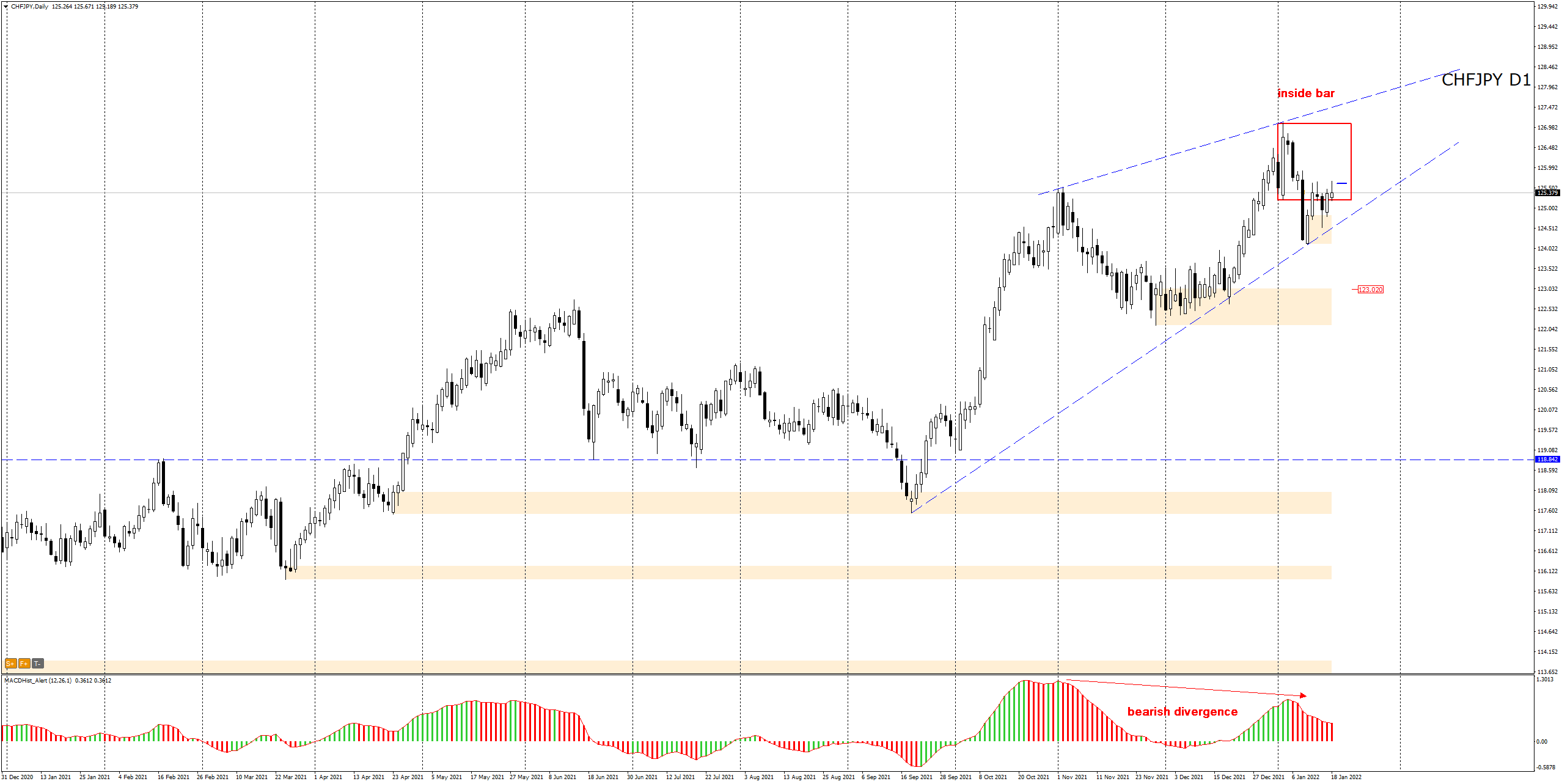

In the first days of January, the pair of the Swiss franc with the yen formed an inside bar formation. The price left the bottom of the formation on January 10 creating at the same time a downward divergence on the MACD on the daily chart.

- Inside bar on the daily chart and downward divergence on the MACD

- On the H4 chart, the franc forms a bearish engulfing pattern

- I invite you to live trading session Wednesday, 10:00 GMT

Franc to Yen exchange rate. What next for CHF/JPY?

The declines stopped at the local trend line, which is also the support of the ascending wedge. Here, demand was activated and the price returned to the inside bar. The growth reached 50% of the last downward impulse.

The last candle on the H4 chart formed a bearish engulfing, which may signal an imminent return to declines. The downward scenario may be negated if the price is able to permanently overcome the level of 125.70, which is the maximum of the candle forming the aforementioned engulfing.

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo

I invite you to my – Wednesday, 19th of January at 10:00-11:00 GMT– live trading session here: https://www.xm.com/live-player/basic

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo