Friday, 10 December. Another winter weekend is ahead of us, but before that we have important data at 14:30 – CPI, the level of inflation in the USA. This could be the event of the day.

- US inflation – data at 14:30

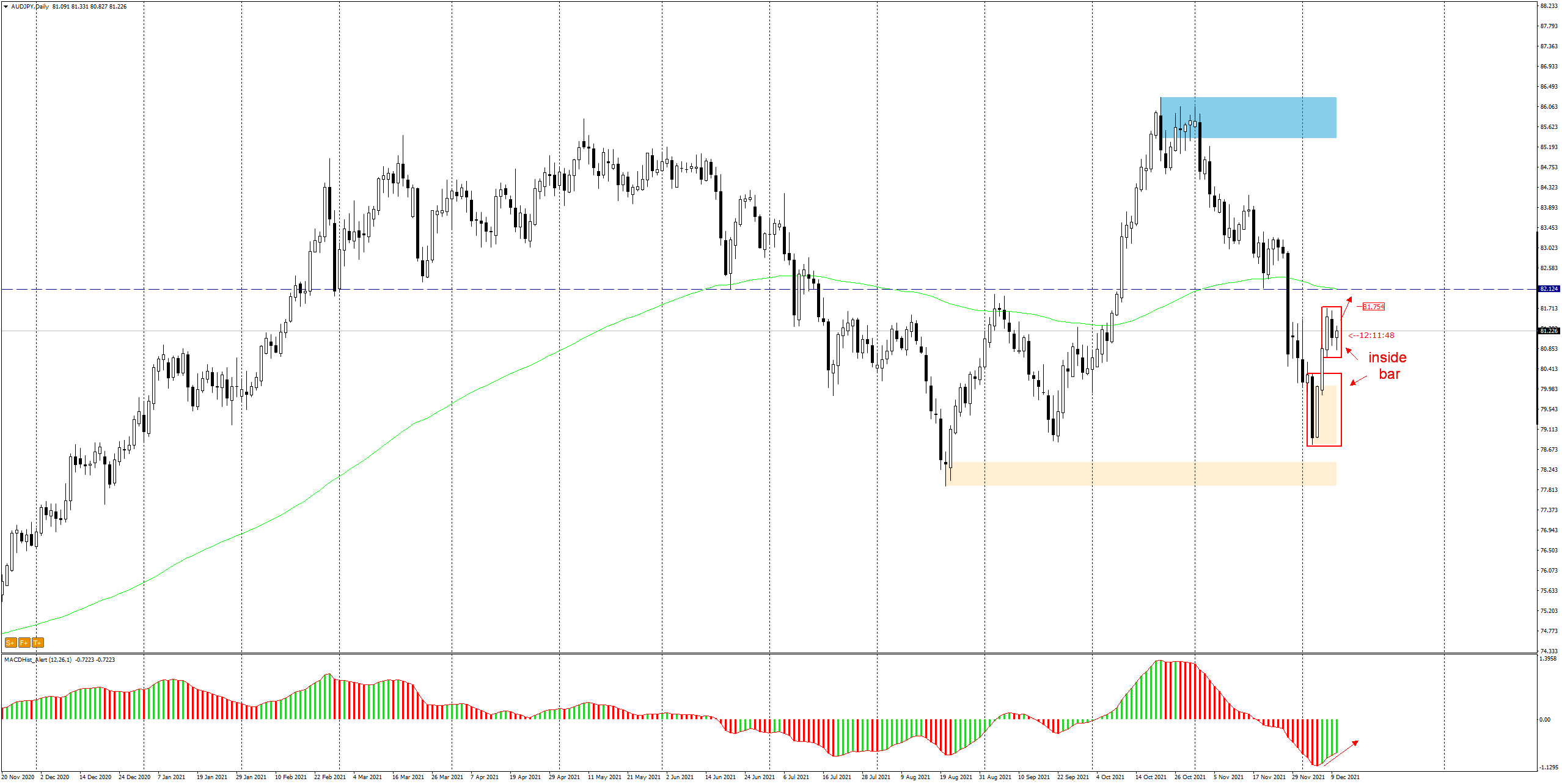

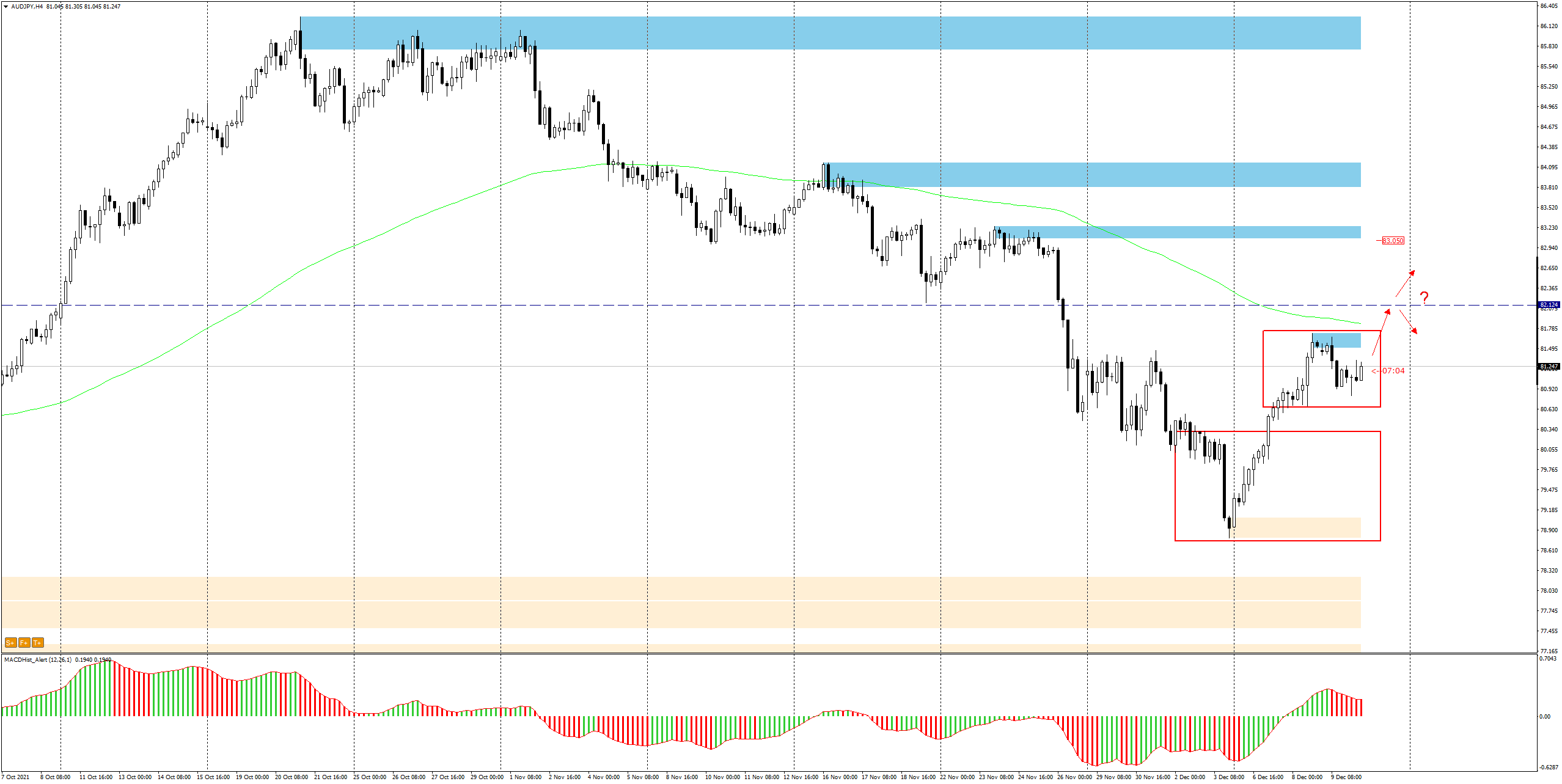

- Inside bar on AUDJPY – continuation or a U-turn?

I looked at the AUDJPY pair – the so-called cross that is the pair without the USD. Such pairs are less vulnerable to volatility when the data concerns only the US economy.

On the D1 chart we can see two inside bar formations – the first has already realized the movement after the breakout, the second is probably a formation of the continuation of the upward correction. MACD is in an upward phase.

Quite near, ca. 75p higher there is a S/R level of support and resistance, which coincides with the EMA144 average creating an area of confluence of resistances.

The 82.00-82.10 area may be a difficult obstacle to overcome and may turn the price south. However, if it can be overcome – the increases may accelerate and the price will follow to the nearest supply zone of 83.00.

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE .

More current analysis on the group : Trade with Dargo

Friday, 10th of December 13:00 GMT – live trading session here: https://www.xm.com/live-player/basic

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo