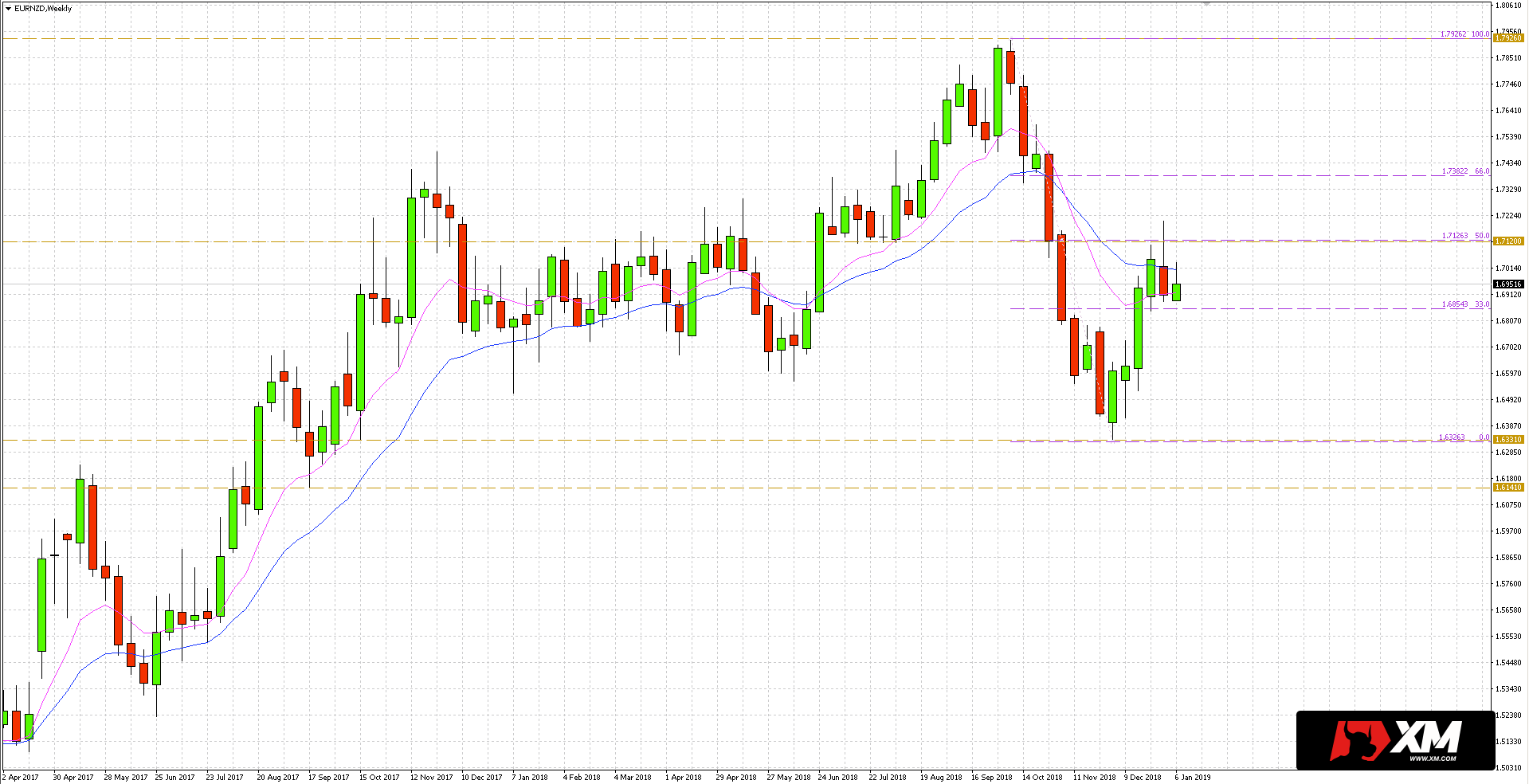

Quotations of the EUR/NZD currency pair went down dynamically from October to December 2018. As a result, the exchange rate set a low at the level of 1,6326 and then started to make up for the losses.

As can be seen from the weekly chart below, the quotations of the Euro in relation to the New Zealand dollar last week tested key resistance, where three important levels converge:

horizontal resistance at 1,7120

50% Abolition of drop impulse

dynamic resistance in the form of EMA 10/20 channel

Last week’s price action indicates a positive resistance confluence test. It may, therefore, turn out that the quotations will return to declines. Where would the nearest target be in such a scenario? The answers to this question can be found on the daily chart.

After going down to the medium channel EMA 10/20, the price may come across bids at 1.6780, where the November 2018 maxima are located. After overcoming this level, sellers would open their way to support near1.6331.