As expected, the Bank of Japan (BoJ) kept monetary policy unchanged at its meeting earlier today, i.e. the key policy rate was left at -0.10% and the yield curve target and asset purchase target were untouched. The JPY has weakened significantly over the past month pushing inflation expectations higher, which means the BoJ can afford to stay patient in the current situation.

As expected, the Bank of Japan (BoJ) kept monetary policy unchanged at its meeting earlier today, i.e. the key policy rate was left at -0.10% and the yield curve target and asset purchase target were untouched. The JPY has weakened significantly over the past month pushing inflation expectations higher, which means the BoJ can afford to stay patient in the current situation.

The US Markit PMI for the service sector released yesterday showed a decline to 53.4 in December from 54.6 against expectations. It has now fallen two months in a row although only slightly. Markit Economics says it is still at a level consistent with GDP growth of around 2% q/q AR in Q4. In comparison, the latest update of Atlanta Fed’s Now GDP forecast from Friday points to 2.6% q/q AR GDP growth in Q4 – it will be updated again on Thursday.

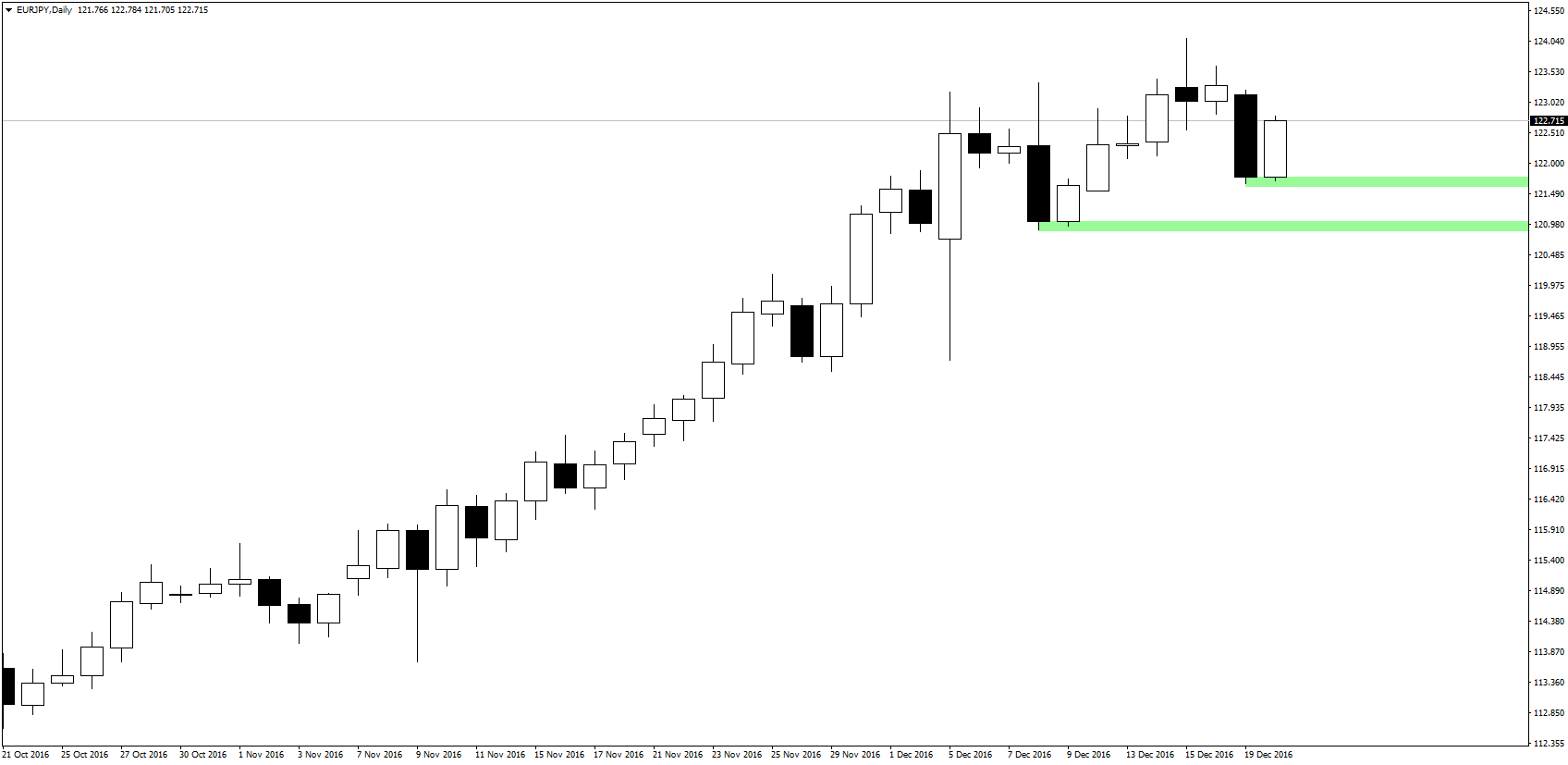

The rally in US fixed income markets on Monday naturally spilled over into JPY crosses in line with the usual correlation with 10Y US Treasury yields. In particular, EUR/JPY and GBP/JPY fell sharply following recent sharp moves higher. Given the recent build-up of short JPY positioning and the reduction in short EUR and GBP positioning, the correction lower in EUR/JPY and GBP/JPY may have further to run.

The rally in US fixed income markets on Monday naturally spilled over into JPY crosses in line with the usual correlation with 10Y US Treasury yields. In particular, EUR/JPY and GBP/JPY fell sharply following recent sharp moves higher. Given the recent build-up of short JPY positioning and the reduction in short EUR and GBP positioning, the correction lower in EUR/JPY and GBP/JPY may have further to run.

Commentaries, trading setups and many more are provided by FxWatcher. Try out FxWatcher service for 5 days for free!

The concerning situation on the Chinese market has spilled over to the market for base metals. The market has sold off over the past week – a development that continued yesterday. China consumes about 50% of the world’s base metals, i.e. tighter monetary conditions weigh on China’s demand for base metals and enough to mitigate the recent positive impulse from higher global growth expectations and the prospect of increased fiscal spending on infrastructure and defence in the US. It has not spilled over to the oil market as it did last January and in August 2015. That may be due to the support to oil prices from the recent producers’ agreement to cut oil output in 2017.

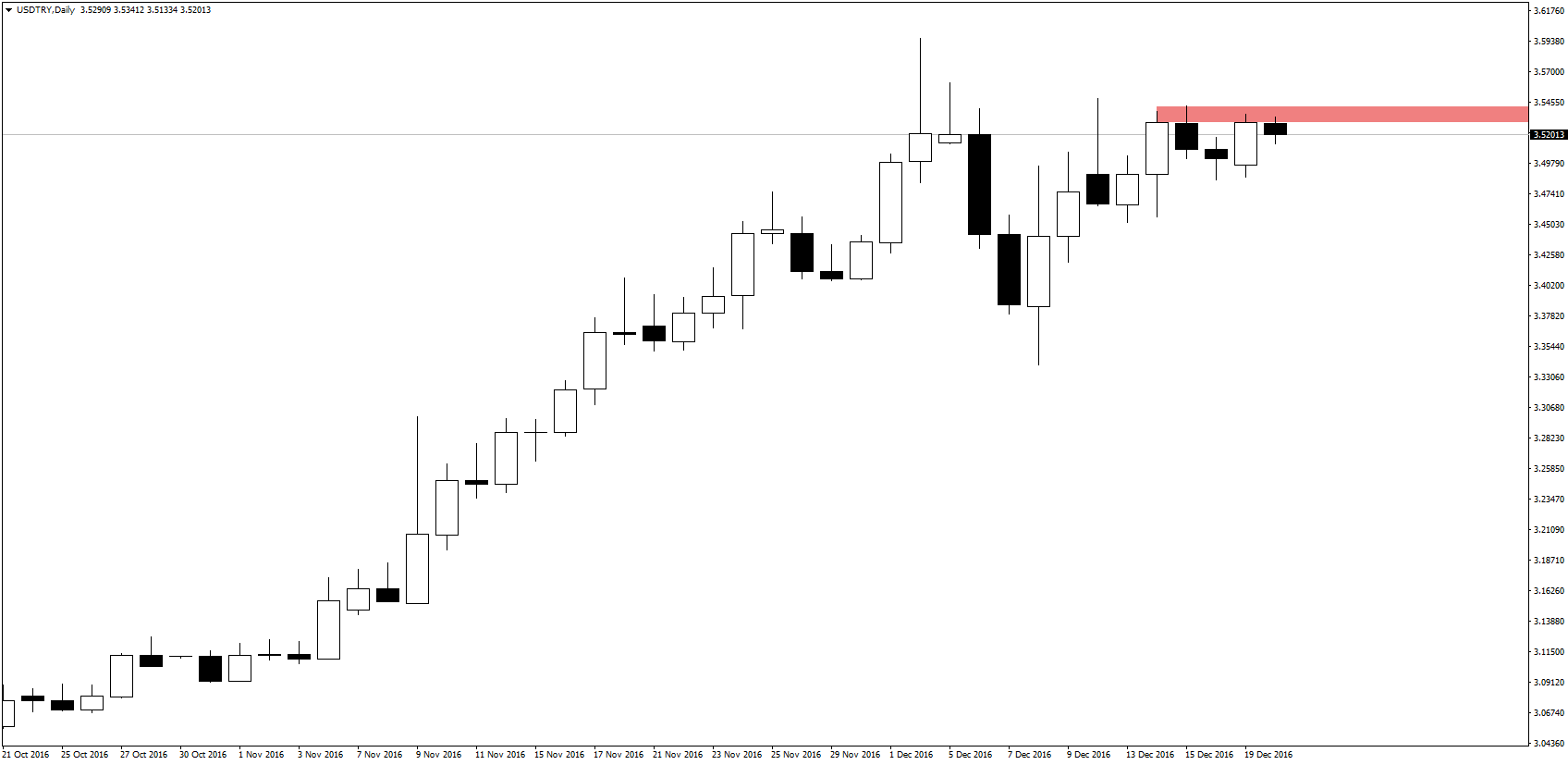

The assassination of the Russian Ambassador to Turkey last night weighed on the already weak Turkish lira. While both Russian and Turkish leaders have stressed their co-operation in the investigation of the murder, the assassination adds to the picture of Turkey as a nation caught in deadly sectarian and geopolitical violence. This will undermine the important tourist sector, worsening the prospect of closing a relatively large current account imbalance. In our recent update on the Turkish lira, we turned bearish on the currency, seeing the USD/TRY 3.60 in 3M and 6M and 3.95 in 12M, respectively. The Turkish central bank meeting today could add further to the negative TRY sentiment if the bank looks for a loosening of monetary conditions. However, we expect unchanged rates.

The assassination of the Russian Ambassador to Turkey last night weighed on the already weak Turkish lira. While both Russian and Turkish leaders have stressed their co-operation in the investigation of the murder, the assassination adds to the picture of Turkey as a nation caught in deadly sectarian and geopolitical violence. This will undermine the important tourist sector, worsening the prospect of closing a relatively large current account imbalance. In our recent update on the Turkish lira, we turned bearish on the currency, seeing the USD/TRY 3.60 in 3M and 6M and 3.95 in 12M, respectively. The Turkish central bank meeting today could add further to the negative TRY sentiment if the bank looks for a loosening of monetary conditions. However, we expect unchanged rates.