Daily Forex Market Preview, 20/06/2017

Amid a slow trading day, the speech from NY Fed President, William Dudley helped the US dollar to maintain its gains. Dudley said that while inflation was lower than what policy makers wanted, he said that the labor market conditions continue to tighten. He was hopeful that wages would pick up which in turn will push inflation higher.

The US dollar index rose nearly 0.4% on the day, rising to 97.54. The UK – EU began the Brexit negotiations yesterday. The British pound was plagued by the latest ongoing incidents in the UK and eventually closed weaker on the day.

Looking ahead, speeches from the FOMC members continue, alongside a scheduled speech from SNB chairman, Thomas Jordan and the BoE Governor, Carney. On the economic front, the markets are looking to another quiet day of trading.

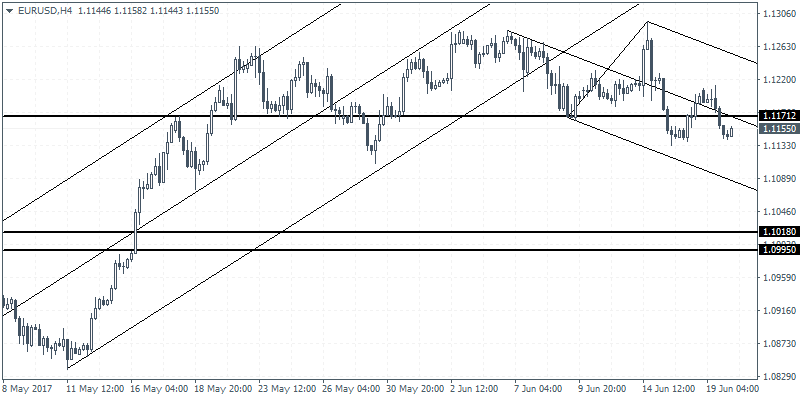

EURUSD intraday analysis

EURUSD (1.1155): EURUSD opened close to 1.1200 yesterday, but price action eventually pushed the currency pair to close weaker on the day. In the near term, EURUSD could be seen testing the resistance level of 1.1171. Establishing resistance at this previous support level could signal further downside in price. EURUSD could be seen testing the lower support at 1.1018 – 1.0995. However, watch for the resistance level at a failure to reverse could signal sideways price action or a potential move to the upside. Above 1.1171, EURUSD could test the previous highs near 1.1300.

GBPUSD intraday analysis

GBPUSD (1.2736): The British pound extended the declines after testing 1.2800 resistance. The resistance level has been formed here with the previous four days unable to break above this level. Further downside is, therefore, expected as we see the 1.2600 support level coming into focus. Below 1.2600, further downside could see price action fall towards 1.2400 where a test of support is pending. On the 4-hour chart, price action continues to remain very volatile with prices trading sideways within 1.2800 and 1.2650 levels.

Above article was provided by Orbex – Serving Traders Responsibly. Check the trading conditions and open your own account.

The Latest News covering forex, commodities, and indices in addition to exclusive CFD and forex trading opportunities identified by the Orbex research team

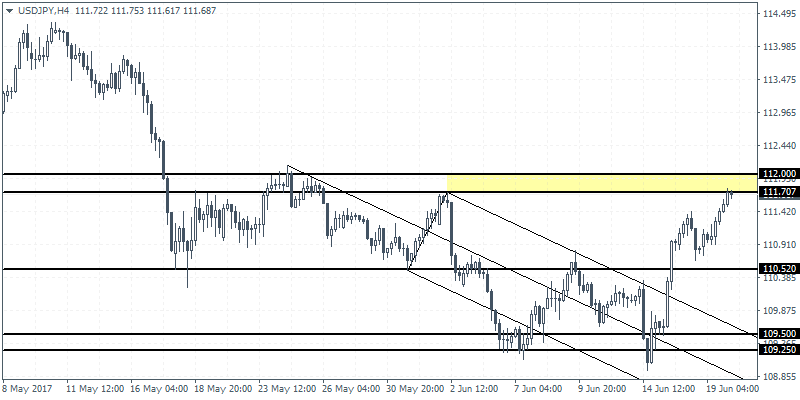

USDJPY intraday analysis

USDJPY (111.68): USDJPY managed to post gains with a bullish close yesterday. This comes above the doji high and price action is seen currently testing the daily resistance level of 111.61. A breakout above this resistance is required for further upside in price. However, with the resistance level staying strong, there is a potential for USDJPY to possibly consolidate its gains with price action likely to slip back. Support at 110.52 is seen on the 4-hour chart where USDJPY could fall back to. Above 111.61 – 112.00, USDJPY will be seen rising to 113.00.