Analysis for Newbies: USDMXN Loses Battle with Resistance?

USDMXN reached last month a key resistance near 19.2745. As you can see on the daily chart below, resistance has been fought since then,...

Weekly FX Review – November 13th

The chart above is EURJPY implied vol going back to 2014. Three-month EURJPY is in blue and six month is in red and the...

Weekly FX Review – November 6th

The melt-up in the commodity complex as represented by the DJ Commodity Index is breaking key topside resistance levels.

Above is a 3YR+ chart of...

Weekly FX Review – October 30th

The chart above is ten years of daily spot CAD data in grey overlaid with 3-month CAD implied volatility in blue. The purple &...

Harmonic Trading – ABCD on EURAUD and EURPLN

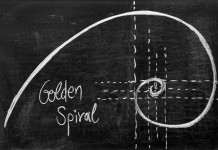

Trading based on harmonic patterns mostly depends on proper measurement of Fibonacci retracement in relation to price movements.

A description of all the patterns can...

Weekly FX Review – October 23rd

The spread between three months implied vs realized vol in CAD is too wide. There remains strong interest to sell C$ volatility as the...

Analysis for Newbies: USDPLN – Between Trend Line and Resistance

USDPLN until recently has been moving in a dynamic upward trend, whose minimum was set around 3.5110. Since that time, pair have been rising...

EMA Rainbow Setups Overview – 29/09/2017 – CADJPY, EURAUD, EURCHF, EURGBP, EURJPY, USDPLN

The setup overview for EMA Rainbow Strategy is a daily collection of analyzes of potential trades based on this strategy. Detailed description of the...

Weekly FX Review – September 25th

One month CAD vol has come off too far too fast. Same story with the one and two week periods. Gamma options are still...

End of the Day Strategy Setups – 20/09/2017

The End of the Day setup overview is a daily set of analyses of investment opportunities based on the EoD strategy, if you want...