Though the overall value of the cryptocurrency market has remained the same, funds within the market are transferring from coin to coin at a rapid rate.

The craze of new coins coming online is astounding. More than 100 new digital assets have been created since the beginning of the year. Some of them with a clear purpose and a good team, some of them, not so much.

What boggles my brain is the amount of money that some of these new startups are raising. Many of them have already collected more than $100 million from alternative investors. This is more money than Leonardo Dicaprio makes in a year ($72M) and more than the annual expenditure of the Republic of Palau($99.5M).

So, unless these companies really need an Airbus A320 ($96.7M) what do they plan to spend that money on??

But what really concerns me, is that all of this money was raised in cryptocurrencies. So if they ever do decide to spend it offline, they’re going to need to cash out. Of course, as we saw with GDAX last month, they don’t always have the decency to spread their orders out.

–Mati Greenspan

eToro, Senior Market Analyst

Please note: All data, graphs & figures are valid as of July 6th. All trading carries risk. Only risk capital you can afford to lose.

Now, let’s amplify this by a billion times!!!

The scary situation outlined above is very similar to what’s happening in the world of “real money.”

However, the scope of the cryptomarket is virtually nothing when compared to fiat, which represents the entire monetary system that all 7 billion of us currently rely on.

It goes like this…

In 2008 there was a financial crisis due to way too many investments in all the wrong places.

In response to the crisis the United States Federal Reserve, in an unprecedented maneuver, stepped into the open market as the largest buyer of financial assets in the history of mankind.

Here, let’s take a look at the S&P 500 index since just before the crisis. The crash and recovery.

As you can see, they’ve breathed enough money into the market for it to rise about 35% higher than the peak in 2007. Talk about overkill.

Now for the scary part…

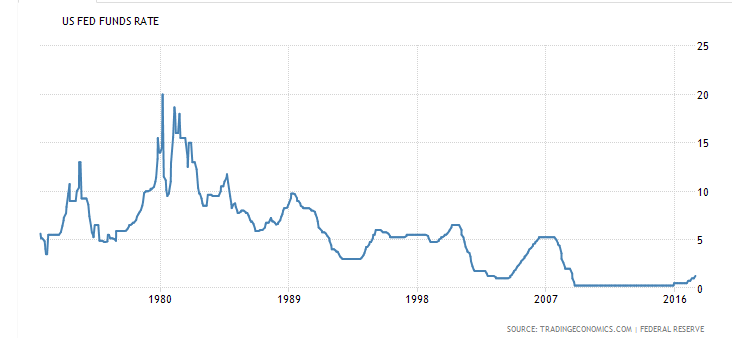

Over the last few months, the Fed has been shifting their strategy. Instead of telling the markets that they will be raising the interest rates, they’ve been talking seriously about selling off $4.5 Trillion worth of assets that they’ve bought over the past decade.

Now, of course, they plan to do this gradually and they understand the implications but the facts remain the same…

The biggest buyer in the market is about to become the biggest seller.

Certainly, the head of the Fed Janet Yellen has more data than I do but I simply cannot wrap my head around her recent statement that “we will not see another financial crisis in our lifetimes.”

Maybe it’s pride. Maybe faith. Perhaps she’s right. It’s definitely possible that they’ve printed enough money to last for the next 4 or 5 generations. Only time will tell.

What I can tell you with reasonable certainty is that the printing policy, in conjunction with historically low interest rates, has tampered with the way that people view savings and the way that investors view risk.

At this point, it’s pretty clear to everybody that money sitting in the bank is money wasted and the trend of people taking more and more risk in order to seek out higher returns is currently at an unsustainable level.

With that, I’ll leave you for today. Please feel free to approach me directly @MatiGreenspan with any questions, comments, or concerns. Have a lovely day ahead.