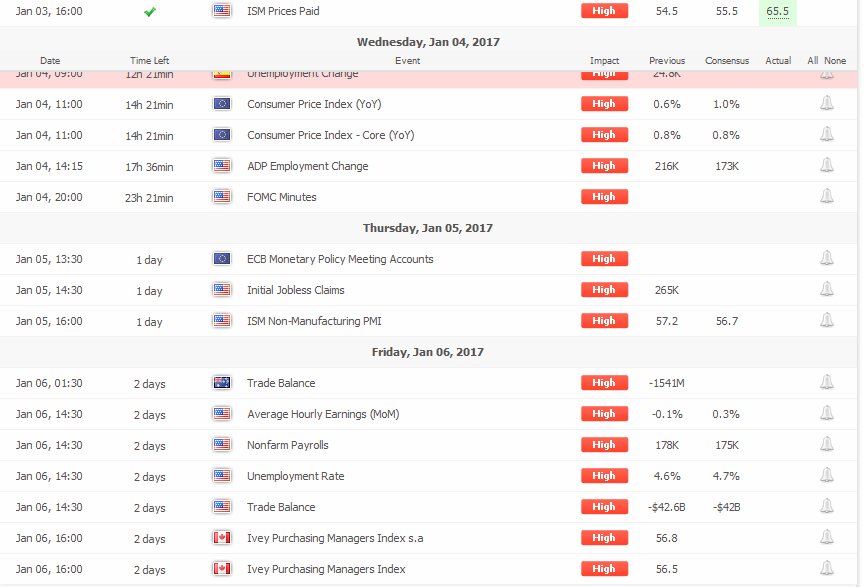

In the first week of the year we await some important macro events that can strongly move currencies related with USD and EUR. Wednesday’s data on inflation in the EU, the minutes of the December FOMC meeting and monthly payrolls NFP on Friday at 14:30 are enough to make me more cautious.

For sure this want be calm and predictable week. In such hot weeks I’m more willing to pay attention to cross pairs without USD and this time I spotted promising system on currency pair AUDNZD.

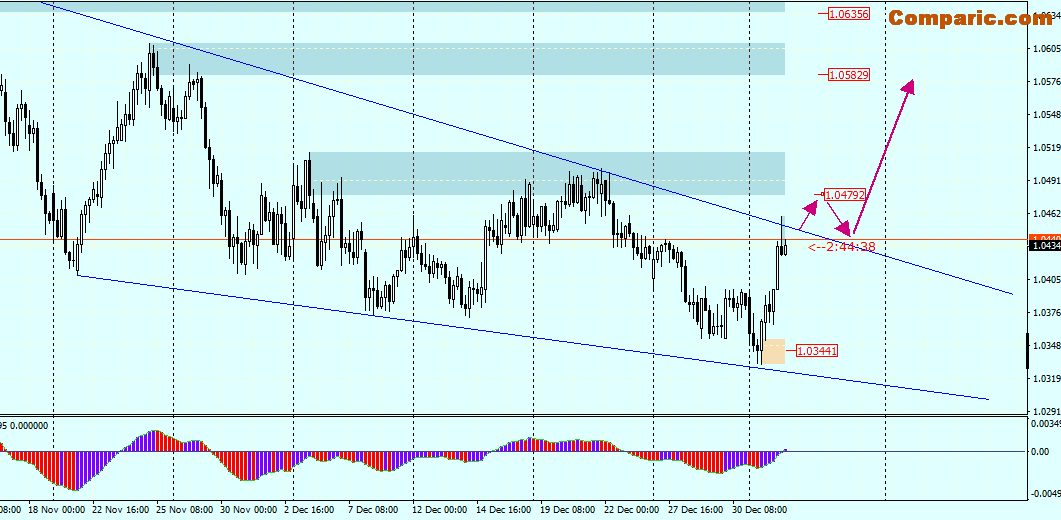

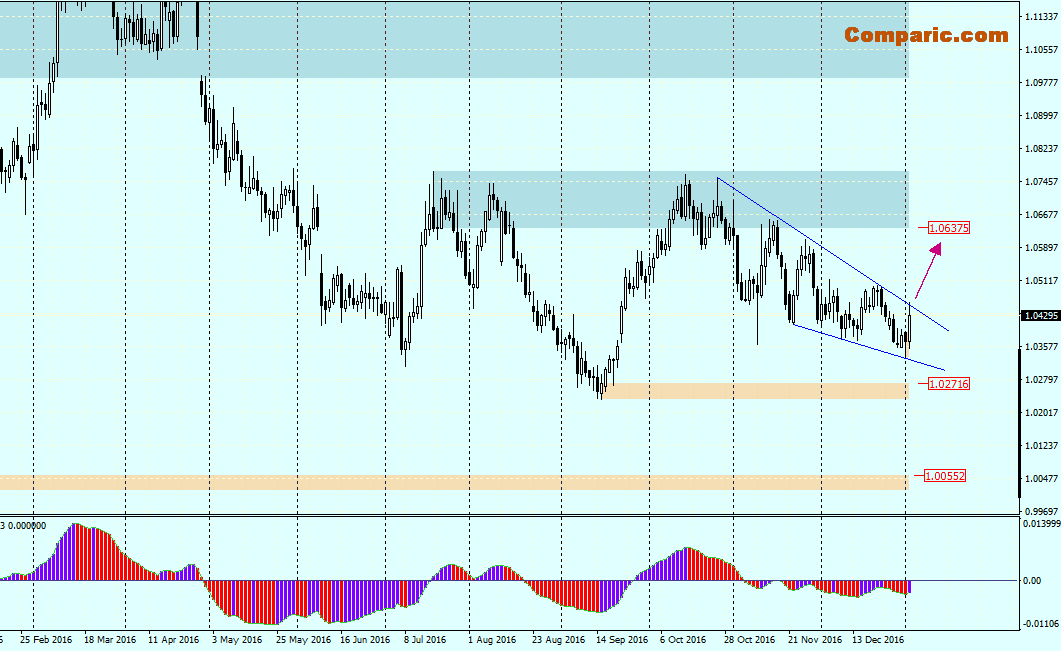

Pair moves within area of a descending wedge. I look forward for a bullish breakout from the wedge and dynamic growth. Further encourages me to this admittedly vague yet but still emerging divergence on MACD on D1 and already ongoing divergence on H4. So lets go Long… after a good buy signal which we should expect on lower time frame H1 or even lower.

In case of a successful bullish breakout from the wedge we can hope for a considerable growth, which can reach 1,060 and higer.