Last week was very bad for German bulls. Although DAX gained 200 pts during this week but technically bears have more power. On Wednesday the most important event of this week will be FOMC meeting and decision about interest rates. Markets don’t expect any hike right now but we can know some hints thanks to the statement. Dovish statement can help bulls and hawkish one will have opposite effect.

IF YOU ARE INTERESTED IN INVESTING ON INDICES LIKE DAX30, TRY FREE FXGROW ACCOUNT

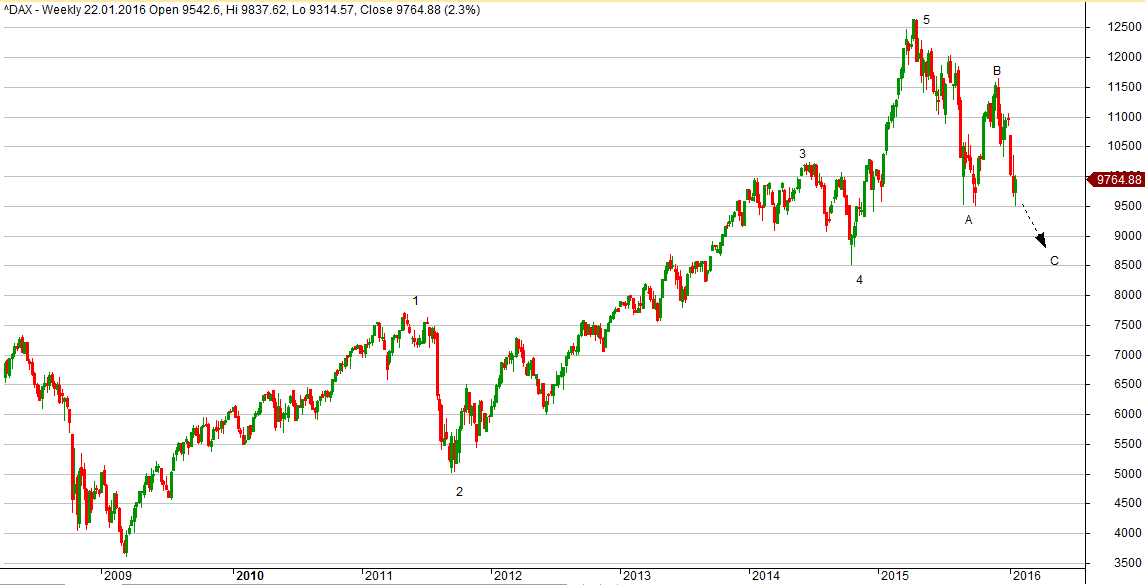

DAX weekly: On the chart below I marked Elliott waves, as you can see they work pretty well on this index. We can notice end of bullish impulse and ABC pattern, which took a form of simple correction. Last week deepening of yearly low has negative impact on the technical situation. According to Elliott waves we can only assume this is wave C of bearish trend and the target is at 8,400 pts (A=C strengthened by 2014 support). If we don’t look at Elliott waves we can spot new low on the chart what confirms characteristic setup of lower highs and lows. Of course it doesn’t mean that there will be immediate decreases but any appreciation will be just a sign of strong market sellout and reaction of bulls on the support.

DAX daily: On D1 chart we should notice two things. The first one is volume which is clearly higher during last candles. It is hard to notice what direction will it be in short term. Currently bullish rebound is possible and on longer time new bottom. In the end of Friday session doji candle showed up. In longer terms it often shows reversal of the trend so we can interpret it as a candle of balance of the powers in the market.