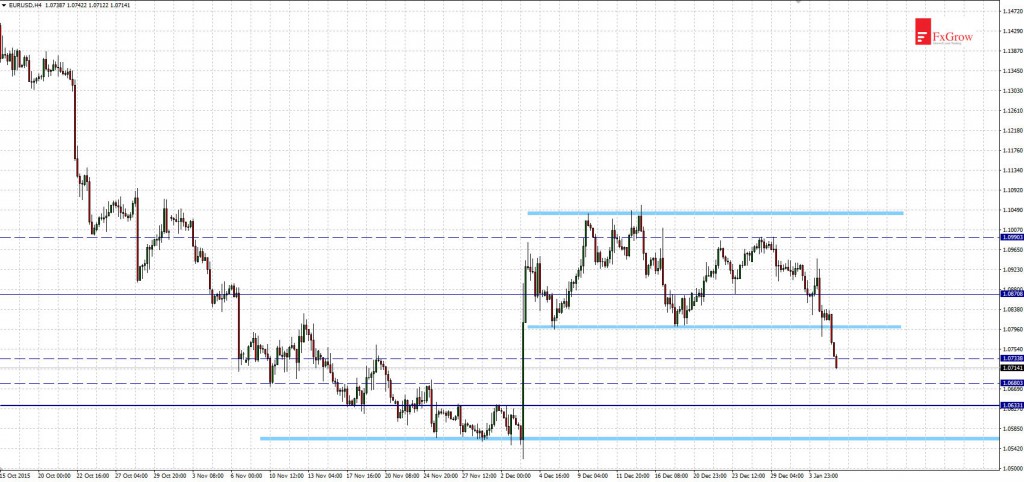

Since December 4 EURUSD moved in consolidation between levels: 1.0800 – 1.1040 (blue lines at the chart). Today price broke below lower consolidation band and immediately price broke two nearest supports: 1.0780, 1.0730. Direction of movement is in line with fundamentals which means a politics of both central banks. Dovish EBC and hawkish FED should cause euro depreciation against the dollar what could be seen on today’s chart.

Next supports are located at levels: 1.0680, 1.0630, 1.0560. Currently it is likely that price will return and test lower limit of consolidation at 1.0800. If demand moves back inside the consolidation, then breakout will be a fake one. However if this scenario won’t succeed and price will rebound, then the lows from 2015 should be tested.

Try FX GROW. Spread from 0.00001 also STP/ECN execution, full transparency.