Equity indices are still making new highs, cheering the low level of Treasury yields (and the implied low level of terminal Fed Funds) while paying scant attention to the flattening yield curve as markets price in a growing chance that Fed Funds will reach 2% by the end of next year.

Equity indices are still making new highs, cheering the low level of Treasury yields (and the implied low level of terminal Fed Funds) while paying scant attention to the flattening yield curve as markets price in a growing chance that Fed Funds will reach 2% by the end of next year.

The curve is at its most inverted when short-term rates are at their highest level, which does indeed tend to come soon before the economy slows (since slowing growth stops the Fed from raising rates). To infer that the flat curve leads to slower growth is to take the correlation between curve shape and rates, and imply a causation which may not be right when the Fed is using different tools and the relationship between growth, inflation, wages, and bond yields is so different from the past. The peak in bond yields may well come before the peak in short rates, and the peak in short rates will indeed precede a slowdown, but I don’t the curve shape tells us much. More parochially from an FX perspective, if the curve flattening tells us that expectations of peak Fed Funds, and peak real rates, aren’t going up, the flat yield curve isn’t doing anything for the dollar.

Check out Lloyds Bank postion on GBPUSD>>>

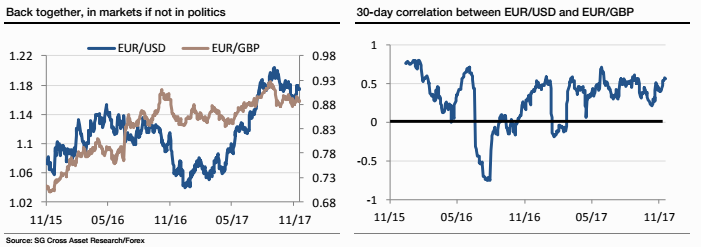

The UK Budget will make headlines, but probably not be a big mover for GBP. Better borrowing figures allows for a £3bn cur in gilt issuance over the remainder of the fiscal year and that can help gilts relative to swaps but the main FX response is likely to be that it was a non-event. The correlation between EUR/GBP and EUR/USD has returned to normal (high) levels and any upward pressure on EUR/GBP today would most likely come as a result of market hopes of progress in resolving Germanys’ political deadlock. Sterling’s still very cheap and still reacts more to good than to bad news as a result. Today may just bring confirmation that the Chancellor has very little room for fiscal handouts.

The biggest story overnight is probably the on-going strength of oil prices, which helps NOK

and CAD within G10 currencies. Short GBP/NOK has been a terrible trade so far, but we have hope for it longer term and a further drop in Norwegian unemployment supports the view that the onshore economy is improving. Otherwise, EUR/USD is locked in its narrower, 1.17-1.1880 range, and USD/JPY is testing the lower end of the most recent mini-range despite rising equity prices (if it bounces off 11.70 that’s a good spot to go short JPY).