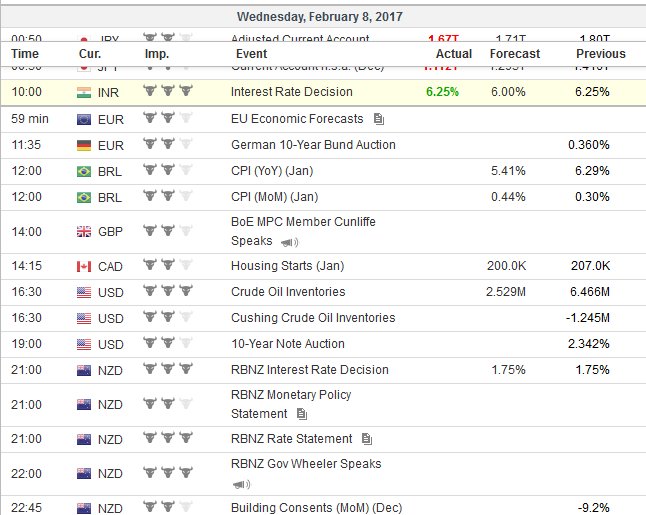

USD/JPY is recently a quite popular pair – all because of the expectation of a return to growth trend after two months of declines. Some analysts point at the support at level 112.50 – as you can see, however, the level was defeated and successfully tested from the bottom. Grid of successive support levels spreads out up to 110.00 and only breaking of this psychological barrier will be a clear sign that the bears will not want to let go so fast:

NBP and RBNZ without a single increase/reduction in 2017?

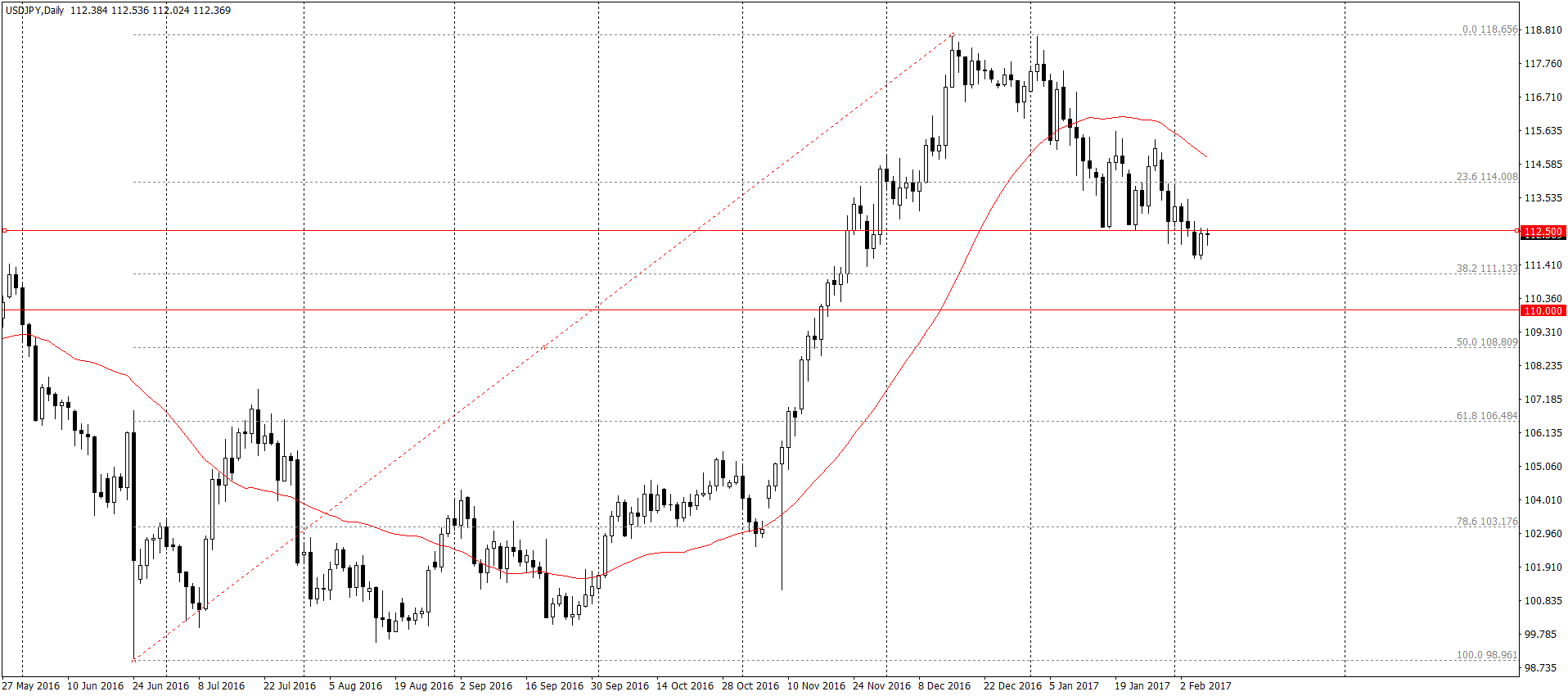

During the last meeting of the Monetary Policy Council, president of the Polish central banking announced that it plans not to raise interest rates over 2017 year. The approach to the subject of monetary policy could only change dynamic economic growth and higher levels of inflation – but such a development so far is not in sight.

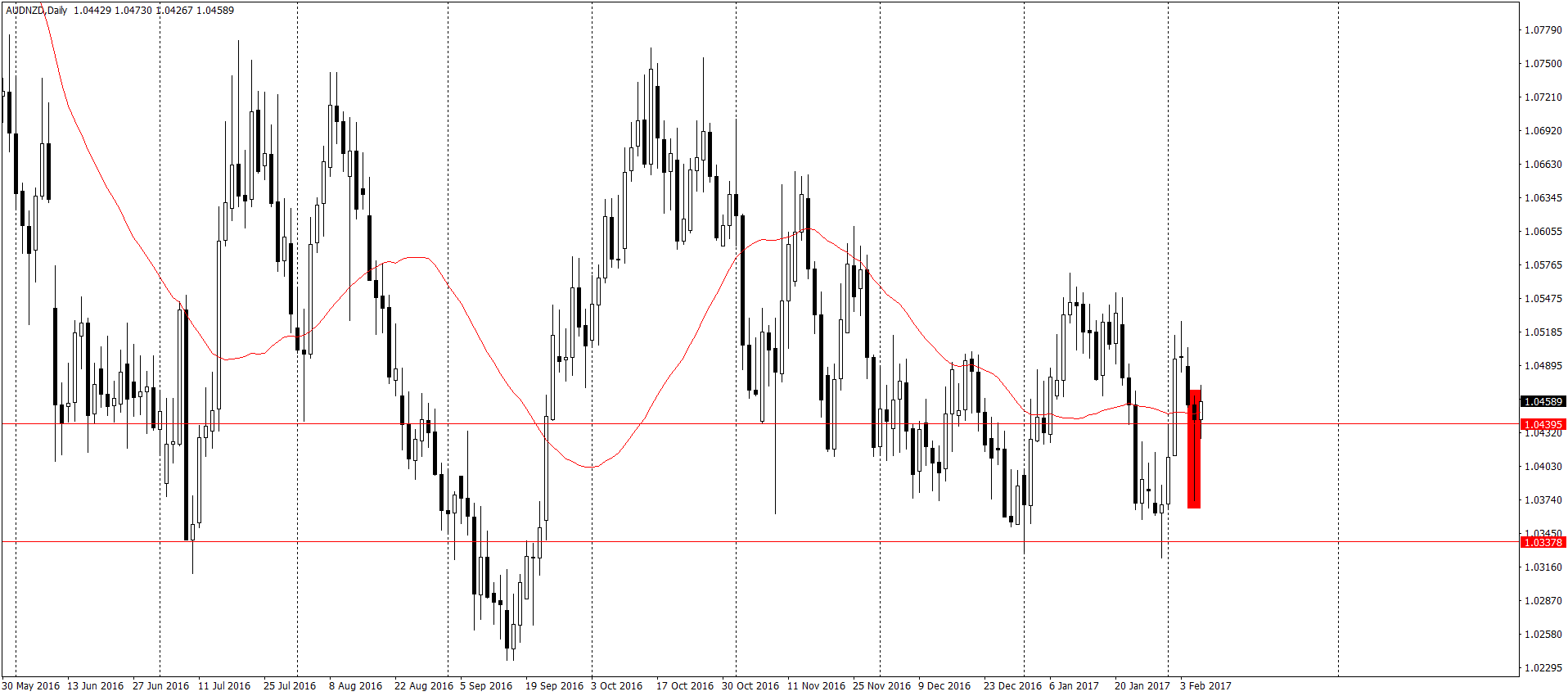

For global markets, of course, much more enticing is the RBNZ meeting. Economists from RBC Capital Markets admitted tonight that they hold long positions on the AUD/NZD before the summary of the meeting. There is a great risk that bank governor will want to weaken with dovish comments current valuation of New Zealand’s Dollar , which will further flatten the curve of expectations for interest rate hikes in the country.

Chart AUD/NZD is undoubtedly strongly jerky, but yesterday’s long bullish pin bar may overlap with RBC projections about growth opportunities of this pair within Wednesday’s session.

What else to follow Wednesday’s calendar?

Besides meetings of the two central banks in the macro calendar on February 8 , there are not too many items to track. In fact, we are only interested in hour 14:15 and 16:30.