For a week EURJPY has moved in a steep downward channel, which was broke above yesterday. Rebound has not reached to the Fibonnacci level of 38.2%. This gives potential that the price will still moves up. That move up can be either a downward correction or permanent change of trend. The closest resistances are 134.75, 135.08. And the next supports are: 133.75, 133.25.

Try FX GROW. ECN & STP execution of order. Spread of 0.00001.

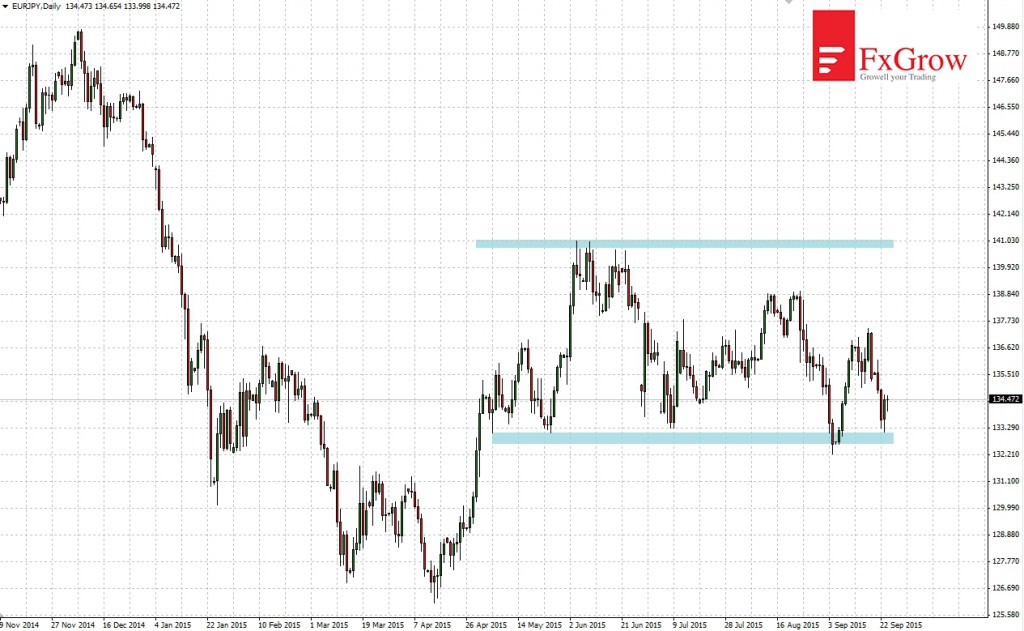

Wider view, interval D1

Since 2012, EURJPY moved in an upward trend. Year 2015 can be the beginning of a trend reversal, because at weekly intervals clearly visible, are lower highs and lower lows. The last 5 months is a consolidation between the levels of 133.00 and 141.00. Maximum of consolidation was tested only once, but minimum four times. That confirms the weakness of the bulls. When support at 133.00 will be break below the nearest target of falls is 131.00.