Citi’s analysts begin their week a bit later than others. Todays bank recommendation convince us to sell both of Citi’s picks. Which pair should we short?

Citi’s analysts begin their week a bit later than others. Todays bank recommendation convince us to sell both of Citi’s picks. Which pair should we short?

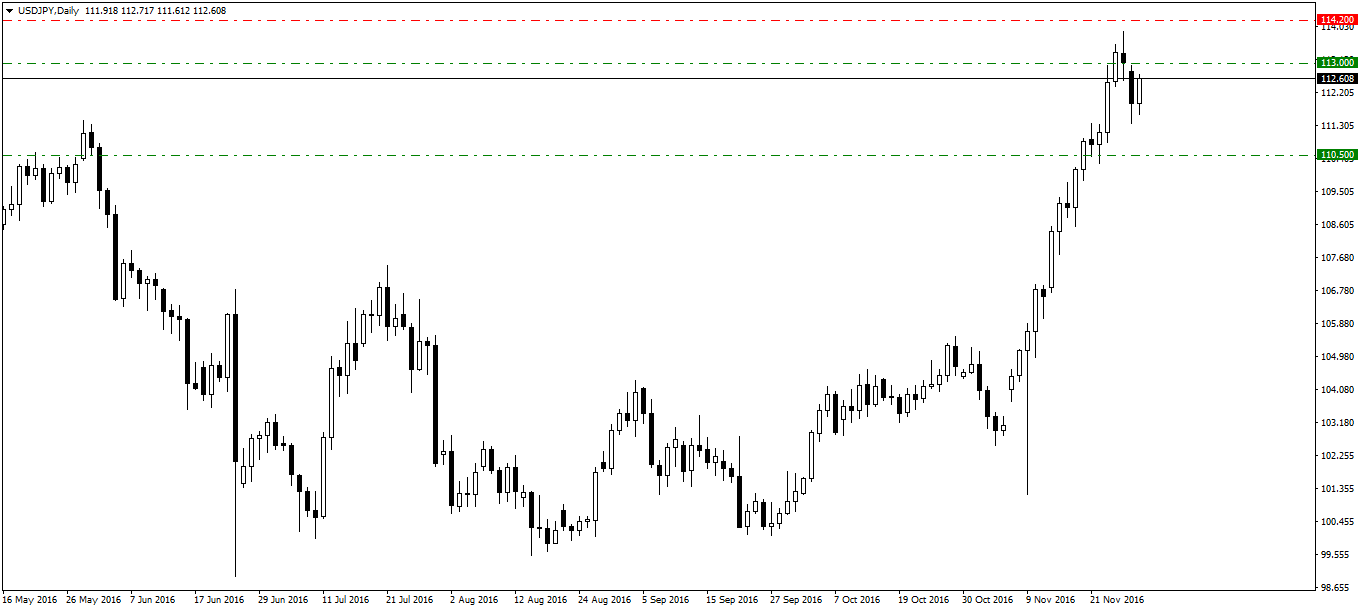

USDJPY

JPY remains bearish in longer term: The widening yield spread between US and Japan may drive fund outflow from Japan, which may be negative for JPY. On the other hand officials in Wisconsin are preparing to conduct a full recount of the votes from the US election in the state. Pennsylvania and Michigan may also do the recount.

Would you like to get more such informations directly on your email? Try out FxWatcher service for 5 days for free!

