The declines since the beginning of the year on EUR/USD are just a correction, according to Credit Suisse.

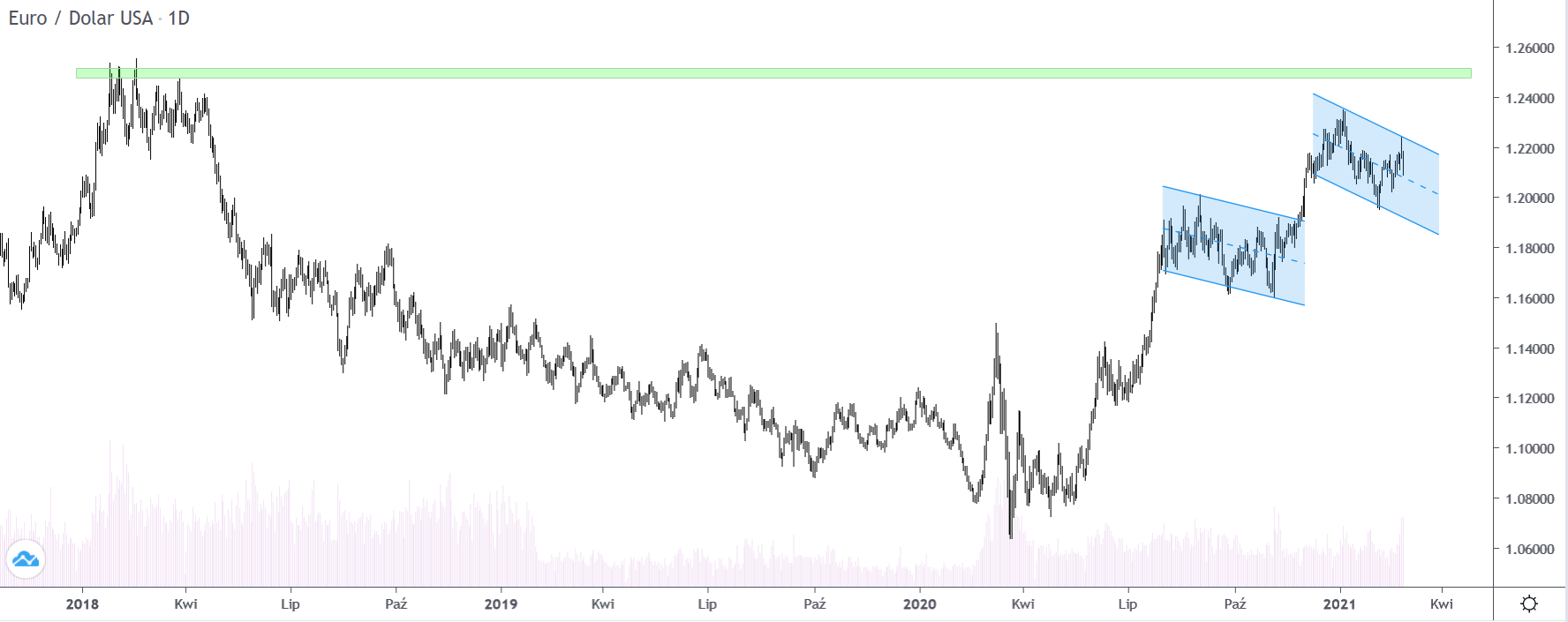

A key resistance level in the region of 1.2190 on EUR/USD, which is visible to the naked eye, is also pointed out by Credit Suisse analysts in their latest forecast.

In their opinion, a breakout above this level will end the period of consolidation, as well as a more extended downward correction, which has been ongoing since the beginning of this year.

The authors of the report indicate that such breakout should in the short term result in the rate increase to the vicinity of 1.2345-55, i.e. practically to the current maximum of the whole upward trend.

EUR/USD will return to growth, Credit Suisse says

On the purely technical side, the analysis points to a small inverted head-and-shoulders formation. It is a fragment of quotations located under the mentioned resistance, which at the same time is treated as the so-called neckline, the breakout of which is equivalent to the activation of such a formation. Its range, in the textbook meaning, would be even higher than the trend maximums.

In the long term, the attitude towards EUR/USD is also positive. Credit Suisse has set a target level in the region of 1.2518-98. This target is based on the vicinity of the 2018 maximums and the level of 38.2% of the abolition of the entire downtrend from 2008-2017. Analysts expect that this is where we have the main barrier for EUR/USD.

ongoing analysis https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo