Daily Forex Market Preview, 11/07/2017

The markets were trading flat yesterday on lack of any clear data to drive the markets. The US dollar remained broadly unchanged, holding on to the meager gains from last Friday’s payrolls data.

Earlier, the San Francisco Fed chief, Williams told a panel of experts in Sydney that the pace of US wage growth and inflation are around where he expected them to be. Williams said that another rate hike remained a reasonable base case as well as normalization of the Fed’s balance sheet.

In Germany, the trade data reached new highs as the total export of goods increased 1.4% marking a fifth consecutive month over month increase.

Looking ahead, Lael Brainard from the FOMC will be speaking today ahead of further Fed speeches lined up this week. The economic calendar continues to remain quiet today with Canadian housing starts and Japan PPI data lined up over the day.

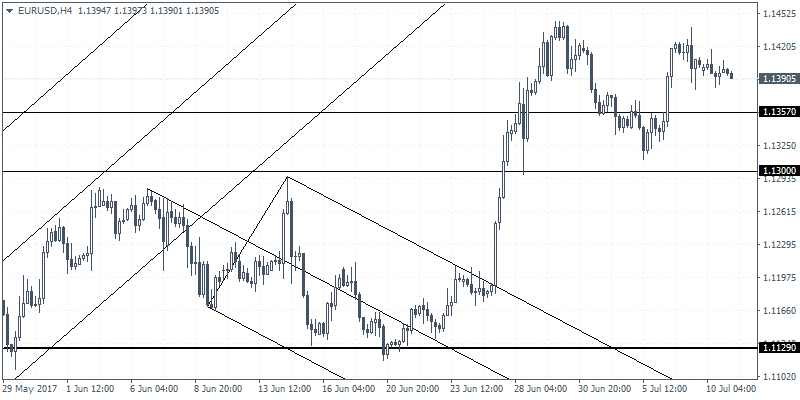

EURUSD intraday analysis

EURUSD (1.1390): The EURUSD closed flat yesterday just a few pips below the $1.1400 handle. Price action is expected to remain trading subdued ahead of the Janet Yellen testimony starting tomorrow. On the 4-hour chart, the bias remains flat with support seen at 1.1357 and 1.1300. Further declines can be anticipated only on a break down below this support. In this case, expect further declines to see EURUSD test the support at 1.1190 level where there is a potential for a head and shoulders neckline support to be established.

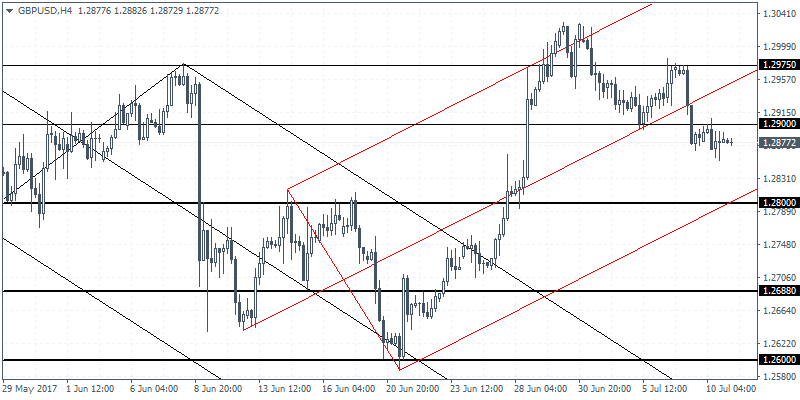

GBPUSD intraday analysis

GBPUSD (1.2877): The GBPUSD also closed rather flat yesterday slowing the momentum of the declines from last week. Any near-term retracement could see price action test 1.2935 where minor resistance could be formed. But the overall bias remains to the downside. To the downside, GBPUSD continues to target the next main support at 1.2800. The bearish bias will shift in the event that GBPUSD manages to break past 1.2900 – 1.2935. In this case, expect the near-term retracement to push GBPUSD back towards the resistance at 1.2975 region.

Above article was provided by Orbex – Serving Traders Responsibly. Check the trading conditions and open your own account.

The Latest News covering forex, commodities, and indices in addition to exclusive CFD and forex trading opportunities identified by the Orbex research team

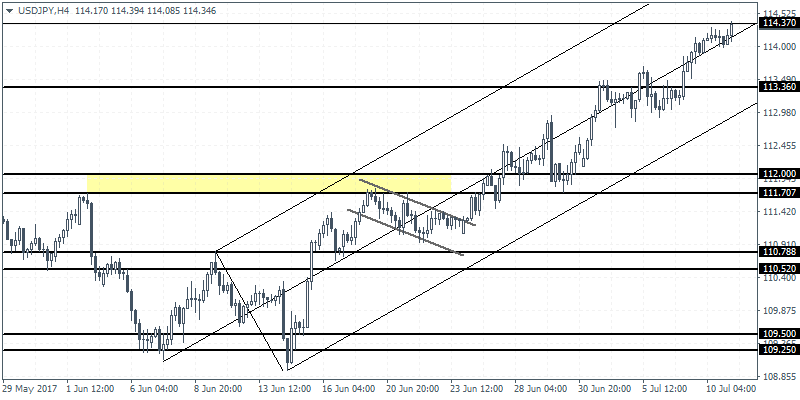

USDJPY intraday analysis

USDJPY (114.34): USDJPY is seen pushing higher as the bullish momentum continues to keep the price higher. Currently, USDJPY is seen testing the resistance level at 114.37. A breakout above this level is required to confirm further upside in price. The next main resistance is seen at 115.35 region. To the downside, in the event of a reversal, then USDJPY could be seen pushing back to the lower support at 112.00 which is pending a retest after previously serving as a resistance level. Ahead of the declines to 112.00, watch for the minor support at 113.36 to offer some short-term support to prices.