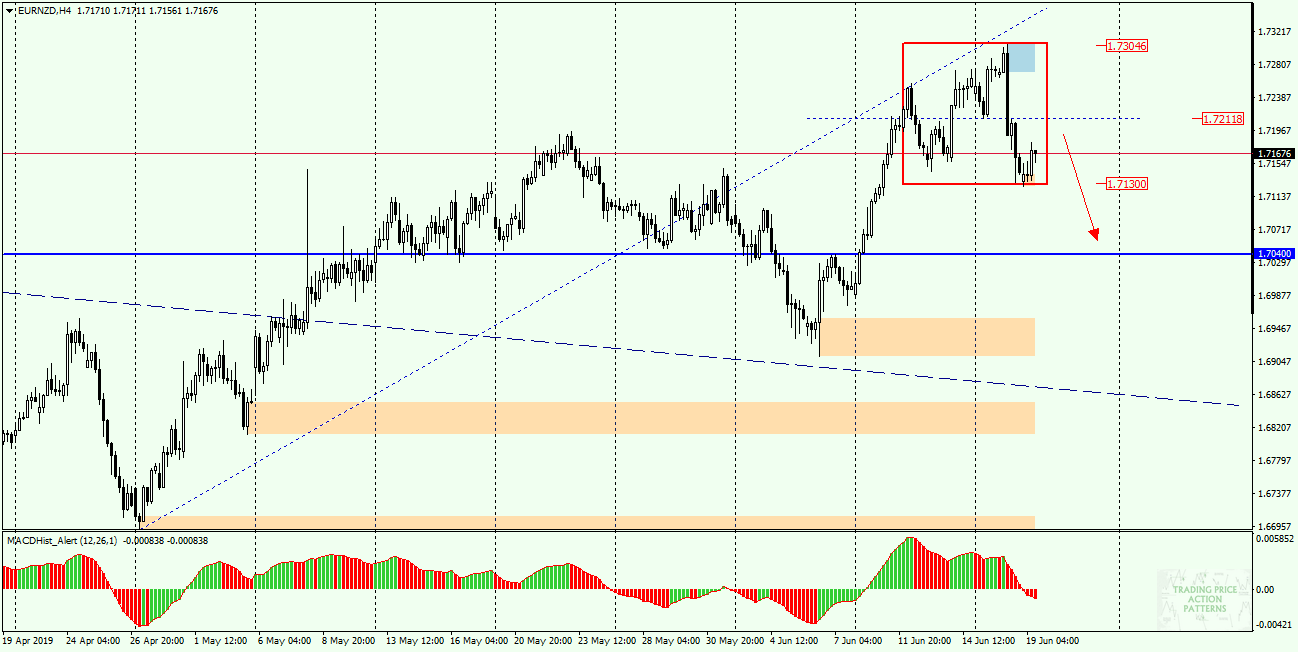

An interesting situation was created on the EURNZD chart. Yesterday’s (18.06.06) daily candle created a Outside Bar – the Bearish Engulfing pattern, covering 4 previous daily candles. This is another such formation in the course of the week, the description of how the situation developed was in the weekend summary. It seems that this time OB has a chance to be more effective than the previous one, because then the drops were limited to only 70p.

Currently the situation seems to be quite clear, the probability of further drops is very high, because the formation of this pattern is accompanied by the appearance of a bearish divergence on the MACD which creates confluence of signals and is a strong support for the bearish scenario.

Moving on to chart H4, we can initially estimate the range of price movement in the coming sessions. If the downward scenario works, the supply target may be the nearest level of S/R (support/resistance) 1.7040. The level above which SL should be placed is half of the OB pattern – 1.7215 where is the local S/R level.

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities