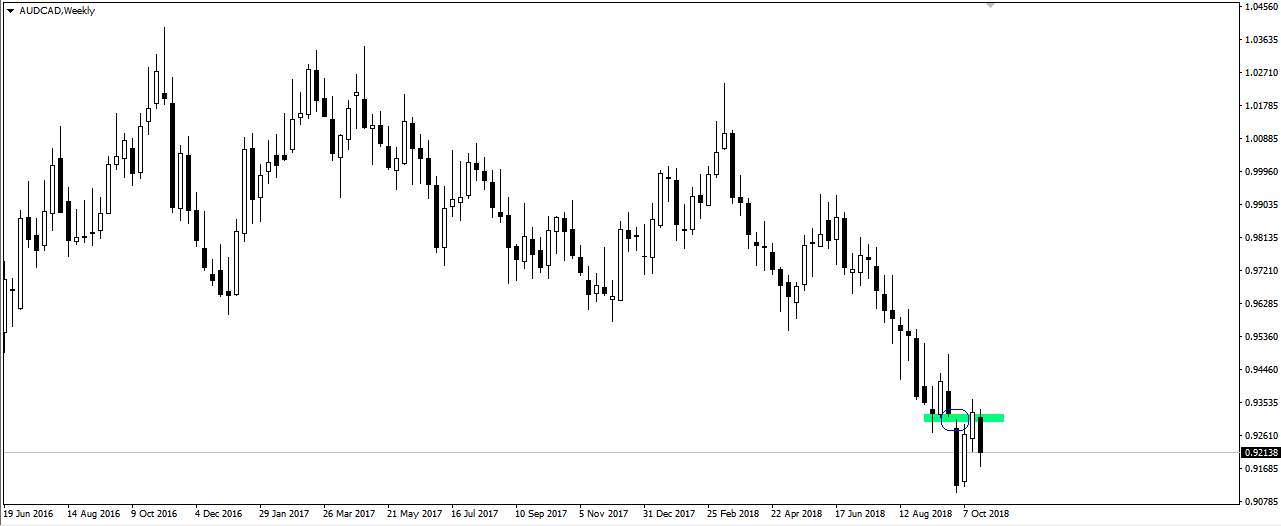

AUDCAD – Yesterday’s meeting of the Bank of Canada brought quite expected interest rate hike. The hike was expected, but the markets were anxious about news, as the latest economic data from Canada surprised negatively. The currency was also influenced by the delay in ratification by the US Congress of agreement between Canada, Mexico and the USA. It turned out that in addition to the rate hike, the markets also received a clear and very positive message, which suggested faster hikes in the future, considering them necessary to keep inflation at an appropriate level. Just after the hike was announced, the pair falls. On the other hand, we are concerned that the tensions between the US and China will hit the economy of Australia. It is extremely interesting on the AUDCAD chart because recently we had a significant bullish correction. Looking at the weekly chart, the biggest corrections lasted two weeks. The last correction closed the bearish gap from the beginning of October. A strong downward rebound in a strong downward trend and after a large correction, suggests that declines should be continued, the more so as fundamental issues seem to push the course to the south.