As the RSI is turning down from the oversold region, short-term upside may be made and the pair may trade inside 111.39-114.31. Next support may be seen at 108.47. Citi recommend to short USDJPY at 113.00 with stop loss at 114.20. Take profit should be set at 110.50

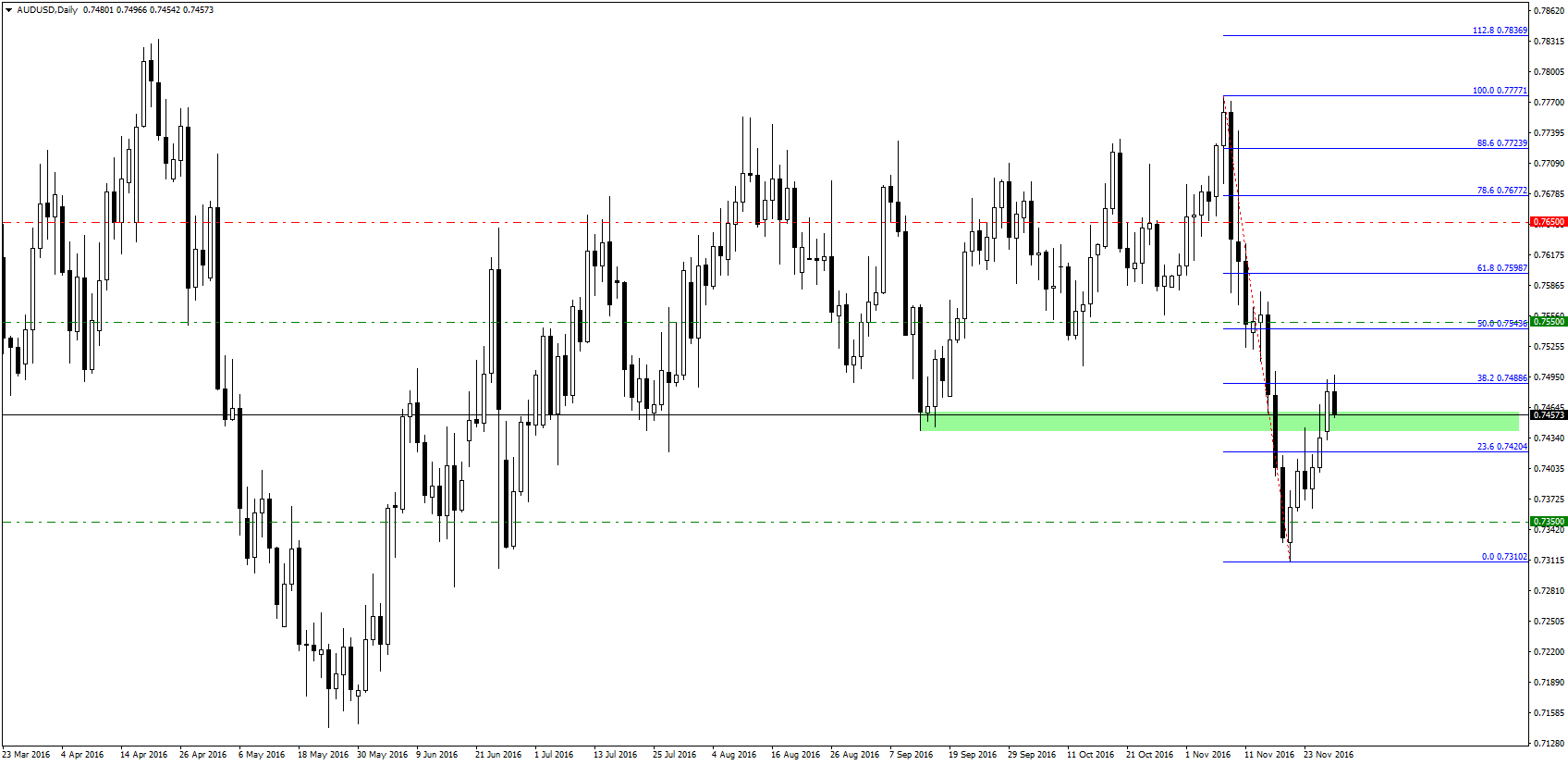

AUDUSD

Upside may be limited: The expectation of rate hike by the Fed and the uncertainty about Trump’s trade policy may cap AUD’s upside. Also iron ore prices has risen for the 5 consecutive days, which may be positive for Australian export and AUD.