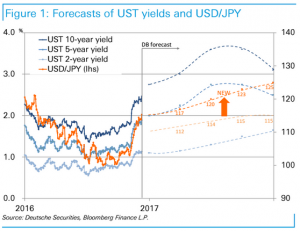

The USD/JPY has already reached our 2017 forecast of 115. This forecast was meant to act as early guidance during the dramatic shift of the USD/JPY risk from downward to upward that followed the US presidential election, but has already fulfilled its purpose. Our new USD/JPY quarterly forecasts for 2017 are 117, 120, 123, and 125.

The USD/JPY has already reached our 2017 forecast of 115. This forecast was meant to act as early guidance during the dramatic shift of the USD/JPY risk from downward to upward that followed the US presidential election, but has already fulfilled its purpose. Our new USD/JPY quarterly forecasts for 2017 are 117, 120, 123, and 125.

These revised forecasts are based on our US interest rates strategy team’s new UST yields forecasts. Our team dramatically raised their projections for US Treasury yields as of June 2017 from 2.5% to 3.6% for 10-year, from 1.75% to 2.75% for 5-year, and from 1.25% to 1.3% for 2-year.

Even if these revisions only prove half correct and the 10-year yield only tops 3%, we see the USD/JPY would try for the 120’s level. Higher expected inflation is behind our aggressive forecasts for US yield increases. As such, seeing from the difference in US and Japan real interest rates, you may think the rise in the USD/JPY should be more moderate than our new forecast shows.

However, trades that are sensitive to changes in nominal interest rates have been driving the recent USD/JPY rally. In the early phase of the rally, we think that the USD/JPY will easily react to relatively long-term yields such as the 5- year and 10-year. When the BoJ tries to cap JGB yields in line with their yield curve control policy, the USD/JPY should become more prone to rises. Assuming we have correctly forecast that the Fed will raise interest rates once this month, at least twice in 2017, and three times in 2018, then the US policy rate could surpass Australia’s. Even if long-term interest rates hit a ceiling in late 2017, the USD/JPY would likely be driven by a pickup in carry trades accompanying rises in 2-year and shorter term rates.

However, trades that are sensitive to changes in nominal interest rates have been driving the recent USD/JPY rally. In the early phase of the rally, we think that the USD/JPY will easily react to relatively long-term yields such as the 5- year and 10-year. When the BoJ tries to cap JGB yields in line with their yield curve control policy, the USD/JPY should become more prone to rises. Assuming we have correctly forecast that the Fed will raise interest rates once this month, at least twice in 2017, and three times in 2018, then the US policy rate could surpass Australia’s. Even if long-term interest rates hit a ceiling in late 2017, the USD/JPY would likely be driven by a pickup in carry trades accompanying rises in 2-year and shorter term rates.

Commentaries, trading setups and many more are provided by FxWatcher. Try out FxWatcher service for 5 days for free!

From a technical perspective, our 115 forecast assumed the largest rally (61.8%) we would expect during a USD/JPY down-cycle in 2016. However, our economists’ latest US growth forecasts (3.0% in 2017, 3.3% in 2018) suggest that the USD/JPY up-cycle is still in play and will last a while longer. Our new forecast of 125 sees the USD/JPY rebounding to roughly the same high (125.86) it hit in June 2015.

The primary risk to our outlook for the USD/JPY is that the Trump administration’s policies remain uncertain. We believe the key determinants of the USD/JPY are the US economy and interest rate trends. As we learned via Abenomics and Reaganomics, extreme macroeconomic policy can have an equivalent impact on the market. In keeping with this logic, we will not hesitate to revise our USD/JPY forecasts if the market changes its appraisal of Trump policy.

The primary risk to our outlook for the USD/JPY is that the Trump administration’s policies remain uncertain. We believe the key determinants of the USD/JPY are the US economy and interest rate trends. As we learned via Abenomics and Reaganomics, extreme macroeconomic policy can have an equivalent impact on the market. In keeping with this logic, we will not hesitate to revise our USD/JPY forecasts if the market changes its appraisal of Trump policy.

Other risks that we cannot ignore include conditions in China, protectionism, and geopolitical risk. The market could easily destabilize if we see real demand participants hesitating to buy because of over-valuation in the USD/JPY in terms of a fair value like PPP. We caution that the recent rapid rally may result in the rate undergoing a time-correction over the coming months. We project a wide trading range of 110-125 in 2017.