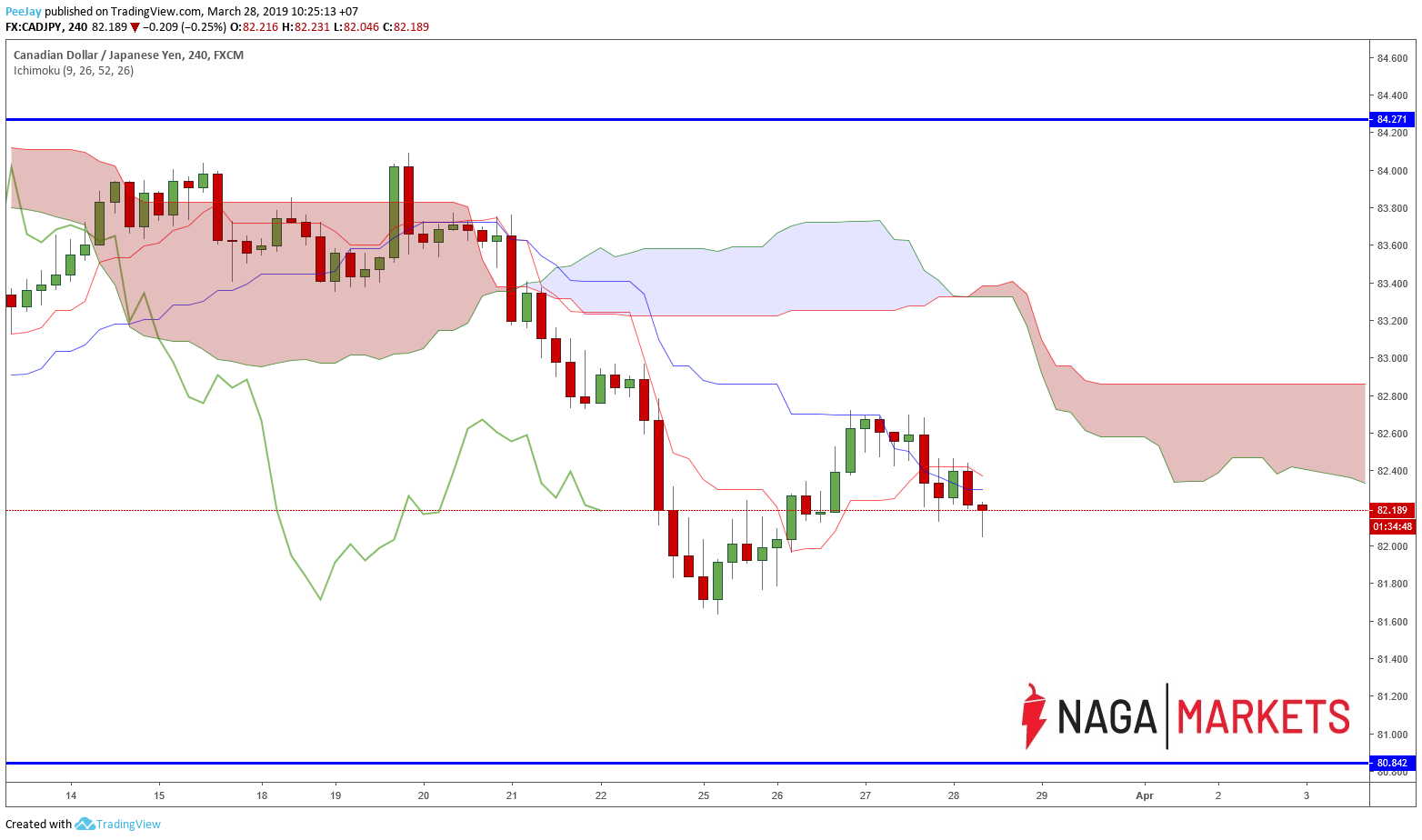

March was marked by declines on CADJPY. On the way, there was one strong upward correction, and now the second one is over. The price stopped near the Kijun line and started to move loosely south with it. The previous four-hour candle is a good place to enter a short.

When opening a position, however, one must be careful to achieve an appropriate profit-risk ratio. It is believed that the RR for Ichimoku should be 2:1, I would be even more inclined towards the 3:1 option. If we place Stop Loss above the last peak, it can be difficult, however.

The support from the day chart is a little under 81.00, with over 100 pips to earn. With a Stop Loss of about 50 pips, the RR will be slightly above 2:1. It is up to you to enter this position according to your risk management.

Join us in our new group for serious traders, get fresh analyses and educational stuff here: https://www.facebook.com/groups/328412937935363/