At 9:00 GMT we got to know Markit’s latest data about PMI in the Eurozone. Five minutes before this publication identical data were published for German economy. Today’s numbersare slightly better than market forecasts. How does this affect valuation of the single currency?

There are two institutes in the world responsible for index publication. The first of these is Markit Group, which publishes readings for 30 countries around the world. The second – Institute of Supply Management (ISM) – which is focused on US market only.

PMI Markit reports are always published at the beginning of each month. Industrial PMI on the first day, PMI in construction sector on the second, and PMI of the services on the third business day of each month.

The PMI Composite Reports on Manufacturing and Services, released by Markit Economics, are based on a large number of business executives in private sector manufacturing and services companies. Data is usually released on the third working day of each month. Each response is weighted according to the size of the company and its contribution to total manufacturing or services output accounted for by the sub-sector to which that company belongs. Replies from larger companies have a greater impact on the final index numbers than those from small companies.

Results are presented by question asked, showing the percentage of respondents reporting an improvement, deterioration or no change since the previous month. From these numbers, an index is derived: a level of 50.0 signals no change since the previous month, above 50.0 signals an increase (improvement), below 50.0 a decrease (contraction).

Positive data

Five minutes before the composite index for the Euro area, we learned latest indexes for the German economy only. In May, entrepreneurs surveyed turned out to be bit more optimistic than analysts expected. The PMI service index was at 55.4 points – up 0.2 points from the April value. The overall index also was better – May composite PMI was at 57.4 points versus the previous 57.3.

The situation is better in the whole Euro area. Although the overall PMI index in Europe has not changed compared to the previous month but its service part was slightly better – 56.3 in May vs. 56.2 in April.

How does Euro react?

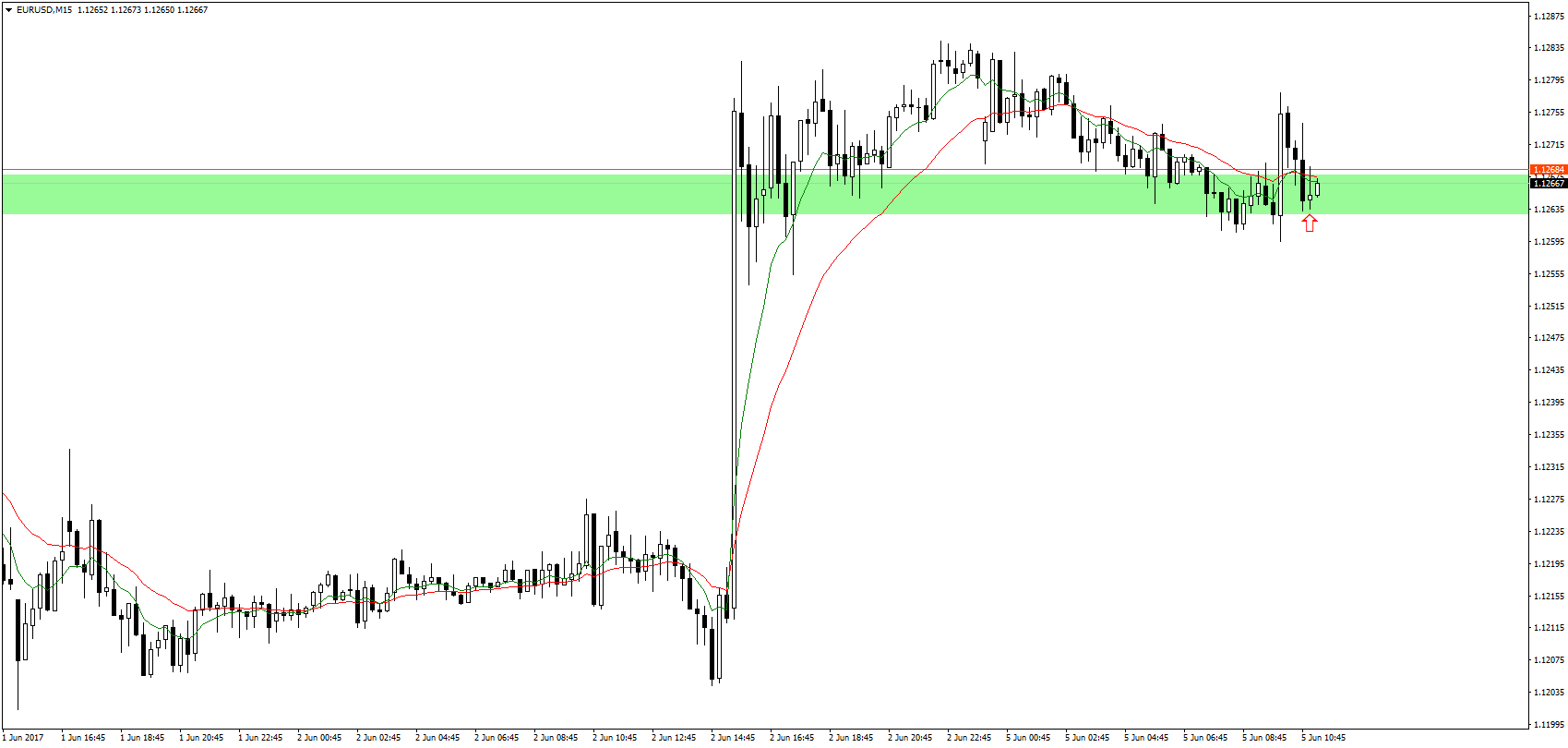

EUR/USD growth started at 9 am and lasted only a quarter of an hour. During these fifteen minutes EUR/USD made only 15 pips, but it was enough to build a noticeable bullish candle.

First reaction to data from Germany was continuation of bullish trend, but with significantly lower momentum. Pair until 8:55 had already corrected earlier gains and struggled to maintain bearish sentiment. Situation improved slightly from 9:00 when it became clear that better situation was taking place throughout the Euro area.

EUR/USD is roughly in the same place as it was before today’s European publications. Data triggered a bit greater volatility but with no clear direction with slightly recognized upward slope. This indicates that market has so far discounted those minor changes in published indicators.