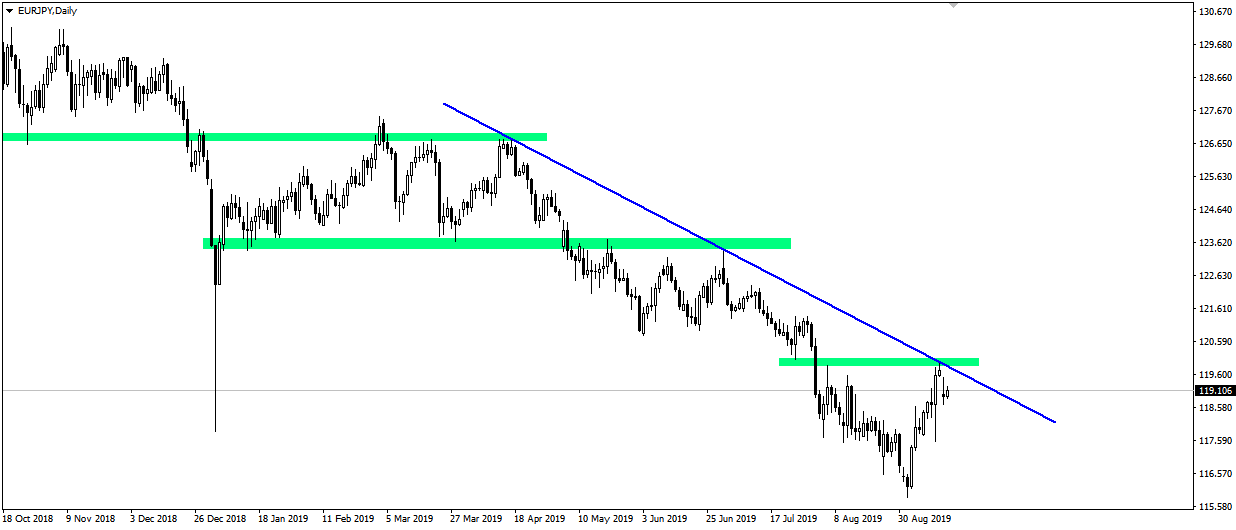

An interesting technical situation takes place on the EUR/JPY pair on the daily time scale. Since the beginning of March there has been a clear downward trend and the current correction movement is the largest in this period of time. It is therefore possible that the market is in a state of overbought, and the moment for a supply reaction is approaching. The weekend turmoil in the oil markets after the drone attack on oil installations in Saudi Arabia caused a strengthening of the currencies considered as safe havens, including Yen.

This may be an excuse to turn south. From Europe we only had weaker inflation readings from Italy, but today we will see the ZEW index readings for Germany and the Eurozone. Weaker data may contribute to the course heading south. On the technical side, after a significant correction, the exchange rate rebounded yesterday from the trend line and the level of the previous low. After a low opening, there was some catching up, but in the end it looked weaker than in other pairs.

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities