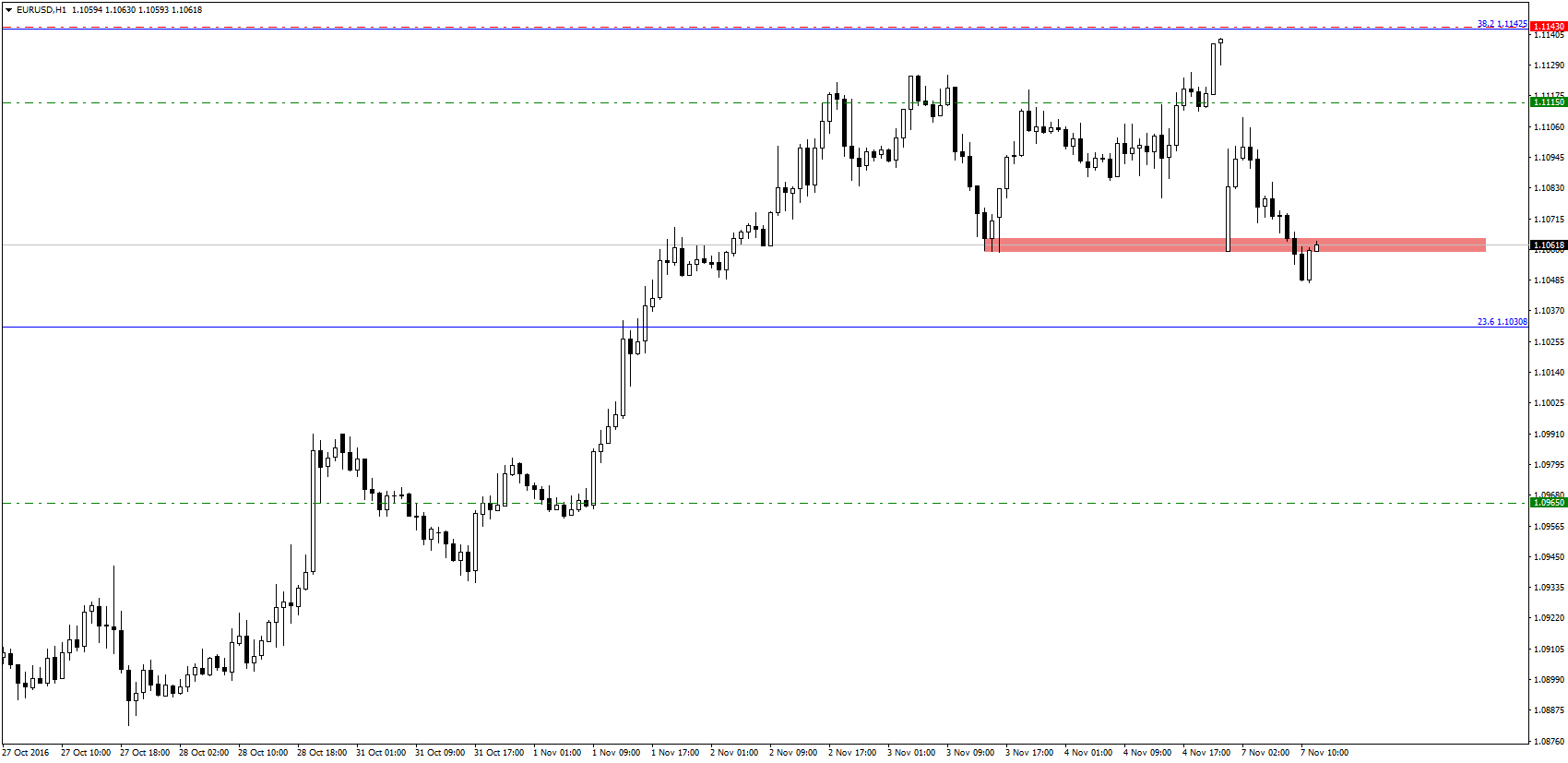

EURUSD

EURUSD has managed to find a cap on challenge of a cluster of resistances at 1.1130/43 ‒ the previous “breakdown zone” and 38.2% retracement of the May/October decline – and turned lower. This brings the attention lower for 1.1038/35 at first, below which is needed to turn the risk lower for 1.0990, followed by 1.0936. Through the latter can then retarget the October low at 1.0851 where buying is expected to show.

Resistance moves to 1.1110, with a clear break above 1.1145 needed to suggest a better recovery for the 200-day average at 1.1182 and then 1.1201/04.

Strategy: Short at 1.1115, stop above 1.1143 for 1.0965.

USDJPY

USDJPY has managed to bounce off its 55-day average now at 102.73, leaving it in a broad range for now. Resistance shows at 105.13/24, ahead of the late October high at 105.54. Above here is needed to target downtrend resistance at 106.11 where we would look for a cap. However, a direct break higher can target the 200-day average at 106.79 where strong selling is expected to show.

Near-term support moves to 103.84, ahead of 103.49, then 102.83/73. Below here is needed to turn the risk lower for a test of the price support at 101.85 initially, followed by 101.19.

Strategy: Flat. Sell at 105.50, stop above 106.11 for 102.90.

Would you like to get more such informations directly on your email? Try out FxWatcher service for 5 days for free!